Key Points Discussed

- The Texas oil revolution

- Diminishing effectiveness of monetary policy

- Commodity prices and the Trade War ‘facade’

- Perverse incentives and the inverted credit cycle

- The Chinese debt load

- Forecasts and trading strategies for 2019?

In this interview senior market analyst, Tyler Yell speaks to Chief Economist and best-selling author, Daniel Lacalle about his latest work, the end of QE in a low growth environment and crude oil expectations for 2019.

We will touch on some of the key talking points in this write up but be sure to check out the podcast for the full interview:

Podcast with Daniel Lacalle: https://www.stitcher.com/podcast/trading-global-markets-decoded-with-dailyfx/e/57808758?autoplay=true

The Texas Oil Revolution

The recent Shale boom in the US, along with reduced bottlenecks, resulted in the US becoming a net exporter of oil for the first time in decades. Daniel explains how this was made possible.

Tyler Yell: You wrote two wonderful books, one of them is ‘The Energy World is Flat’ can you share with the audience some of the key points that drove you to write this well-respected book?

Daniel Lacalle: In ‘The Energy World is Flat’ the idea was to debunk the theory that we were going to be living in an environment in which supply would be scarce and we would have tremendous inflation in energy commodities. It’s an analysis of both the demand and supply environments for oil but also talks about renewable energy. The book explores how new technology, efficiencies and improvements lead to a disinflationary environment and highlights the radical role of natural gas in this beautifully, disinflationary environment. This means that supply will be more abundant and lead to a better energy environment for everybody. This is the key factor in driving growth. It’s basically a book that talks about improvements in technology and diversification.

TY: In the book your co-author Diego Parrilla mentions that the last barrel of oil will not be as valuable as one would imagine. This just reinforces the “10 forces” that you identify in the book that are flattening the energy world. Could you shed some more light on how these forces are playing out today?

DL: Absolutely, yes. I think it was the ex-CEO of Exxon, Rex Tillerson who said the energy world did not have a problem of resources it only had a problem with access and development of those resources. I think that what has happened in this period of low interest rates and high liquidity, there has been a massive improvement that has led to the energy revolution in Texas which has propelled the US in very little time from a net importer of oil to essentially being energy independent. This very factor has helped drive, what we call in the book, the “energy broadband”, which is this absolutely massive level of investment in diversification and technology and alternative sources of energy like natural gas and renewables. What we are seeing is this beautiful role of competition between the different sources of energy that has contributed to the decline in the average household bill for electricity and gas decline despite high growth in the economy and alleged geopolitical challenges in the supply chain.

Develop your oil trading knowledge with our free guide, Understanding the Core Fundamentals of Oil Trading.

The Diminishing Effect of Monetary Policy

TY: You wrote another great book, ‘Escape from the Central Bank Trap’, can you share with the audience some of the key points that drove you to write this well-respected book?

DL: ‘Escape from the Central Bank Trap’ talks about, from a constructive perspective, the challenges that we are facing after this monstrous increase in liquidity injections, central banks’ balance sheets soaring and lowering interest rates to all-time lows. The idea of the book is to be critical and at the same time constructive as there are differing opinions on the effectiveness of monetary policy currently.

TY: In reference to these two books, one would assume they are different topics but in the same breath, a lot of the trouble the Central Bank is having is that inflation is nowhere to be found and energy is such a key driver of inflation. It seems like technology has backed central banks into a corner because inflation is harder to come by. What are your thoughts on this?

DL: Central planners are looking at the economy with a rear view mirror specifically in terms of how price formation happened in the past. Therefore, they try to implement the same measures that they used in the past in order to drive inflation and growth, but these measures don’t work anymore. Technology is working as a fantastic disinflationary factor but also the world is much more interconnected. It is a lot more difficult to get those drivers of inflation that existed in price formation and the appearance of technology giants has a key part to play in this.

Central banks, through liquidity injections and low rates, have been driving absolutely amazing amounts of investment into technology. This is similar to what we saw during the Tech Bubble in that we are now seeing what we call the energy broadband. The result of this increased investment will lead to better access to different products and services which will undermine the efforts of the central bank to inflate prices in an attempt to deflate debt. At the end of the day, monetary policy becomes disinflationary because it is perpetuating overcapacity.

For a better understanding of Quantitative Easing (QE), check out these articles form DailyFX:

Commodity Prices and the Trade War “Façade”

TY: Recently, you were in the IG studio, and you made a great point very clear about how Trade Wars are not the main story with commodities, but rather the growth picture as a whole. Can you shed more light on that?

See our infographic for a brief history of trade wars: https://www.dailyfx.com/trade-wars-history

DL: It is less about Trade Wars and more about general growth issues. It all starts from the incorrect diagnosis of the economy. Central Banks and governments look at the Global Financial Crisis as a problem of demand. Therefore, they push interest rates lower and liquidity higher in order to incentivise demand artificially. What ends up happening is that every incremental unit of money supply provides a lower placebo effect in the market.

What you tend to see is that growth and inflation is lower than anticipated while debt increases. The “sugar rush” that has been created by lowering rates and increasing liquidity tends to remain in the economy but doesn’t translate into higher demand growth, capital expenditure and industrial production.

TY: Following on from your ‘sugar rush’ analogy, I recently presented a podcast show based on what former Fed President, Richard Fisher mentioned in an interview back in 2016, in which he basically said that they pumped the markets full of stimulants. In a medical sense, a patient does not immediately climb down from such a high and bringing this back to markets, it seems like this is where we are now?

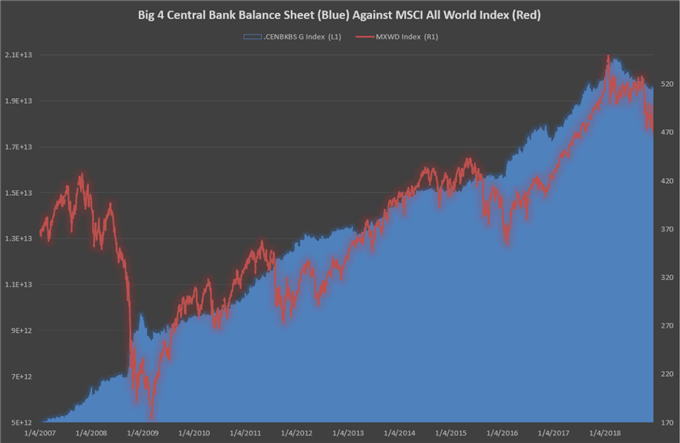

DL: That’s exactly it. It puzzles central bankers how quickly the data points worsen and we might see the central bank delaying its decisions. We are seeing a diminishing effect on monetary stimulus as we are using the same tools to create excess capacity and excess debt but the reality of what ‘demand’ needs is completely different. Simply put, another dose of stimulants is not going to get the economy pumped up. We are also witnessing money supply continuing to grow despite the fact that central bank balance sheets are winding down. Where we find ourselves is in the middle of a $20 trillion experiment and we have never been here before

Markets reacting poorly as central bank balance sheets wind down

Perverse Incentives and the Inverted Credit Cycle

TY: Towards the end of 2018 the Bank of Japan balance sheet has exceeded the annual output of the economy. This is a fitting example of how central banks seem to have hit a wall and hence the signalling effect is disconnected, what are your thoughts?

DL: This is something I have discussed with a well know advocate for central bank policies where I asked him why Japanese citizens don’t spend at the levels central planners would like them to? This is because Japanese citizens have a long memory and know that the result of large scale money printing is stagflation. Therefore, they prepare for stagnation by spending moderately. After the European real estate bubble, it seems increasingly unlikely that people are prepared to borrow aggressively to buy a home or take on excessive levels of debt. Citizens are more aware of the ramifications monetary stimulus.

TY: The signalling effect and the drive that puts entrepreneurs to work is being taken out of the market because of this flood of capital. This aligns with something that you have said, which is that cheap money overtime becomes expensive in the long run. Do you agree?

DL: Absolutely, the reason why money needs to be relatively scarce is because it promotes the creative positive cycle of credit. You have a short term credit cycle in which the efficient industries benefit from credit and also the cost of credit penalises the inefficient and over-levered. So, what you do by lowering interest rates and injecting liquidity is you completely change the cycle.

The short-term cycle becomes massively beneficial to over-indebted, low productivity sectors and to government for current spending. This generates a negative effect for high productivity sectors because deficits soar and the tax burden increase for these sectors. The long-term credit cycle that should be driven by higher productivity growth in stronger industries, ends up being corroded. Investors, entrepreneurs and governments actually have a perverse incentive to do what is bad (spending more and taking on more debt).

The Chinese Debt Load

China has been aggressively adding to their existing debt. What could this mean for markets?

TY: It is difficult to talk about inverted credit cycles without thinking about China. You’ve mentioned that their economy, which has been a driver of global growth would be akin to ‘bursting bubble dominos’. Can you please explain more on that?

DL: Think about what we have discussed already, the problem of the economy is incorrectly diagnosed as a problem of demand, over-capacity and levels of investment are incentivised with the reasoning that there is one massive country out there that is going to absorb all of that. The US and the European Union have been doing this but now China is creating its own overcapacity by doing all of this themselves. I’m not criticising that but what is shows is that there is a domino effect.

The reason why I don’t believe in a massive crisis in this environment of stagnation is because the imbalances built in China will be dealt with by central planning entities, like the Chinese government and therefore, it is more likely that we will move into a long term stagnation.

TY: Why do you think investors fail to grasp the China contagion risk?

DL: There is this very Keynesian view that because the massive debt problem seen in China is fundamentally in Yuan, takin by local banks, that it can be managed without contagion by printing and devaluing. This doesn’t work because at the end of the process you see that devaluation is not a tool for growth and is more likely to result in stagnation.

Devaluation exports disinflation to the rest of the world and locally, it damages the purchasing powers of salaries of families that are already highly indebted. You may argue that salaries are devalued but so is the existing debt. However, in reality these two effects do not materialise at the same time and the analysis of inflation can become tricky.

Forecasts and Trading Strategies for 2019 – Crude Oil Price in Focus

TY: Turning to commodities, the ‘Synchronised Growth’ has become unhinged, and we may well be moving toward Secular Stagnation. What are your thoughts here, and how does that affect crude oil and other commodities in 2019?

DL: In my opinion, we are already starting to see that process if disinflation which has nothing to do with whether the Fed hikes rates or if there is a Trade War. It is something deeper rooted in over-indebtedness and over-capacity. Therefore, what was seen was not synchronised growth but rather synchronised debt growth. When you have synchronised debt growth, deficits that were already a problem in important economies will rise further as long as Crude Oil and other commodity prices are going down.

The massive wall of debt falling due, plus any additional debt, is going to subtract a lot of liquidity from the market. The biggest bear signal is that all these deficits will be refinanced. There is not going to be a debt crisis and defaults as these debts will be refinanced, even at higher rates. Therefore, liquidity will be sucked out of other risky assets. It was mentioned to me that in 2019 and 2020 you have the equivalent of 2 QEs of new debt financing being added to the economy.

I think that the likelihood of the process of multiple expansion that we saw in the last 10 years will continue to deflate. At the same time earnings growth might continue to be positive for many industries, for example, it’s going to be great for EU that the Crude Oil price leading into 2019, is around $50 a barrel. But there is still a gradual move towards stagnation.

TY: From a portfolio manager or even individual trader point of view, that the buy and hold strategy days are over and it seems like a lot of the success that we will see will depend on identifying pockets of weakness on the short side as opposed to the robust growth we have seen in tech and other industries of late. Do you have any thoughts on what type of portfolio managers or strategies might outperform in the future?

DL: I think you need to avoid passive investment, you need to be a lot more active and that short term economic cycles are going to be very powerful and attractive. I always refer my clients to the long term trend of the Nikkei with special focus on the ups and downs. It is like throwing a ball down the stairs. The bumps are impressive, so I think we need to be a lot more active and more short term focused instead of having the mindset that everything will be fine in the long term.

Graph: Nikkei Long Term Trend Exhibiting Shorter Term Swings in Price (weekly chart)

We need to avoid, in my opinion, the two most risky parts of the investment world. These are the sovereign bonds of countries experiencing problems with growth and stagnation that are yielding negative real rates, as well as, avoiding those sectors that are cheap for a reason (mega-cap conglomerates with no growth). So, it’s going to be a lot less about industries, indices and sectors and more about taking those opportunities by being more active, but at the same time, more cautious.

Keep up to date with the latest insights from Daniel:

Be sure to connect with him on Twitter @dlacalle or via his website www.dlacalle.com/en/.

For a list of some of Daniel’s finest work head on over to his Amazon Page

Helpful Resources

- If you are looking for in depth analysis and an oil price forecast 2019, head on over to our Trading Guides section.

- Stay up to date with the latest developments in WTI and Crude Oil through our dedicated Oil Market Data page.

- At DailyFX we host several webinars every week, providing insight and analysis on central banks, major FX pairs, commodities and even basic trading Q&A sessions. Capitsalise on this great resource via our webinar calendar

- At DailyFX we researched over 100,000 live IG Group accounts to find out the secrets of successful traders and published the findings in our Traits of Successful Traders.

If you found this interview useful, you should follow our weekly podcasts. Whether you are looking for market analysis, trading education or interviews with well-known industry professionals, we have you covered.

Follow our podcasts on a platform that suits you:

iTunes:https://itunes.apple.com/us/podcast/trading-global-markets-decoded/id1440995971

Stitcher:https://www.stitcher.com/podcast/trading-global-markets-decoded-with-dailyfx

Soundcloud:https://soundcloud.com/user-943631370

Google Play:https://play.google.com/music/listen?u=0

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals