China’s auto industry has hit a soft patch, but there may be a bright spot.

Auto sales have fallen in China for nine straight months, including a 5.2 percent decline in March.

But electric-powered cars were on display from start-ups and foreign auto giants alike at this week’s Shanghai Auto Show. For some in the industry, they say it will be the smartphone-like interface of the new vehicles that will really attract buyers. Those consumers are increasingly using internet-connected services such as food delivery for daily life, especially in China.

So-called new energy vehicles are booming, with sales jumping 62 percent last year. And not just because of the way they’re powered.

“The key point is not new energy. The key is smart,” Fu Qiang, president and co-founder of electric vehicle start-up Aiways, said Wednesday in a Mandarin-language interview translated by CNBC.

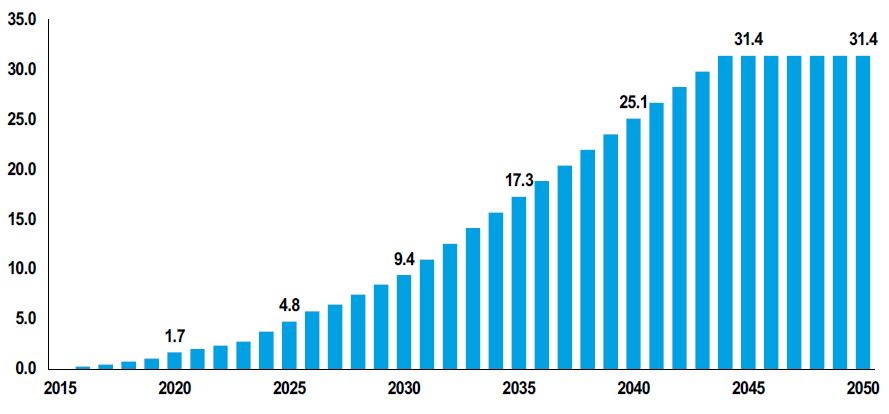

China battery-electric vehicle unit sales forecast (in millions)

Source: Morgan Stanley Research

“The entire decline in the auto industry, much more, in my personal view — of course has some small connection to the economy — but I think the greater reason is that customers right now are not satisfied with the product mix,” said Fu, formerly president and CEO of Volvo Cars China.

The nine-month slide in automobile sales in the world’s largest vehicle market has many worried about a significant slowdown in the Chinese economy, and the wallets of a population of more than 1 billion. Last year, uncertainty about the fallout from the U.S.-China trade war and Beijing’s efforts to reduce reliance on debt for growth put a chill on spending, especially on big-ticket items such as cars.

Much of the decline in auto sales in the last two years was the result of a tough comparison with rapid growth in 2016, Alan Kang, Shanghai-based senior market analyst at LMC Automotive, said on Tuesday. He noted a major drop came from decreased demand from China’s smallest cities for domestic auto brands, while premium foreign brands had less of an impact.

“This year will be overall a year of recovery,” Kang said in a Mandarin-language interview translated by CNBC. And despite subsidy cuts, he said he expects sales volume in “new energy” vehicles to increase to 1.5 million from 1 million last year.

The category — which includes both pure battery-powered vehicles and hybrids — has been a bright spot in China, helped by favorable government policies. Sales grew 62 percent last year, while overall auto sales fell for the first time in more than 15 years, according to data from the China Association of Automobile Manufacturers accessed through the Wind Information database.

“The electrification, internet connectivity and smartness of automobiles has become the industry’s future trend,” Victor Ai, head of China Everbright’s new economy fund, said in a written response translated from Chinese by CNBC.

Young people’s positive views on technology will “thoroughly revolutionize the traditional auto industry,” Ai said. He cited third-party statistics implying that, by 2027, those born after 1990 will account for the largest segment of China’s buyers of new cars, at 41.8 percent.

Tastes can change quickly in China. Wen Shuang, a Chinese social media influencer in the auto industry since 2012, said SUVs were in favor at the turn of the century, but now there’s more interest in having multiple cars of different kinds. Wen has 750,000 followers on Weibo, China’s version of Twitter, and says she was born in 1990.

She also noted in a Mandarin-language interview translated by CNBC that enthusiasm for the future of Chinese car consumption has been generally waning, and this week’s Shanghai Auto Show was not as hectic and exciting as it had been the last two years. However, she added that Chinese brands have become more attractive relative to foreign brands, except for those from Germany and Japan. She said she expects more of the industry’s emphasis will be put on services.

That’s the strategy of many Chinese electric car start-ups, which are often selling directly to consumers or trying to create ecosystems that build customer loyalty.

Services can also be a weak point for traditional automakers in China. A customer’s poor experience at a Mercedes-Benz dealership in the central city of Xi’an went viral on social media earlier this month, prompting parent company Daimler to suspend the franchise’s operations this week, Reuters reported.

The technology-driven change in consumers’ habits and a lower barrier to entry in producing electric cars is forcing the auto industry to revamp itself, Aiways’ Fu said. In this environment, he said, there should be as many new automakers as there were old ones.

At least 100 new energy vehicle companies now exist in China, Fu estimated.

This is a completely new playing field, he said: “How many old ones can transform themselves is an unknown number. How many new ones can survive, that’s (also) an unknown number.”

For a country of rapid change in consumer tastes and the adoption of technology, the auto industry may still be trying to catch up.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals