The Bullish Hammer Candlestick Pattern: Main Talking Points

The bullish hammer candlestick pattern is frequently observed in financial markets. Traders can exploit the detection of a bullish hammer with a proper understanding of its foundations. This article will outline the following:

• What is a bullish hammer?

• Using a Bullish Hammer Candlestick Pattern in Trading

• Further Reading on Trading with Candlestick Patterns

Interpreting Japanese candlesticks can give a trader important insight into market momentum. By understanding how to read candles, traders can often include them in their analysis to find areas of price continuations and possible reversals. Today we will focus on one candle that can help validate a charts reversal point. Let’s learn to identify and trade the bullish hammer candle.

What is a bullish hammer?

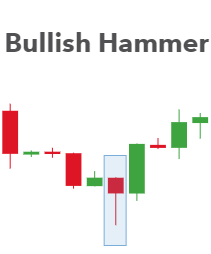

A bullish hammer differs from other candlestick patterns as it is a single candle hinting at a turn during an established downtrend. Pictured below the hammer is interpreted by understanding a candles particular open, low high and close levels. To create a hammer, price must first significantly sell off to create a new low for a currency pair. However, after this decline, prices must significantly rally causing prices to have a small body and close near its opening price.

It should be noted that hammers should have long wicks at least twice the length of the candle body. In addition, the candle itself can either be red or green depending on the strength of the reversal.

Often the bullish hammer is confused with a bearish hanging man candle. The misrepresentation is logical because both candles look identical! The difference between these two candles lies in their placement in a trending market. The hanging man has a small body and long wick but is found hanging at the end of an uptrend. Bullish hammers have small bodies and long wicks also but are only seen at the end of a downtrend.

How to spot a Bullish Hammer pattern:

• Candle with a short body and long wick (at least 2x the size of the body)

• Occurs at the bottom of a downward trend

• Confirmation from other indicators as mentioned below

What does it indicate:

• Trend reversal to the upside (bullish reversal)

• Price rejection at a certain ‘key level’

Value to traders:

• Indicates potential price reversals which could lead to entering a long position at the start of an upward swing – capitalize on the full upward movement

• Easy to identify

Using a Bullish Hammer Candlestick Pattern in Trading

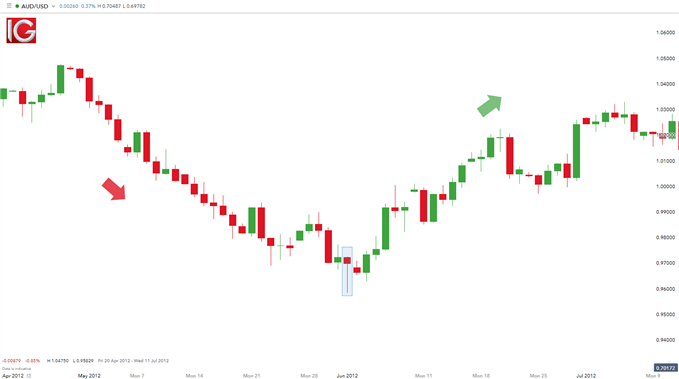

AUD/USD Bullish Hammer candlestick:

Bullish hammer candles can be found on a variety of charts and time frames. Depicted above is an example of the hammer on the AUD/USD daily chart. From 20 April through to 31 May the AUD/USD fell as much as 892 pips. This downtrend was concluded with a bullish hammer candle, and price has subsequently rallied a total of 792 pips through today’s price action.

As the strength of a hammer depends on its placement on the graph, normally traders use this candle in conjuncture with other indications of price support. This includes using tools such as Fibonacci retracements, pivot points and psychological whole numbers. In an ideal scenario, the wick of the hammer will penetrate a support level, but the body will close above support on renewed buying sentiment. With a new buying opportunity presented, traders may then choose to place stops under the created wick below support.

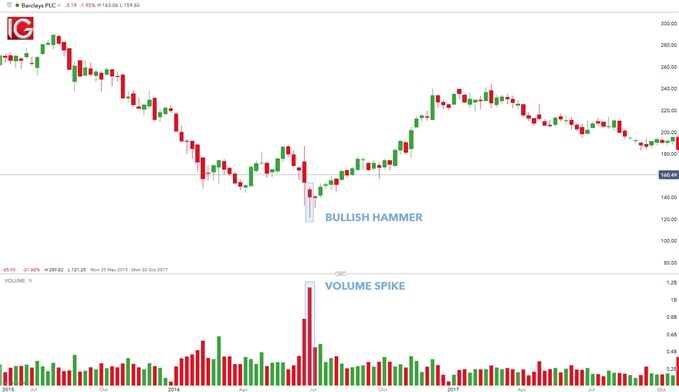

The bullish hammer candle is interpreted the same way in all financial markets (indices, forex, commodities and stocks) however, stock analysis requires further data as confirmation. It is important to note that brokers generally show internal volume figures for the other financial markets including forex which is why the volume indicator is not reliable for an overall market volume estimate. The chart below shows a bullish hammer candle on a Barclays PLC chart. In conjunction with the bullish hammer, there is a subsequent relative increase in volume traded as highlighted. This emphasizes institutional activity for this period due to the large volume – retail traders will not be able to affect such large volumes. This ‘denial’ by bulls (traders taking long positions) after the recent swing low displays price rejection at that level. This level may be a key level whereby ‘buy’ order are triggered. With the bullish hammer and the volume exhibit this relationship, traders can have some form of validation to place a long trade. As always, the principals of risk management should apply to all trades.

Barclays PLC Bullish Hammer:

Further Reading on Trading with Candlestick Patterns

The bullish hammer candle is one of many bullish price patterns that can assist traders when entering a trade. Other bullish patterns traders should be aware of, include: morning star and the inverse head and shoulders among others. Day traders, however, incorporate the use of indicators and key levels of support and resistance, alongside candlesticks, to substantiate trades before entering. Other aides you can use to improve your trading include our free trading guides and for those just getting started, take a look at our New to FX guide.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals