Sterling is staying as the strongest one for the week after UK Prime Minister Theresa May narrowed survived the confidence vote in Commons. Though, there is no follow through buying against Dollar. Upside momentum in the Pound is also relatively weak against Euro and Yen. Traders would probably stay cautious until May tells us what’s next on Monday.

Staying in the currency markets, Dollar and Yen are stronger today while Commodity currencies are generally. But fresh selling is seen in Euro and Swiss Franc as we enter into European session. Persistent worries over Eurozone slowdown, in particular in Germany and Franc, will weigh on Euro, which in turn drags down the Franc.

Technically, USD/CHF is sustaining well above near term falling channel, which carries bullishness implication. Focus will stay on 0.9963 resistance and break will confirm completion of corrective pull back from 1.0128. EUR/USD is on course to 1.1307 support. Break there will be an early sign of larger down trend resumption. USD/CAD is extending the consolidation from 1.3180 temporary low. But near term outlook will remain bearish as long as 1.3323 minor resistance holds. Similar, while AUD/USD is retreating, rebound from 0.6722 could still have another leg up as long as 0.7116 minor support holds.

In other markets, stocks markets in Asia are rather quiet. Nikkei is down -0.26%. Hong Kong HSI is up 0.07%. China Shanghai SSE is up 0.30%. Singapore Strait Times is down -0.21%. Japan 10-year JGB yield is down -0.0025 at 0.005, still positive. Overnight, DOW rose 0.59%. S&P 500 rose 0.22%. NASDAQ rose 0.15%. All three indices are now facing 55 day EMA resistance. 10-year yield rose 0.20 to 2.731 but 30-year yield rose just 0.006 to 3.077. Yield curve remain inverted from 1-year (2.579) to 2-year (2.545) to 3-year (2.525) and 5-year (2.542). But it’s looking was better than just a few weeks ago.

UK PM May won confidence vote, to table way forward for Brexit next Monday

UK Prime Minister Theresa May won the confidence vote narrowly by 325-306 in the Commons, a day after her Brexit plan was rejected. Now, she has started meeting some party leaders to “find solutions that are negotiable and command sufficient support” from the House. May also plans to return to the House on Monday to “table an amendable motion and to make a statement about the way forward.” And she reiterated the pledge to deliver Brexit.

However, there is no meeting with opposition Labour leader Jeremy Corbyn yet. Corbyn insisted that there will be not talks unless no-deal Brexit is ruled out. His spokesman said “Of course (Labour leader) Jeremy is prepared to meet the prime minister but if we’re talking about substantive talks on how to resolve the crisis over Brexit … then the starting point for that needs to be that no deal comes off the table.”

Fed’s Beige Book: Contacts had become less optimistic

According to Fed’s Beige Book economic report, 8 of 12 districts reported modest to moderate growth in the period through January 7. Two districts reported flat or slight growth. Another two reported slower pace of growth.

The report noted that “outlooks generally remained positive, but many districts reported that contacts had become less optimistic in response to increased financial market volatility, rising short-term interest rates, falling energy prices and elevated trade and political uncertainty”.

On prices, most Districts indicated that firms’ input costs had risen due to :rising materials and freight prices”. And, “a number of Districts said that higher tariffs were also a factor.”

BoJ Kuroda: Japan is facing the most aged society in the world

In a keynote speech at the G20 symposium in Tokyo, BoJ Governor Haruhiko Kuroda said Japan is “facing the most aged society in the world.” And he discussed the impacts of aging and declining population on macroeconomy, fiscal conditions and social security systems, and monetary policy and financial system.

On monetary policy market, Kuroda said “As a low interest rate environment persists and credit demands become stagnant amid declining population, banks might accelerate their search-for-yield activities such as expanding their exposures to overseas assets and increasing loans and investments to firms with higher credit risks. If that were the case, the entire financial system could become less stable.”

On the data front

US RICS house price balance dropped to -19 in December, below expectation of -13. Australia home loans dropped -0.9% mom in November, better than expectation of -1.4% mom. Eurozone will release December CPI final. US will release Philly Fed survey and jobless claims. Housing starts and building permits will miss due to record government shutdown.

GBP/USD Daily Outlook

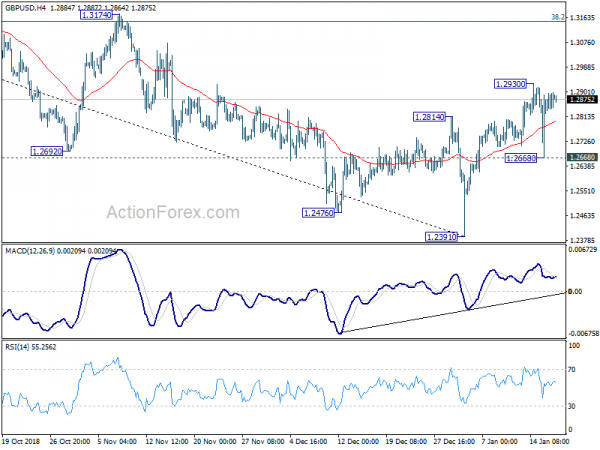

Daily Pivots: (S1) 1.2836; (P) 1.2867; (R1) 1.2909; More….

GBP/USD is staying in consolidation from 1.2930 and intraday bias remains neutral. Further rise is expected with 1.2668 minor support intact. On the upside, break of 1.2930 will extend the corrective rebound from 1.2391 to 1.3174 resistance, which is close to 38.2% retracement of 1.4376 to 1.2391 at 1.3149. We’d expect strong resistance from there to limit upside, at least on first attempt. On the downside, break of 1.2668 should now confirm completion of the rebound. In this case, intraday bias will be turned back to the downside for retesting 1.2391 low.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend from 2.1161 (2007 high). And this will now remain the preferred case as long as 1.3174 structural resistance holds. GBP/USD should target a test on 1.1946 first. Decisive break there will confirm our bearish view. However, sustained break of 1.3174 will invalidate this case and turn outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:01 | GBP | RICS House Price Balance Dec | -19% | -13% | -11% | |

| 0:30 | AUD | Home Loans M/M Nov | -0.90% | -1.40% | 2.20% | 2.10% |

| 10:00 | EUR | Eurozone CPI M/M Dec | -0.20% | -0.20% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | 1.90% | 1.90% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec F | 1.00% | 1.00% | ||

| 13:30 | USD | Housing Starts Dec | 1256k | 1256k | ||

| 13:30 | USD | Building Permits Dec | 1300k | 1328k | ||

| 13:30 | USD | Initial Jobless Claims (JAN 12) | 218K | 216K | ||

| 13:30 | USD | Philadelphia Fed Business Outlook Jan | 10.1 | 9.4 | ||

| 15:30 | USD | Natural Gas Storage | -91B |

NOTE: You can not find the right trading strategy? if you have no time to study all the tools of the trade and you have not funds for errors and losses – trade with the help of our best forex robot developed by our professionals. We offer forex robot free download. Signal2forex reviews

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals