EUR/USD Outlook: Bears Likely to Travel Further as Conditions Continue to Worsen

The Euro hit new marginally lower 20-year low in early Wednesday, as risk assets fell in Asia, lifting the dollar to new high. Technical studies show indicators on daily chart in full bearish setup, with oversold conditions likely to slow...

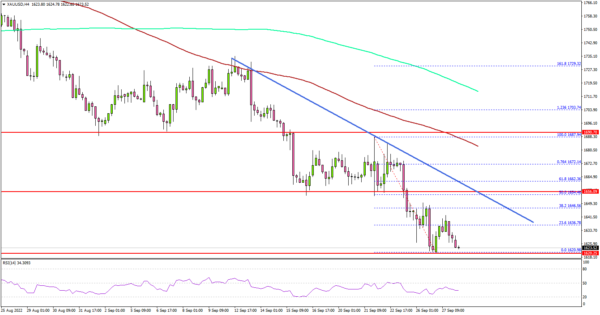

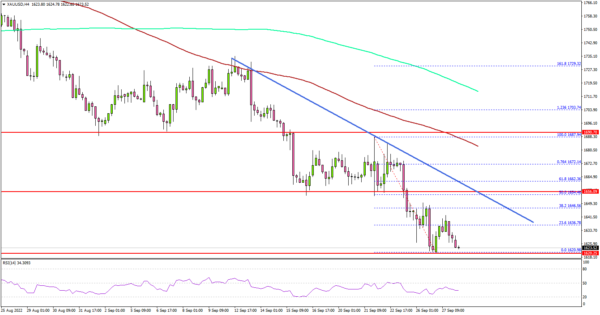

Gold Price Turns Red Below $1,650, Upsides Capped

Key Highlights Gold price extended losses below the $1,650 support. A major bearish trend line is forming with resistance near $1,650 on the 4-hours chart. EUR/USD and GBP/USD might start a fresh downward move. USD/JPY could clear the last high...

Gold Price Turns Red Below $1,650, Upsides Capped

Key Highlights Gold price extended losses below the $1,650 support. A major bearish trend line is forming with resistance near $1,650 on the 4-hours chart. EUR/USD and GBP/USD might start a fresh downward move. USD/JPY could clear the last high...

Brent Dropped to Its February Lows

The commodity market is now experiencing a huge stress due to concerns of the reduction in demand for energies. Early in the week, Brent dropped to $85.35 and no other negative factors have appeared since then. However, those that are...

Gold Extends its Decline to Fresh 29-Month Lows

Gold has been losing ground since early March, generating a profound structure of lower highs and lower lows within a descending channel. Furthermore, in the last few daily sessions, the technical picture has deteriorated, with the pair forming consecutive fresh 29-month...

GBP/USD Freefall: Where Will It Stop?

Cable traders will remember today for a LONG time. The UK government’s announcement of a “mini” budget cutting taxes and capping energy bills has spooked international investors, leading to a surge in UK gilt yields and driving GBP/USD down to...

Gold Falls Below $1650 as US Dollar Soars

On the back of fresh data via the PMI flashes out of the EU and UK, which showed that both economies are in contractionary territory, the EUR/USD and GBP/USD are trading lower on the day. As a result, the strength...

GBP/USD: Sterling Falls to New Multi-year Low after Disappointing Data

Cable accelerates below 1.12 mark on Friday and hit new lowest since 1985, in extension of steep bear-leg from 1.1738 (Sep 13 lower top), which is a part of larger downtrend from 1.4249 (June 2021 peak. The action in Asian...

USD/JPY Dips As Bulls Take Breather, Gold Consolidates

Key Highlights USD/JPY started a downside correction from the 145.90 high. It broke a major bullish trend line at 143.75 on the 4-hours chart. Gold price is still consolidating below the $1,700 resistance zone. The US Manufacturing PMI could decline...

CHFJPY Sinks to 2-Week Low; Bullish Structure Intact

CHFJPY lost almost 2.0% within two hours during Thursday’s European trading hours, plunging to a two-week low of 143.92 before edging slightly higher. The technical oscillators followed the price sharply lower, with the RSI sliding below its 50 neutral threshold...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals