There are countless ways to approach the market to find opportunities, and as such this means there aren’t any truly right or wrong ways to analyze and trade. With that said, though, the process used to identify good trade set-ups tends to be similar regardless of the disciplines a trader adopts. There is some form of ‘case-building’ process used to determine why (or why not) a trade should be made.

Whether you are a new trader building a foundation or an experienced trader struggling (happens to the best), here are 4 ideas to help you Build Confidence in Trading

When using a case-building process you are basically asking yourself; what criteria point to a good set-up and is the market validating them? Most of the time the answer is “no”, because more often than not trade set-ups don’t mature to the point of being worth executing. But when the answer is “yes”, there are strong supportive arguments for why you should place a trade and in simple form your logic will look something like this: Criteria 1 + Criteria 2 + Criteria 3 = TRADE

What are the criteria I am referring to? They could be a whole host of tools and methodologies. One of the biggest keys to focus on here is that there is confluence. For example, a market trending higher that pulls back to price and trend-line support arriving at the same level, it would offer a confluence between varying degrees of support as well as a trend that is conducive for further price appreciation. In a simple formula it would look like this: Uptrend + Price Support + Trend-line Support = Quality Set-up

If no case can be built, then of course the proper thing to do is nothing at all. One of the single biggest problems traders have is over-trading, but by always being mindful of whether good criteria are met or not it will help eliminate many trades that shouldn’t be taken.

The Becoming a Better Trader series in one location, check it out.

Sample list of criteria to consider (from webinar slide)

*The criteria on the left are my own, while those on the right side in blue are other common factors traders use. Again, your list is likely to be different.

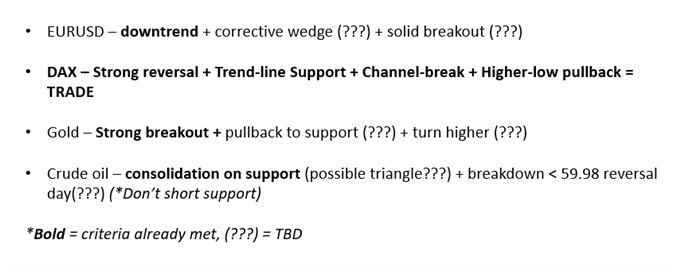

Below is a sample watchlist we looked at in the webinar. The bolded criteria have already been met, while the (???) indicates pending criteria that are needed to be met before the scenario has enough factors to support a trade. You can simply walk through the steps on a piece of paper or in an electronic format (i.e. Excel, Word, etc.); it doesn’t matter how just that there is a pattern of adding up the criteria to make a case to trade.

Once you get to a certain point this process should become a natural part of your thinking and you don’t necessarily have to ‘put it on paper’, but it can be a good process to do nevertheless; especially if you have a lot of slow-developing set-ups you are tracking.

Sample Watch-list

Rules of Thumb:

We also discussed a few good rules of thumb. These can be extremely helpful for keeping you trading in-line with your general trading plan, and as a result helpful for creating consistency. You might think of these as cliché, but clichés are around for a reason – because they are usually true. It’s important to read your rules of thumb over and over until they sink far enough into your head that they become an extension of your automatic thinking; from conscious to subconscious.

Here is a sample of rules of thumb

To conclude: Trading isn’t an easy endeavor and even when you have a good process and set of rules in place, at times you will still deviate off the proper path. We’re human. What we are trying to do here is create a structure that helps significantly reduce the number of mistakes and ill-advised trades we make, and of course ensure that none of our mistakes completely take us out of the game by having good risk management rules.

For the full conversation, please check out the video above…

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals