As the frequency of cross-border payments continues to rise, cross-border instant payments will slowly gain traction, given corporates’ need to quickly settle international payments in a global arena, says Andy Schmidt, vice president, global financial services at technology consulting firm CGI.

“Traditionally, cross-border payments have been slow and expensive and the lag creates inefficiencies and extra costs for corporates that transact globally,” he says.

“Cross-border instant payments is the obvious solution to this, and new digital money-transfer companies are offering solutions such as this while traditional banks have fallen behind.”

According to CGI’s Transaction Banking Survey 2019, published in September, corporate client satisfaction with main banking services providers has fallen below 50% for the first time since the survey began seven years ago.

Meanwhile, corporates are increasingly demanding digital, ‘best-in-class’ products and services but banks are falling short – just under half of all respondents said this is very important to them, but only 8% of banks were delivering on this.

The survey is based on more than 400 responses from 136 corporate practitioners working in their organization’s treasury or finance function and 251 banking services providers.

Companies such as Transferwise, WorldRemit, Payoneer and WorldFirst have raised their profile thanks to their ability to provide money transfer services at much lower prices than traditional banks.

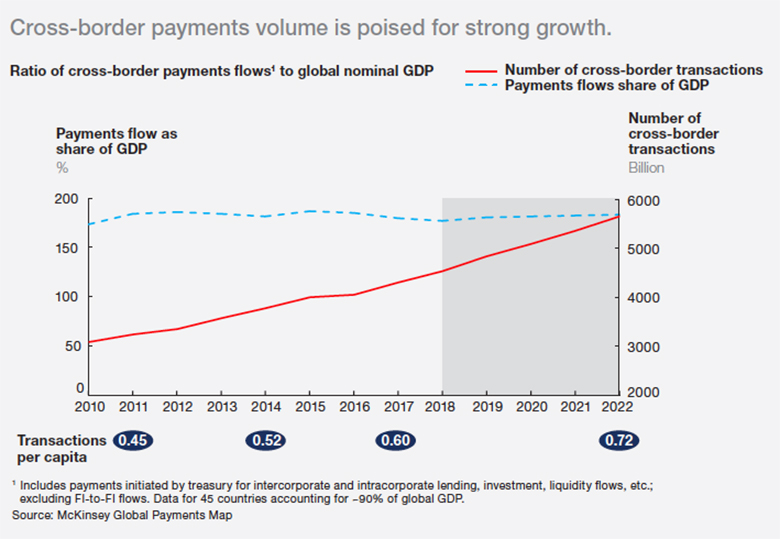

While the majority of these companies focus on the C2C sector, opportunities abound in the $22 trillion cross-border payments market.

In July this year, World Remit stepped into the cross-border B2B market in Africa with the launch of World Remit for Business. Similar companies may follow suit, says Schmidt, hoping to gain a piece of the pie as international commerce, migration and changing economic trends push the payments industry further.

Banks fighting back

In response, traditional banks are working hard to retain business from corporates attracted to new – and often cheaper – money transfer companies.

“There is change on the horizon,” says Schmidt. “Banks are responding to disrupters in an effort to retain market share in payments, and cross-border instant payments is the new battleground.”

Banks are increasingly leveraging new technology or working with fintechs in order to bring the cost down and increase the speed of international transactions.

|

Shahrokh Moinian, JPMorgan |

Target Instant Payment Settlement (TIPS) and the Single Euro Payments Area (SEPA) in Europe, The Clearing House’s Real Time Payments (RTP) initiative launched in 2017 in the US, Singapore’s Fast and Secure Transfers (FAST) and SWIFT GPI Instant are just some of the initiatives in place to encourage and support instant cross-border payments.

Back in April, JPMorgan became the first American bank to offer SEPA Instant services via RT1 clearing ‒ the European Banking Authority’s infrastructure solution for the processing of instant SEPA credit transfers at a pan-European level ‒ which will help the bank support corporate customers working in Europe. SEPA Instant was the obvious choice for JPMorgan’s transactions given the network’s coverage, says Shahrokh Moinian, head of wholesale payments, EMEA at JPMorgan.

And with standardization across the bank’s payments business in the US and Europe, via a single API, accessing multiple global instant payment systems is simplified, he says.

“With the launch of SEPA Instant we are now able to take the same approach with instant payments in both the US and Europe. Soon we will be able to expand our real-time payment solutions to Asia as well, further supporting the needs of our international corporate clients. The hope is that cross-border instant payments between different jurisdictions will be next on the agenda.”

There is change on the horizon. Banks are responding to disrupters in an effort to retain market share in payments, and cross-border instant payments is the new battle ground

– Andy Schmidt, CGI

JPMorgan is bullish about its role in the instant payments landscape. “Banks have been criticized in the past for not investing enough in payments, and not meeting the requirements of their corporate clients,” Moinian adds. “But given our work in the space, and our recent foray into SEPA Instant, as well as the amount of money we are investing in technology and IT, this is no longer the case.”

As Schmidt says: “This is a logical strategy for JPMorgan to take – to broaden their appeal for a global cash management audience, especially as businesses become much more international in nature.”

Indeed, in February this year, JPMorgan announced its ambitions to expand its commercial banking business into Asia and Europe and part of this offering will include instant cross-border payments on behalf of corporate clients.

“It has taken some time for a US bank to use the SEPA rails, but it will be interesting to see which European banks will be the first to do something similar in the US, although the US market for instant payments hasn’t really taken off as yet,” says Schmidt.

“Interoperability between platforms will only really take off when other banks come in, so this is where we need to go,” he says.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals