Looking back on a tumultuous year where the majority of asset classes were deep in the red, cocoa futures turned out to be one sweet spot.

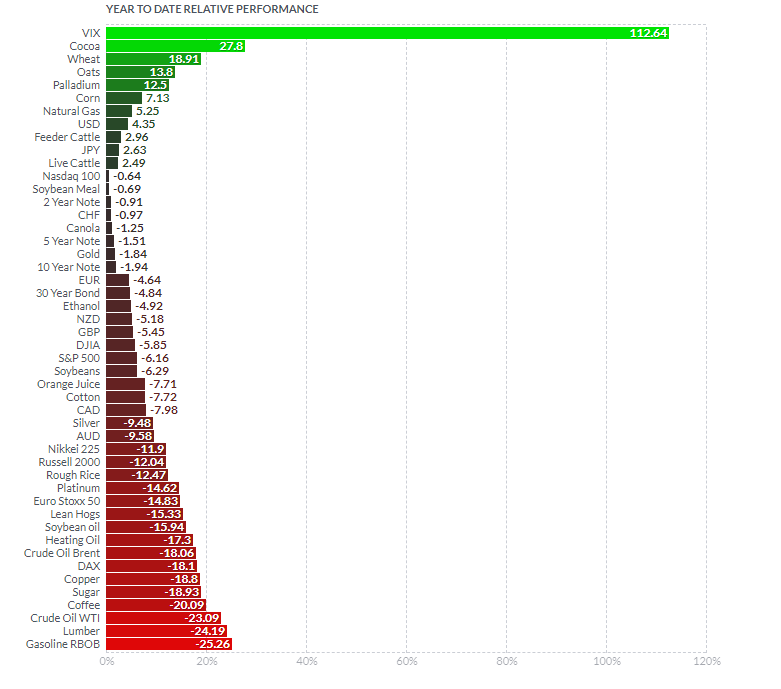

In fact, a look at the top year-to-date performers among major futures markets reveals that cocoa has returned a whopping 28 percent this year. (The only trade that did better were complicated bets in volatility futures, which gain in value along with the Cboe Volatility Index. Volatility is not a pure asset class like a commodity or other security.)

Source: Finviz.com (Through Dec. 28)

While the stock market and other risk assets were battered this year on fears of slowing global growth and trade battles, cocoa prices enjoyed a surge because of short supply as the dry weather in top producing areas such as Ivory Coast hurt production.

“The main crop harvest is continuing in West Africa. Conditions are hot and dry. Main crop production ideas for Ivory Coast and Ghana are being reduced, with Ivory Coast now estimating its main crop production at 1.985 million tons, down from previous estimates just over 2.0 million tons,” said Jack Scoville, senior softs analyst at Chicago’s Price Futures Group, in a note on Friday.

“Conditions appear good in East Africa and Asia. Demand is said to be improving as offers from the new harvest start to increase,” Scoville added.

The higher cost of cocoa, which is used to make chocolate, has put pressure on candy companies this year. The Hershey Co. and Tootsie Roll Industries have both lost about 6 percent in 2018, while Nestle is set to finish the year flat.

“We had some commodity and packaging headwind of about 20 basis points in the first half,” Francois-Xavier Roger, Nestle’s chief financial officer, said on an earnings call in July. The company’s “cost savings were partially offset by higher commodity and packaging costs. … In 2019 and 2020, I’m more encouraged by some of the internal projects we have underway to reduce our commodity costs.”

Other than trading futures, investors could have also accessed the winning commodity through the iPath Bloomberg Cocoa SubTR ETN, which has gained 22 percent this year.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals