Key points discussed in this interview

- Global market volatility

- Signs of a market focused Fed

- Economic powershift: The influence of central bankers

- Unique insights from a Fed insider

- Going with the flow: A cautionary note for passive investors

Former Federal Reserve Advisor, Danielle DiMartino Booth is known for her bold research-based predictions and is sought out for her insights on monetary policy in the US and abroad. In this interview Danielle and DailyFX Senior Analyst, Tyler Yell walk through the recent pivotal developments in markets, as well as central banking, to unravel what it could mean for investors down the road.

This article presents the highlights of the podcast so be sure to listen to the full interview below.

Listen to the full podcast here:

Stitcher: https://www.stitcher.com/podcast/trading-global-markets-decoded-with-dailyfx/e/58208052?autoplay=true

iTunes: https://itunes.apple.com/us/podcast/trading-global-markets-decoded/id1440995971

Google Play and Soundcloud links provided at the end of the article.

Global Market Volatility

Tyler Yell:Let’s kick off with your excellent book, Fed Up: An Insider’s Take on Why the Federal Reserve is Bad for America. You wrote about the aggressive expansion of liquidity following the 2008 crisis and how that may not have been the best approach, could you share your thoughts on what we can expect in 2019 in a world of shrinking liquidity?

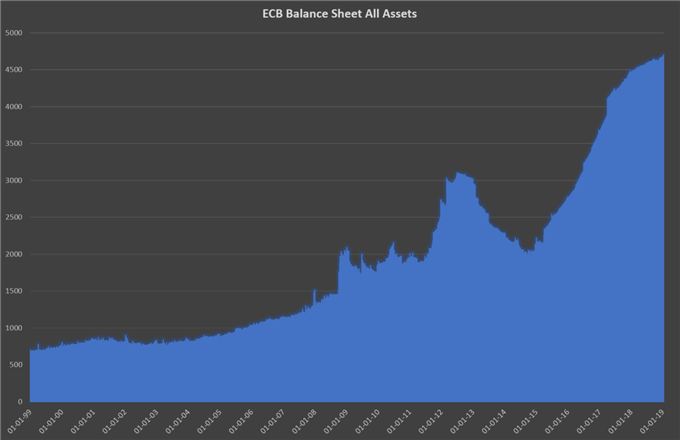

Danielle DiMartino Booth: I think “volatility” is the key word and 2018 gave us a small flavor of what we have to look forward to in 2019. We forget that 2017 was the least volatile and most complacent year in the record of global financial markets in an environment where we saw $2.12 trillion of global Quantitative Easing (QE) coursing through the veins of financial markets. Thisreally put investors into a comatose state as they believed nothing could possibly go wrong however, with the onset of 2018, we saw for the first time the European Central Bank (ECB) start to reduce the pace at which it was expanding its balance sheet.

At the same time, we had Jerome Powell come in as head of the Fed which the markets really did not like. Fast forward one year and the ECB is completely out of the market, they tapered throughout 2018 as we watched volatility rear its ugly head time and again and now we are at the point where we really only have the Bank of Japan which has materially pulled back its own QE. We are sitting at a negative $20 billion per month of central bank liquidity vs. a prior $100 billion per month aggregate flood. This is a huge swing of the liquidity pendulum and I have no idea what the repercussions will be going forward as an experiment of this magnitude has never been implemented and subsequently unwound. One thing that is for sure is that we are going to find out, just put your seat-belt on.

Adding to the volatility, it is rumored that the ECB is considering ways to inject new forms of liquidity, that aren’t called quantitative easing, into the system so we do not see the demise of the Italian banking system.

ECB balance sheet expanding to new heights

Signs of a market focused Fed

TY: In the wake of a slower than anticipated normalization process, Powell has seemingly become more dovish than he has been perceived before. Is it possible that central banks – and specifically the Fed – may be listening to the market too much?

DDB: I hate to say it but it’s undeniable that there has been a huge about-face on the part of Jerome Powell literally 16 days after he said in his last FOMC press conference that quantitative tightening was going to be on auto-pilot. The markets reacted negatively to this news all the way into the Christmas Eve blood bath. Since then he has backed off from this stance and if he has been reading my research, he would have seen that at no time in US history has the fortunes of the US stock market been so tethered to the real economy. This is extremely problematic for central bankers even though this is the very situation they have created over the past decade.

Economic powershift: The influence of Central Bankers

TY:What will central banking potentially look like going forward (10 years from now) as the models that have been relied upon have consistently failed to bring the desired results?

DDB: The best-case scenario, according to central bankers, is that they will be dealing with the exact same things they are dealing with today. I’ll take you back to the real time horror show I was afforded as an employee of the Fed when the models said they could grow the Fed balance sheet to the moon.

What we are learning, particularly from the European Central Bank, is that if global QE is to ease off you may end up in a bind very quickly. Additionally, I think US policy makers were premature in patting themselves on the back and declaring victory because the Fed was able to “successfully” taper the growth of the Fed balance sheet and not see a pick-up of any kind in the financial markets. This is true if you are studying QE in a vacuum but as my good friend, Jim Bianco and I have discussed, QE as far as the markets are concerned is global and fungible. Investors don’t care who is printing, they just care that somebody is printing and propping up the markets.

TY:Do you think central banks will face a credibility crisis down the road when the next crisis hits, and do you think central bank induced liquidity will ever be shunned by the markets?

DDB: I certainly do believe that central bankers are opening themselves up to criticism. Investing today is like painting with numbers but with a blindfold on.

You are told that emerging markets is going to be a hot asset class this year. Subsequently, everyone piles into Brazil so there is a lot of herding going on while due diligence and individual investment analysis is seen as outdated. Modern dayInvesting just works by following flows.

I think we are operating under very dangerous assumptions and that policy will be more politically motivated than economically motivated because the longer central banks intervene in financial markets, the wider the inequality divide becomes. At some point I think you will end up having to choose investments when the central bankers are no longer the most powerful leaders in the world. I would argue that right now central bankers are more powerful in influencing the economy than their respective presidents.

Unique insights from a Fed insider

TY: What unique insight did you gain on markets working for the Federal Reserve that your counterparts on Wall Street perhaps didn’t have?

DDB: My former colleagues will remember a time in college when the coursework required us to derive the Black-Scholes model or endure classes in portfolio management and we cannot come up with a good reason why we took those classes because nowadays you simply do not fight the Fed. If there is one key take away it’s that liquidity flows supersede security analysis.

So many people in the investment world look at you strangely when you try to present any argument, on a fundamental basis, that suggests securities may be overvalued. This is the effect that the central bank has in inflating asset prices and if you invest according to astute fundamental analysis, you are fighting the Fed. All you have to do is compare 2017 to 2018. In 2017, people who applied fundamental analysis, fared much worse than those who placed more importance on rising asset prices and what the Fed was doing. In 2018 when there was less liquidity flowing through the system, investors could be more active when looking for alpha because liquidity was coming off a full boil. Securities may be overvalued with a supportive central bank in a rising market.

It’s a difficult lesson to learn because you want to be smarter than a spigot than can simply be turned on or off, but until this era comes and goes, you may as well just be in a passive index tracking fund and go on vacation.

Going with the flow: A cautionary note for passive investors

TY: Leading on from this, in your book Fed Up, you alluded to the carry trade unwind in 2007 and how that would end up being a sign of things to come.Do you think traders are putting themselves in a tough to win situation,following trends that could quickly unwind because even in a market flooded with liquidity you are susceptible to really sharp movements that could ruin a passive investor’s year, or worse?

DDB: Absolutely! I get a little emotional when it comes to central bankers and their naivety because they don’t even understand that they are the ones who should not be fought. They do not comprehend that markets are fully dependent on liquidity. They will continue to tell you that active investing still has a place in this world.

If there is one thing that October and December (2018) hopefully communicated to passive investors, it’s that you are in a bad situation if the liquidity dries up and if Mario Draghi sticks to his guns. My warning is that this is not going to be as easy as flicking a switch to inject liquidity into the market overnight to save passive investors. Passive investors should be cognizant that they can suffer more from capital losses than they ever made in saved fees.

Keep up to date with the latest from Danielle DiMartino Booth:

The Daily Feather newsletter: https://quillintelligence.com/subscriptions/

Danielle’s website: https://dimartinobooth.com/

Connect with Danielle on Twitter: @dimartinobooth

Amazon best-selling book: Fed Up – An Insider’s Take on Why the Federal Reserve is Bad for America

Helpful Resources

- Danielle mentions 2019 will follow on from the volatility in 2018. See what our DailyFX analysts have put together in their trading forecasts for major currency pairs and selected equities alongside our top trading Ideas for 2019.

- For insight on major central bank developments be sure to register for DailyFX Senior Currency Strategist, Christopher Vecchio’s Central Bank Weekly webinar

- Stay up to date with central bank rate announcements and other significant economic releases via our economic calendar.

- Wondering how a hedge fund manager will be trading in 2019? We sat down with best-selling author and chief economist, Daniel Lacalle to find out.

If you found this article useful, you should follow our weekly podcasts. Whether you are looking for market analysis, trading education or interviews with well-known industry professionals, we have you covered.

Follow our podcasts on a platform that suits you:

iTunes:https://itunes.apple.com/us/podcast/trading-global-markets-decoded/id1440995971

Stitcher:https://www.stitcher.com/podcast/trading-global-markets-decoded-with-dailyfx

Soundcloud:https://soundcloud.com/user-943631370

Google Play:https://play.google.com/music/listen?u=0

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals