Yen trades generally lower in rather quiet markets today. Risk appetite strengthens mildly despite extended record run in US government shutdown. There were rumors that US is considering to roll back tariffs to facilitate trade negotiation with China. But that was quickly denied. Nevertheless, Fed’s “patience” rhetorics continued which is sentiment supportive. For the week, Sterling continues to ride on Theresa May’s Brexit deal defeat and stays the strongest one. Dollar follows as second strongest, with a little help from rebound in yields. Kiwi is the weakest one followed by Swiss Franc.

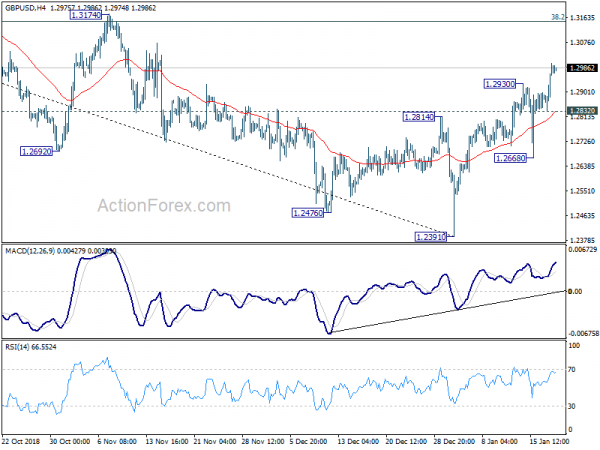

Technically, GBP/USD’s rebound form 1.2391 resumed by breaking 1.2930 overnight. Further rise would be seen to 1.3174 resistance. EUR/GBP is also on track to 0.8655 low as fall from 0.9101 extends. GBP/JPY’s strong break of 139.88 resistance now raises the chance of larger trend reversal. 143.93 minor resistance is the next hurdle. USD/CHF is also getting closer to 0.9963 resistance. Break there will confirm completion of recent corrective pull back from 0.9963.

In other markets, Nikkei closed up 1.22% at 20650.64. Hong Kong HSI is currently up 1.21%. China Shanghai SSE is up 1.15%. Singapore Strait Times is up 0.26%. Japan 10-year JGB yield is up 0.0035 at 0.015. Overnight, DOW rose 0.67%. S&P 500 rose 0.76%. NASDAQ rose 0.71%. 10-year yield rose 0.018 to 2.749. But 30-year yield ended flat at 3.077. Look our videos of trading at forex…

Fed Evans: We’re at a good point for sort of pausing rate hikes

Chicago Fed President Charles Evans said “I’m not worried about inflation getting out of hand” and Fed is “at a good point for sort of pausing” rate hikes. Though, he “wouldn’t be surprised if at the end of the year we have a funds rate that’s a little bit higher than where we are now.” But, “that would be associated with a better economy and inflation moving up.”

Evans also noted risk from uncertainties including slowdown in Europe and China, trade war. On government shutdown, he warned “the longer it goes on, I think it becomes a little bit more of a challenge, and the uncertainties mean that people are going to delay making certain types of investments, and that’s not good for the outlook either.”

US Treasury denies rumors that Mnuchin mulls China tariff rollback

WSJ reported yesterday that US Treasury Secretary Steven Mnuchin was considering the idea of lifting some of even all of extra tariffs on Chinese imports to facilitate trade negotiation with China. But a Treasury spokesman quickly denied.

The spokesman said “neither Secretary Mnuchin nor Ambassador Lighthizer have made any recommendations to anyone with respect to tariffs or other parts of the negotiation with China.” And, “this an ongoing process with the Chinese that is nowhere near completion.”

Mnuchin is widely considered a dove in the trade war with China, and he has rather good relationship with Chinese Vice Premier Liu. So we won’t be surprised if Mnuchin has considered or even brought out such idea. But he is often seen as isolated by others in the team on the issue. So, it doesn’t really mean a thing even if he did make that suggestion.

Liu has confirmed his scheduled to visit Washington on January 30-31. The result of the meeting with USTR Robert Lighthizer then is the real key and the whole negotiation. if you want to trade professionally use our forex advisor download…

Germany and China signed pacts to deepen financial sector cooperation

Germany and China pledged to deepening cooperation in the finance sector and fight trade protectionism during Finance Minister Olaf Scholz’s two-day visit to Beijing. And three pacts are signed, including agreements with the China Banking and Insurance Regulatory Commission and China’s Securities Regulatory Commission.

Ahead of today’s meeting with Chinese Vice Premier Liu He, Scholz said “it is important that, contrary to recent trends that we can observe elsewhere, we are seeing progress in our cooperation”. And, “we have a lot of common interests in financial matters, and then we need to bring different perspectives together. I believe that is the very important task of this financial dialogue.”

Japan core CPI slowed more than expected to 0.7% in Dec

In December, Japan all item CPI slowed to 0.3% yoy, down from 0.8% yoy and matched expectation. Core CPI, all item ex-fresh food, slowed to 0.7% yoy, down from 0.9% yoy and missed expectation of 0.8% yoy. Core-core CPI, al item ex-fresh food, energy, stayed unchanged at 0.3% yoy.

The data showed that even discounting the fall in energy prices, consumer inflation stayed week. And apparently, the recovery is not passed on to consumers. And business remained reluctant to raise prices.

The data added to the case for BoJ to cut inflation forecasts next week. Back in October, BoJ projects core CPI to hit 1.4% in fiscal 2019 and then 1.5% in fiscal 2020. Such projections would be trimmed to reflect the decline in oil as well as global slowdown.

Looking ahead

Swiss will release PPI in European session while Eurozone will release current account. But main focus is on UK retail sales. Later in the day, Canada CPI will catch most attention. US will release industrial production and U of Michigan consumer sentiment.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2878; (P) 1.2940; (R1) 1.3047; Read gbp/usd forecast…

GBP/USD’s rebound from 1.2391 resumed by taking out 1.2930 and reaches as high as 1.3001 so far. Intraday bias is back on the upside and current rise should target 1.3174 resistance, which is close to 38.2% retracement of 1.4376 to 1.2391 at 1.3149. As such rebound is seen as a corrective pattern, we’d expect strong resistance from there to limit upside, at least on first attempt. On the downside, below 1.2832 minor support will turn intraday bias neutral first. But further rally will remain in favor as long as 1.2668 minor support holds.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend from 2.1161 (2007 high). And this will now remain the preferred case as long as 1.3174 structural resistance holds. GBP/USD should target a test on 1.1946 first. Decisive break there will confirm our bearish view. However, sustained break of 1.3174 will invalidate this case and turn outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing PMI Dec | 55.1 | |||

| 23:30 | JPY | National CPI Core Y/Y Dec | 0.70% | 0.80% | 0.90% | |

| 4:30 | JPY | Industrial Production M/M Nov F | -1.00% | -1.10% | -1.10% | |

| 7:30 | CHF | Producer & Import Prices M/M Dec | ||||

| 7:30 | CHF | Producer & Import Prices Y/Y Dec | ||||

| 9:00 | EUR | Eurozone Current Account (EUR) Nov | ||||

| 9:30 | GBP | Retail Sales Ex Auto Fuel M/M Dec | ||||

| 9:30 | GBP | Retail Sales Ex Auto Fuel Y/Y Dec | ||||

| 9:30 | GBP | Retail Sales Inc Auto Fuel M/M Dec | ||||

| 9:30 | GBP | Retail Sales Inc Auto Fuel Y/Y Dec | ||||

| 13:30 | CAD | International Securities Transactions (CAD) Nov | ||||

| 13:30 | CAD | CPI M/M Dec | ||||

| 13:30 | CAD | CPI Y/Y Dec | ||||

| 13:30 | CAD | CPI Core – Common Y/Y Dec | ||||

| 13:30 | CAD | CPI Core – Median Y/Y Dec | ||||

| 13:30 | CAD | CPI Core – Trimmed Y/Y Dec | ||||

| 14:15 | USD | Industrial Production M/M Dec | ||||

| 14:15 | USD | Capacity Utilization Dec | ||||

| 15:00 | USD | U. of Mich. Sentiment Jan P |

NOTE: You can not find the right trading strategy? if you have no time to study all the tools of the trade and you have not funds for errors and losses – trade with the help of our best forex robot developed by our professionals. We offer forex robot free download. Signal2forex reviews

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals