Dollar spikes higher in early US session as Q1 GDP grew much more than market expectations. However, the greenback quickly pulled back as details are seen as much weaker than the headline number suggests. It’s actually a set of data welcome by stock traders as Fed will likely stay cautious. DOW futures rebound strongly after the release while NASDAQ futures point to extending record run. US 10-year yield falls sharply and breaches 2.5% handle.

Back to the currency markets, Yen is the weakest one for today, followed by Dollar and Swiss Franc. New Zealand Dollar is the strongest, followed by Australian. But for the week, Yen remains the strongest, followed by Dollar. Aussie is the weakest, followed by Euro.

In Europe, currently, FTSE is down -0.08%. DAX is up 0.15%. CAC is up 0.18%. German 10-year yield is down -0.012 at -0.018. Earlier in Asia, Nikkei dropped -0.22%. Hong Kong HSI rose 0.19%. China Shanghai SSE dropped -1.2%. Singapore Strait Times rose 0.20%. Japan 10-year yield dropped -0.0169 to -0.046.

US GDP grew 3.2% in Q1, blows past expectations

US real GDP grew 3.2% annualized in Q1, way better than expectation of 2.2%. However, the underlying details are seen by some economists as much weaker than the headline number suggests. Personal consumption expenditures grew merely 1.2%, much lower than Q4’s 2.5%. Fixed investment growth also slowed to 1.5%, down from 3.1%. Core PCE, Fed’s preferred inflation measures, slowed to 1.3%, well below 2% target.

ECB Rehn: Some policymakers want to keep low interest rates a little longer

ECB Governing Council member Olli Rehn said stubbornly low inflation expectations could be a result of investors’ doubt of the central bank’s policy. he said “firstly, long-lasting slow inflation may have lowered inflation expectations durably, and even so that they are easily moving downwards”. And “secondly, markets may find that monetary policy measures are not, under the current circumstances, effective enough to accelerate inflation.”

Additionally, Rehn hinted that some policymakers could prefer to keep interest rate at current level beyond the end of this year. He said “some of us were of the opinion that the low interest rate policy could have been pursued even a little longer”. And, “in this situation of economic uncertainty and weaker growth, there are reasons to pursue a very stimulating monetary policy.”

SNB Jordan: Negative interest rate and willingness to intervene remain both essential and appropriate

SNB Chairman Thomas Jordan warned that situation on financial and foreign exchange markets remains “fragile”. And, “against the current backdrop, our unconventional monetary policy with the negative interest rate and our willingness to intervene in the foreign exchange market as necessary remains both essential and appropriate”. He is optimistic that eventually, interest rate will turn positive again. But he added “I cannot tell you now when exactly that will be”.

Separately, head of the SNB Council, Jean Studer emphasized “the SNB can only fulfil its statutory mandate if it retains full independence in monetary policy matters”. He warned “a politicized central bank would no longer be able to carry out its tasks in the best interests of the country as a whole.”

Japan: Large contraction in industrial production raises recession risk

In March, Japan industrial production dropped -0.9% mom, below expectation of 0.0% mom. For the whole of Q1, industrial production contracted -2.6% yoy. The overall contraction in industrial production in Q1 was the largest in nearly five years, since Q2 2014. The data suggested that Japanese economy could have suffered a mild recession as external demand was hurt by US-China trade war.

Also released, unemployment rate also rose to 2.5%, up from 2.3% and was higher than expectation of 2.4%. Nevertheless, retail sales rose 1.0% yoy, above expectation of 0.8% yoy. Housing starts rose 10.0% yoy, above expectation of 5.5% yoy. In April, Tokyo CPI accelerated to 1.3% yoy, up from 1.1% yoy and beat expectation of 1.1% yoy.

New Zealand exports hit record NZD 5.7B in March, NZD/USD recovers

In March in New Zealand, exports jumped 19% yoy to NZD 5.7B, hitting a record for any month. Imports, on the other hand, dropped -3.4% yoy to NZD 4.8B. Trade balance came in at a NZD 922m surplus, highest since April 2011, and beat expectation of NZD 131m. International statistics manager Tehseen Islam said, “exports to China were the leading contributor to increases in several primary sector commodities including dairy products, beef, lamb, and forestry products.”

From Australia, import price dropped -0.5% qoq in Q1 versus expectation of -1.1% qoq. PPI slowed to 1.9% yoy versus expectation of 2.0% yoy.

IMF Lagarde: China’s Belt and Road should only go where it’s needed and sustainable

IMF Managing Director Christine Lagarde called for greater balance in the next phase of China’s Belt and Road Initiative. She borrowed from a Chinese proverb “It is easy to start a venture — the more difficult challenge is what comes next.”

Lagarde warned that “history has taught us that, if not managed carefully, infrastructure investments can lead to a problematic increase in debt”. And, “to be fully successful, the Belt and Road should only go where it is needed. I would add today that it should only go where it is sustainable, in all aspects.”

Also she emphasized, BRI 2.0 can also benefit from “increased transparency, open procurement with competitive bidding, and better risk assessment in project selection.”

EUR/USD Mid-Day Outlook

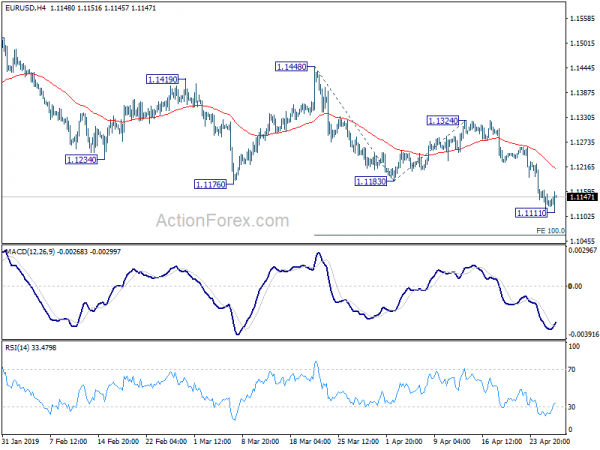

Daily Pivots: (S1) 1.1113; (P) 1.1138; (R1) 1.1157; More…..

With 4 hour MACD crossed above signal line, a temporary low is in place at 1.1111 in EUR/USD. Intraday bias is turned neutral for some consolidations. But recovery should be limited below 1.1324 resistance to bring fall resumption. On the downside, break of 1.1111 will resume the down trend to 100% projection of 1.1448 to 1.1183 from 1.1324 at 1.1059. Break will target 161.8% projection at 1.0895.

In the bigger picture, down trend from 1.2555 is now resuming with break of 61.8% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.1186. Medium term also remains with EUR/USD staying well below falling 55 week EMA. Next downside target will be 78.6% retracement at 1.0813. Sustained break there will pave the way to retest 1.0339. On the downside, break of 1.1448 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance Mar | 922M | 131M | 12M | -68M |

| 23:30 | JPY | Unemployment Rate Mar | 2.50% | 2.40% | 2.30% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Apr | 1.30% | 1.10% | 1.10% | |

| 23:50 | JPY | Industrial Production M/M Mar P | -0.90% | 0.00% | 0.70% | |

| 23:50 | JPY | Retail Trade Y/Y Mar | 1.00% | 0.80% | 0.40% | 0.60% |

| 01:30 | AUD | PPI Q/Q Q1 | 0.40% | 0.60% | 0.50% | |

| 01:30 | AUD | PPI Y/Y Q1 | 1.90% | 2.00% | 2.00% | |

| 01:30 | AUD | Import price index Q/Q Q1 | -0.50% | -1.10% | 0.50% | |

| 05:00 | JPY | Housing Starts Y/Y Mar | 10.00% | 5.50% | 4.20% | |

| 08:30 | GBP | BBA Loans for House Purchase Mar | 39980 | 38675 | 39083 | 39207 |

| 10:00 | GBP | CBI Reported Sales Apr | -5 | 3 | 1 | |

| 12:30 | USD | GDP Annualized Q/Q Q1 A | 3.20% | 2.20% | 2.20% | |

| 12:30 | USD | GDP Price Index Q1 A | 0.90% | 1.30% | 1.70% | |

| 14:00 | USD | U. of Mich. Sentiment Apr F | 97 | 96.9 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals