Highlights

- On the back of weakening global growth and downgrades to the corporate profit outlook, equity markets are down significantly from 2018 highs.

- With such a strong swing in market sentiment, discussion has increased on whether the decade long economic expansion in the U.S. is approaching an end.

- When looking back at history, equity markets have a very spotty track record for calling recession. Since the 1950’s, a bear market for the S&P 500 has about a 50/50 chance of calling a recession.

- For a more accurate signal of recession, we need to consider the transmission mechanism to the overall economy. Even though business confidence is declining from lofty levels, we have not yet seen financial market contagion into the macro economy. Though the equity market can influence Main Street, it has so far failed to do so.

Equity markets have been on a roller coaster ride these last few months. After falling significantly in late-2018, we have seen a positive bounce the last couple of weeks. Though this is encouraging, it is far too early to say we are in the clear, and if markets fall further, talk of recession will only get louder. To assess this risk, we compare the current market stress relative to history and consider the pass-through of stocks to consumer and business confidence in order to determine how close we are to recession. (if you want to trade professionally use our forex advisor download, Look our videos of automated trading at forex… )

Putting the sell-off in perspective

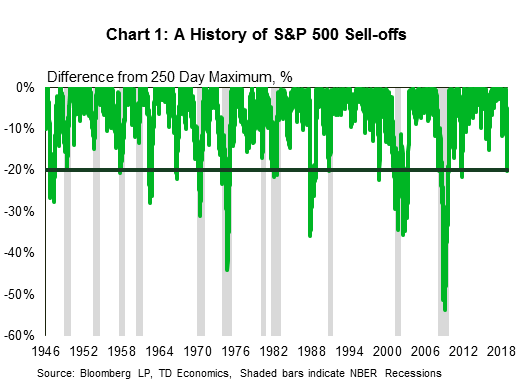

After peaking in September 2018, the S&P 500 Index sold-off dramatically, reaching an intraday peak-to-trough low of approximately 20% (a bear market) on Christmas Eve. When we look back at recessionary episodes in the post-WWII time period, we see that equity markets typically reach bear market territory (Chart 1). With such a significant drawdown at the end of 2018, the equity market is flashing a strong warning signal.

Should we all run for the hills? Probably not. Bear markets have given many false signals in the past (2011, 2002, 1998, 1987, 1966, 1962, and 1946). When we get a bear market, a recession occurs only 50% of the time. And in several instances, the stock market didn’t even decline more than 20% during a recession (1980, 1960, and 1953).

When it comes to forecasting recessions, we need to be more accurate. Equities alone are far too volatile to be effective at predicting recession. This is apparent when we model recessions using just financial variables compared to when we add macro variables to the model (Chart 2). It is for this reason that other factors have to be taken into account. We have written extensively on the slope of the yield curve as a predictor of recession. But, it alone cannot predict recession either. We need to confirm the transmission of financial market volatility into the macro environment in order to solidify a call for recession. Use our Portfolio of forex robots reviews…

How stocks impact the economy

When financial market stress occurs, businesses can become fearful, changing hiring/spending plans, and laying off workers. When this leads to a persistent labor market hit, consumer confidence falls and a recession is all but confirmed (Chart 3). For this reason, we want to gauge a shift in the sentiment of businesses via profit outlooks, new orders, and overall survey indicators. For example, the ISM Manufacturing Index is closely watched (Chart 4). When the Index breaks the 50 level, it implies negative growth for that sector, but this would give more false signals than even equity markets. A threshold analysis shows that a persistent drop below 47 provides more conviction of recession and a level of 42 all but confirms it. The current level of the Index is 54. If this drops towards the warning levels along side financial market stress, the combination will increase the probability of recession to a high level.

But the next couple of months will be key. If equity markets resume weakness, there will be a point where a recession becomes inevitable. The fall would likely reflect market expectations for negative corporate profit growth. If this causes stalled spending plans and hiring by businesses, the hit to the labor market would be visible in the weekly data on unemployment claims. A significant rise in this indicator will cause the unemployment rate to jump and consumer confidence to drop into recessionary territory. Once the consumer goes to sleep, the expansion is over.

Right now, global growth is decelerating but the current level of business sentiment has not been sufficient to translate into a shock to the labor market.

What it equates to is a slower, rather than negative, growth. Main Street has not been impacted by the jitters on Wall Street for now. When calling recession, that is all that matters.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals