S&P 500 and NASDAQ made record highs overnight but sentiments turned around in Asia. Weaker than expected China PMIs raised doubt on the sustainability of the post lunar new year recovery. There is even question on whether slowdown has bottomed. Nevertheless, Chinese stocks remain resilient so far, with Shanghai SSE staying comfortably above 3000 handle.

In the currency markets, Australian Dollar is the weakest one for today for its economic tie with China. New Zealand and Canadian Dollars are the next weakest. Yen is the strongest one for now, followed by Sterling and then Swiss Franc. The big picture could drastically change in European session with Eurozone GDP featured. We’d finally see how bad the slowdown in Eurozone was.

Technically, Dollar and Yen remain generally in corrective mode and consolidations are set to extend further. It should be a matter of time when the two resume recent rises. The question is who’d be stronger. Judging from the price actions in USD/JPY, Yen is having a slight upper hand.

In Asia, currently, Hong Kong HSI is down -0.48%. China Shanghai SSE is up 0.43%. Singapore Strait Times is down -0.31%. Japan remains in the ultra-long 10-day holiday. Overnight, DOW rose 0.04%. S&P 500 rose 0.11%. NASDAQ rose 0.19%. 10-year yield rose 0.031 to 2.536.

China PMI manufacturing dropped in April, no upward turning point

China’s April PMIs came in all weaker than expected. The results raised much doubt on the case of recovery in the economy. And, they suggested that even the post lunar new year seasonal rebound in Mach couldn’t sustain. The official PMI manufacturing dropped to 50.1, down from 50.5 and missed expectation of 50.6. Official PMI non-manufacturing dropped to 54.3, down from 54.8 and missed expectation of 55.0.

Caixin PMI manufacturing dropped to 50.2 in April, down from 50.8 and missed expectation of 50.2. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “In general, China’s economy showed good resilience in April, yet it stabilized on a weak foundation and is not coming to an upward turning point. The Politburo meeting signalled that in the first quarter of this year China had adjusted its countercyclical policy marginally. As pressure on the economy remains in the second quarter, we expect that there will be minor adjustments to the policy but not a turnaround.”

New Zealand business confidence dropped to -37.5, soft patch proving reasonably long-lasting

New Zealand ANZ Business Confidence dropped slightly from -38.0 to -37.5 in April. Agriculture has the least confidence at -62.9 while manufacturing at -25.8 was already the best. Activity Outlook improved from 6.3 to 7.1. Agriculture outlook was the best at 20.0 while retail was worst at -7.5.

ANZ noted that the economy is “experiencing a soft patch that is proving reasonably long-lasting”. Steadily declining GDP is expected to continue to middle of this year. However, , easier monetary conditions and policy certainty should see momentum recover, assuming the global outlook continues to improve.

Also, “cost pressures are expected to dissipate as capacity pressures wane, reducing the pressure on firms’ profitability.” ANZ expects RBNZ to cut the OCR, starting in August, to support growth in inflation.

UK GfK consumer confidence unchanged at -13, a case of ‘Keep Calm’

UK GfK consumer confidence was unchanged at -13 in April, matched expectations. Joe Staton, Client Strategy Director at GfK, says: “We have reported a -13 headline for the past three months and it appears it’s a case of ‘Keep Calm’ when it comes to how confident consumers are feeling right now. Despite political carry-on in the Westminster bubble with the clock ticking on Britain’s eventual departure from the EU, consumers are holding firm and remain unshaken by the daily headlines of turmoil and intrigue, although we remain in negative territory.”

Eurozone GDP to highlight a busy day

Looking ahead, the economic calendar is very busy today. Q1 GDP from Eurozone, France and Italy will be the major focus in European session. Germany will also release Gfk consumer confidence, import price, unemployment and CPI. Eurozone will release unemployment rate. Swiss will release KOF economic barometer.

Later in the data, Canada GDP will catch most attention. IPPI and RMPI will also be featured. From US, employment cost, S&P Case Shiller house price, Chicago PMI, pending home sales and consumer confidence will also be featured.

AUD/USD Daily Outlook

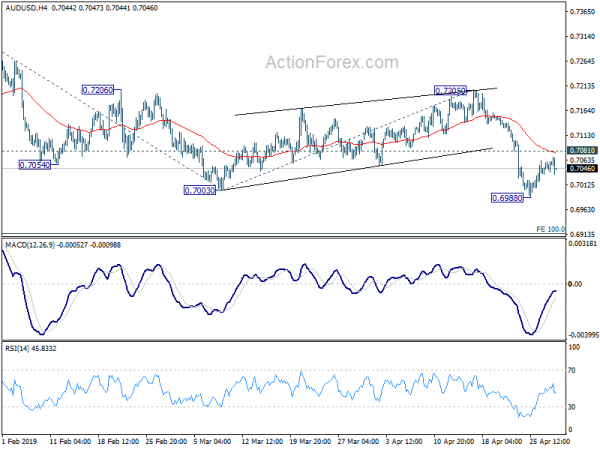

Daily Pivots: (S1) 0.7042; (P) 0.7052; (R1) 0.7066; More…

AUD/USD dips mildly after recovery from 0.6988 lost momentum. But it’s staying well above 0.6988 temporary low. Intraday bias remains neutral first. More consolidation would be seen. In case of another rise, upside should be limited by 0.7081 minor resistance to bring fall resumption. Prior break of 0.7003 suggests resumption of whole fall from 0.7295. On the downside, break of 0.6988 will extend the fall from 0.7295 to 100% projection of 0.7295 to 0.7003 from 0.7205 at 0.6913. Decisive break there will indicate further downside acceleration.

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Apr | -13 | -13 | -13 | |

| 01:00 | NZD | ANZ Business Confidence Apr | -37.5 | -38 | ||

| 01:00 | CNY | Manufacturing PMI Apr | 50.1 | 50.6 | 50.5 | |

| 01:00 | CNY | Non-manufacturing PMI Apr | 54.3 | 55 | 54.8 | |

| 01:45 | CNY | Caixin PMI Manufacturing Apr | 50.2 | 51 | 50.8 | |

| 05:30 | EUR | French GDP Q/Q Q1 P | 0.30% | 0.30% | ||

| 05:30 | EUR | French GDP Y/Y Q1 P | 1.10% | 1.00% | ||

| 06:00 | EUR | German Import Price Index M/M Mar | 0.30% | 0.30% | ||

| 06:00 | EUR | German GfK Consumer Confidence May | 10.3 | 10.4 | ||

| 07:00 | CHF | KOF Leading Indicator Apr | 97 | 97.4 | ||

| 07:55 | EUR | German Unemployment Change (000’s) Apr | -6K | -7K | ||

| 07:55 | EUR | German Unemployment Claims Rate Apr | 4.90% | 4.90% | ||

| 09:00 | EUR | Eurozone Unemployment Rate Mar | 7.80% | 7.80% | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q1 A | 0.30% | 0.20% | ||

| 10:00 | EUR | Italian GDP Y/Y Q1 P | -0.10% | 0.00% | ||

| 12:00 | EUR | German CPI M/M Apr P | 0.50% | 0.40% | ||

| 12:00 | EUR | German CPI Y/Y Apr P | 1.50% | 1.30% | ||

| 12:30 | CAD | GDP M/M Feb | 0.00% | 0.30% | ||

| 12:30 | CAD | Industrial Product Price M/M Mar | 0.30% | |||

| 12:30 | CAD | Raw Materials Price Index M/M Mar | 4.60% | |||

| 12:30 | USD | Employment Cost Index Q1 | 0.70% | 0.70% | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Feb | 3.10% | 3.60% | ||

| 13:45 | USD | Chicago PMI Apr | 59 | 58.7 | ||

| 14:00 | USD | Pending Home Sales M/M Mar | 0.70% | -1.00% | ||

| 14:00 | USD | Consumer Confidence Apr | 126.5 | 124.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals