Even though US non-farm payroll report came in much stronger than expected. There is no apparent buying in Dollar as initial reactions. Weaker than expected wage growth seems to be a factor that’s capping the greenback’s strength. On the other hand, stocks are apparently boosted with DOW futures trading up 140 pts at the time of writing. 10 yield yield was shot up to above 2.56 but quickly dips back to 2.54. Traders would need some more time to digest the implications.

In the currency markets, commodity currencies are indeed the strongest ones at the time of writing, with help from stock futures rally. Euro remains the weakest for today, followed by Sterling and then Swiss Franc. Dollar and Yen are mixed.

In Europe, currently, FTSE is up 0.82%. DAX is up 0.52%. CAC is up 0.37%. German 10-year yield is flat at 0.033. Earlier in Asia, Hong Kong HSI rose 0.46%. China Shanghai SSE rose 0.52%. Singapore Strait Times dropped -0.03%. Japan stayed in 10-day holiday.

US NFP grew 263k, unemployment rate dropped to 3.6%, lowest since 1969

US non-farm payroll employment grew strongly by 263k in April, well above expectation of 185k. Prior month’s figure was revised slightly down from 196k to 189k. Unemployment dropped to 3.6%, down from 3.8% and beat expectation of 3.8%. That’s the lowest level since December 1969. Participation rate dropped by -0.2% to 62.8%. Average hourly earnings rose 0.2% mom, below expectation of 0.3% mom. But prior month’s figure was revised up from 0.1% mom to 0.2% mom.

Eurozone CPI accelerated to 1.7%, core CPI rose to 1.2%

Eurozone CPI accelerated to 1.7% yoy in April, up fro 1.4% yoy and beta expectation of 1.6% yoy. CPI core also accelerated to 1.2% yoy, up from 0.8% yoy and beat expectation of 1.0% yoy.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in April (5.4%, compared with 5.3% in March), followed by services (1.9%, compared with 1.1% in March), food, alcohol & tobacco (1.5%, compared with 1.8% in March) and non-energy industrial goods (0.2%, compared with 0.1% in March).

Also released, PPI dropped -0.1% mom, rose 2.9% yoy in March, versus expectation of 0.0% mom, 3.0% yoy.

UK PMI services rose to 50.4, marginal expansion only

UK PMI services rose to 50.4 in April, up from 48.9 and matched expectations. March’s reading was a 32-month low. Markit noted marginal rise in service sector business activity. New work dips for the fourth month in a row. Input cost inflation accelerates to its highest since January.

Chris Williamson, Chief Business Economist at IHS Markit said in the release: “A near-stagnant service sector in April means that all three major parts of the economy were struggling to grow in April. Although the service sector joined construction in reporting a return to growth, in both cases the expansions were only marginal. An upturn in manufacturing is meanwhile showing signs of waning, as a temporary boost from Brexit-related stockpiling faded in April.

“The resulting rise in business activity signalled collectively by April’s PMI surveys was only marginal, suggesting the economy remained more or less stalled at the start of the second quarter. “The disappointing start to the second quarter follows a first quarter in which the average PMI reading was the lowest since late 2012 and indicative of the economy flat-lining.”

Swiss CPI unchanged at 0.7% yoy, consumer sentiment dropped to -6

Swiss CPI rose 0.2% mom 0.7% yoy in April, matched expectations. Core CPI rose 0.3% mom, 0.5% yoy. The 0.2% mom increase in headline CPI compared with the previous month can be explained by several factors including rising prices for fuel and for air transport. In contrast, prices for hotel accommodation, glasses and contact lenses decreased.

Swiss SECO consumer confidence dropped to -6 in April, down from -4 and missed expectation of -3. SECO noted that: “Swiss consumer sentiment has worsened slightly. The index now comes in only just above average. The labour market has still been assessed positively. However, the likelihood of consumers making major purchases remains low.

EUR/USD Mid-Day Outlook

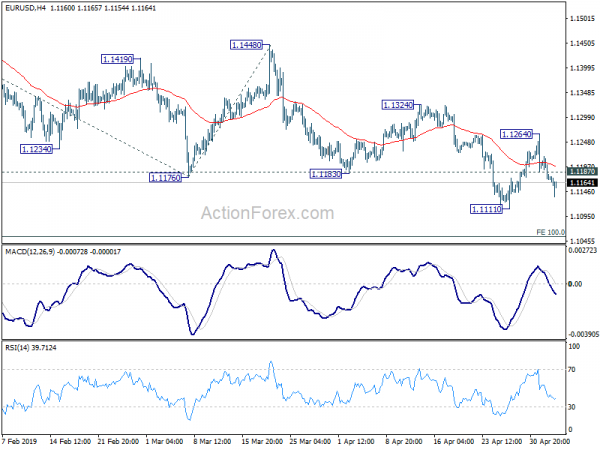

Daily Pivots: (S1) 1.1156; (P) 1.1187; (R1) 1.1204; More…..

Intraday bias in EUR/USD remains on the downside for 1.1111 low. Firm break there will resume larger down trend from 1.2555. Next target will be 100% projection of 1.1569 to 1.1176 from 1.1448 at 1.1105 next. On the upside, above 1.1187 minor resistance will turn intraday bias neutral for more consolidation. But in case of another recovery, upside should be limited below 1.1324 resistance to bring down trend resumption eventually.

In the bigger picture, down trend from 1.2555 (2018 high) has just resumed. Current fall should now target 78.6% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.0813. Sustained break there will pave the way to retest 1.0339. On the downside, break of 1.1448 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Service Index Apr | 46.5 | 44.8 | ||

| 01:30 | AUD | Building Approvals M/M Mar | -15.50% | -12.50% | 19.10% | |

| 05:45 | CHF | SECO Consumer Confidence Apr | -6 | -3 | -4 | |

| 06:30 | CHF | CPI M/M Apr | 0.20% | 0.20% | 0.50% | |

| 06:30 | CHF | CPI Y/Y Apr | 0.70% | 0.70% | 0.70% | |

| 08:30 | GBP | Services PMI Apr | 50.4 | 50.4 | 48.9 | |

| 09:00 | EUR | Eurozone PPI M/M Mar | -0.10% | 0.00% | 0.10% | |

| 09:00 | EUR | Eurozone PPI Y/Y Mar | 2.90% | 3.00% | 3.00% | |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Apr | 1.70% | 1.60% | 1.40% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Apr A | 1.20% | 1.00% | 0.80% | |

| 12:30 | USD | Advance Goods Trade Balance Mar | -71.45B | -73.0B | -72.0B | -80.38B |

| 12:30 | USD | Wholesale Inventories M/M Mar P | 0.00% | 0.20% | 0.20% | |

| 12:30 | USD | Change in Non-farm Payrolls Apr | 263K | 185k | 196k | 189K |

| 12:30 | USD | Unemployment Rate Apr | 3.60% | 3.80% | 3.80% | |

| 12:30 | USD | Average Hourly Earnings M/M Apr | 0.20% | 0.30% | 0.10% | 0.20% |

| 13:45 | USD | Services PMI Apr F | 52.9 | 52.9 | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Apr | 57 | 56.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals