Dollar turns mixed in Asian session today as markets turn their focus to non-farm payroll reports from US. The greenback has indeed been regaining grounds this gradually this week. In particular, it’s helped by Fed Chair Jerome Powell who talked down the need of rate cut. But buyers are so far seen as hesitating to commit yet.

As for today, New Zealand Dollar is the strongest one so far, followed by Canadian and then Sterling. Swiss Franc is the weakest, followed by Australian and then Euro. The picture is rather mixed. For the week, commodity currencies are the weakest ones, led by Aussie. Sterling is the strongest one as BoE inflation report, at least, didn’t paint a dovish picture. Euro is for now the second strongest but it’s rather vulnerable.

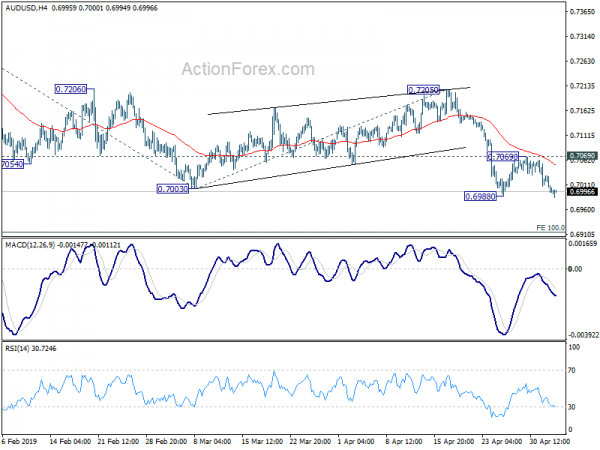

Technically, EUR/USD’s breach of 1.1175 minor support suggests that recovery from 1.1111 has completed. Retest of this temporary low should be seen next. USD/CHF is also heading back towards 1.0237 temporary low. AUD/USD breaches 0.6988 temporary low and is likely resuming recent decline from 0.7295. Dollar is ready to have a come back should NFP delivers.

In Asia, Hong Kong HSI is up 0.25%. China Shanghai SSE is up 0.52%. Singapore Strait Times is down -0.13%. Japan remains on holiday. Overnight, stocks were pressured on fading chance of Fed rate cut. DOW dropped -0.46%. S&P 500 dropped -0.21%. NASDAQ dropped -0.16%. 10-year yield jumped 0.041 to 2.552. Near term bullishness in 10-year yield was revived and focus is back on 2.6 handle.

Solid NFP expected as service sectors drive growth

Markets are expecting NFP to show 185k job growth in April. Unemployment rate is expected to be unchanged at 3.8%. Average hourly earnings growth is expected to pick up again to 0.3% mom.

Looking at other job data, the strong growth in ADP employment (275k) and sharp fall in ISM manufacturing employment (from 57.5 to 52.4) looks conflicting. But looking deeper ADP actually reported 223k growth in service jobs and only 52k in manufacturing jobs. The two reports were indeed consistent. That job growth was mainly from services sector. If ISM services would be released earlier than today, there would be more confirmation on the picture.

Meanwhile, four-week moving average of initial jobless claims was steady at 212.5k. Conference Board consumer confidence also rose from 124.2 to 129.2. The job related data generally support a solid set of NFP data today.

Dollar and treasury yields will likely be lifted if NFP delivers. Stocks could be pressured, in particular if wage growth beat expectations, on reducing chance of Fed cut. USD/JPY’s reactions, thus could be mixed. Instead, AUD/USD, which is already pressing 0.6988 support, is a good candidate to sell in such developments.

Here are some suggested readings on NFP:

Bundesbank Weidmann: Private consumption in Germany to overcome its weakness

Yesterday, Bundesbank President Jens Weidmann talked down risks of recession in Germany, as he spoke in a business forum. He said “given excellent labor market conditions and rising incomes, I expect private consumption in Germany to overcome its weakness”. And, there were “early signs of this already as the retail sector recorded strong growth in the first quarter.”

On ECB monetary policy, Weidmann said “the task of monetary policy is to ensure price stability… This means reacting to the weak domestic price pressures but also continuing on the path of policy normalization and not postponing unnecessarily if the inflation outlook permits it.”

EU Juncker: Germany, Austria, Netherlands stand in the way of EU reform

European Commission President Jean-Claude Juncker complained that Germany, Austria, Netherlands are hindering Eurozone reforms. He told German newspaper Handelsblatt that “there is no progress with the deepening of the monetary union because the Netherlands, Austria and all too often Germany stand in the way when it comes to solidarity in action and joint responsibility.”

On trade negotiations with the US, Juncker said EU is not aiming at a comprehensive deal along the lines of the Trans-Atlantic Trade and Investment Partnership. He also emphasized EU would not want to include agriculture in any trade deal. He added: “The Americans keep trying but we have stood our ground.”

On the data front

Australia AiG performance of services index rose to 46.5 in April, up from 44.9. Boiling approvals dropped -15.5% mom in March, below expectation of -12.5% mom.

Swiss CPI and SECO consumer confidence will be released in European session. UK PMI services will be featured. Eurozone PPI and CPI will also be watched.

Later in the day, in addition to NFP, US will also release trade balance, wholesale inventories and ISM non-manufacturing.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.6987; (P) 0.7008; (R1) 0.7022; More…

AUD/USD drops to as low as 0.6984 so far today. Breach of 0.6988 temporary low suggests resumption of fall from 0.7295. Intraday bias is back on the downside for 100% projection of 0.7295 to 0.7003 from 0.7205 at 0.6913. Decisive break there will indicate further downside acceleration. On the upside, break of 0.7069 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Service Index Apr | 46.5 | 44.8 | ||

| 1:30 | AUD | Building Approvals M/M Mar | -15.50% | -12.50% | 19.10% | |

| 5:45 | CHF | SECO Consumer Confidence Apr | -3 | -4 | ||

| 6:30 | CHF | CPI M/M Apr | 0.20% | 0.50% | ||

| 6:30 | CHF | CPI Y/Y Apr | 0.70% | 0.70% | ||

| 8:30 | GBP | Services PMI Apr | 50.4 | 48.9 | ||

| 9:00 | EUR | Eurozone PPI M/M Mar | 0.00% | 0.10% | ||

| 9:00 | EUR | Eurozone PPI Y/Y Mar | 3.00% | 3.00% | ||

| 9:00 | EUR | Eurozone CPI Estimate Y/Y Apr | 1.60% | 1.40% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y Apr A | 1.00% | 0.80% | ||

| 12:30 | USD | Advance Goods Trade Balance Mar | ||||

| 12:30 | USD | Wholesale Inventories M/M Mar P | 0.20% | 0.20% | ||

| 12:30 | USD | Change in Non-farm Payrolls Apr | 185k | 196k | ||

| 12:30 | USD | Unemployment Rate Apr | 3.80% | 3.80% | ||

| 12:30 | USD | Average Hourly Earnings M/M Apr | 0.30% | 0.10% | ||

| 13:45 | USD | Services PMI Apr F | 52.9 | 52.9 | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Apr | 57 | 56.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals