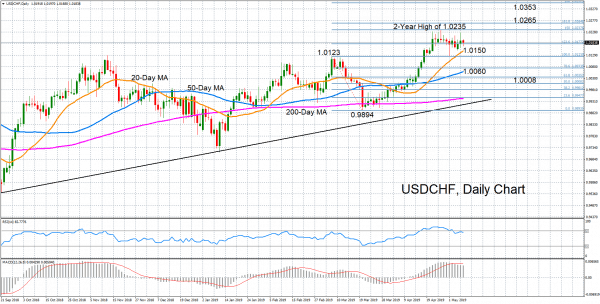

USDCHF is lacking near-term direction as the pair continues to consolidate after touching a two-year high of 1.0235 in April. The RSI has come off from overbought levels and the MACD histogram has crossed below its red signal line, pointing to some downside risks. However, the declines have been gradual and both indicators are looking steady, suggesting more sideways movement in the short term.

If the pair drifts downwards, immediate support is likely to come from the 20-day moving average (MA) around 1.0150. A drop below this mark would open the way for the 1.0123 level, which was the March top, followed by the 50-day MA in the 1.0060 region. Falling below the 50-day MA, and subsequently below the 50% Fibonacci retracement of the 1.0123-0.9894 downleg at 1.0008, would risk shifting the current bullish picture in the medium term to a neutral one.

However, if USDCHF regains some positive momentum, the immediate target for the bulls would be the 2-year high of 1.0235 before aiming for the 161.8% Fibonacci extension at 1.0265. Climbing above this level would reinforce the bullish outlook and bring the 200% Fibonacci at 1.0353 into scope.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals