Swiss Franc and Yen firm up again in Asian session as markets are gradually convinced that a full-blown US-China trade war is underway. Tensions between the two countries have clearly worsened after trade negotiation collapsed weeks ago. And it’s clearly not just about trade but a broad range of practices of China, including IP theft. Huawei is highly unlikely to be the only one who will receive broad based sanctions from the US, and more are coming.

Additionally, as Treasury Secretary Steven Mnuchin, a relative trade dove, indicated, tariffs on all untaxed Chinese imports are probably just a month away. A full-blown trade war is quickly becoming the baseline scenario. Tariffs impacts are seen again in today’s Japan PMI manufacturing, which is back in contraction. Eurozone PMIs and German Ifo might add more pessimistic evidence.

Back in the currency markets, Dollar is following as the third strongest one for today on risk aversion. Sterling is the weakest one for today as Brexit crisis in UK deepens with resignation of high profile minister Andrea Leadsom. Australian Dollar is the second weakest so far on anticipation of RBA cut in June. Canadian Dollar got just a very brief lift by retail sales overnight. It’s then pulled down by oil price on surprised inventory build.

Technically, USD/CAD’s quick rebound is inline with our view that it’s just extending consolidation from 1.3521. Further rise is expected through this resistance eventually. GBP/JPY resumed recent decline through 139.54 overnight. EUR/JPY and USD/JPY might follow before weekly close, if risk sentiment worsens. Similarly, USD/CHF could break through 1.0050 to resume recent fall soon. AUD/USD, too, looks ready to break through 0.6864 temporary low any time.

In Asia, Nikkei is currently down -0.67%. Hong Kong HSI is down -1.30%. China Shanghai SSE is down -0.84%. Singapore Strait Times is down -0.41%. Japan 10-year JGB yield is up 0.0005 at -0.05. Overnight, DOWN dropped -0.39%. S&P 500 dropped -0.28%. NASDAQ dropped -0.45%. 10-year yield dropped -0.033 to 2.393, back below 2.4 handle.

US Mnuchin indicates new tariffs on China probably just a month away

Yesterday, US Treasury Secretary Steven Mnuchin reminded the House Financial Services Committee that new tariffs on USD 300B in Chinese imports are probably just a month or so away. He said, “there won’t be any decision probably for another 30 to 45 days.” Meanwhile, there is no plan to travel to China to resume trade negotiations yet.

On Walmart’s claims that tariffs will push up retail prices, he said “that’s something I can assure you the president will be focused on before we make any decisions.” However, he also talked down the threat of higher prices for consumers. He said “my expectation is that a lot of this business will be moved from China to other places in the region so that there will not be a cost.”

FOMC minutes show no urgency to cut interest rate

Dollar is steady after minutes of May 1 FOMC meeting showed that Fed is in no rush to move interest rates, up or down. The minutes noted that “members observed that a patient approach…would likely remain appropriate for some time”. The tone regarding the economy was also upbeat, due to upside surprise in Q1 growth. GDP was forecast to “expand at a rate above the staff’s estimate of potential output growth in 2019 and 2020 and then slow to a pace below potential output growth in 2021”. Recent weak inflation was also viewed by many participants “as likely to be transitory.”

However, firstly, there was increasing concerns over persistence of low inflation. “Several participants commented that if inflation did not show signs of moving up over coming quarters, there was a risk that inflation expectations could become anchored at levels below those consistent with the committee’s symmetric 2% objective.” Secondly, the meeting was held before current round of escalation in US-China trade war. It is possible that the Fed would turn more cautious over the economic outlook at the June meeting, when the members take into account the effects of recent re-escalation of US-China trade war.

For now, comments from Fed officials are generally inline with the minutes. But as more data come in, upcoming rhetorics leading to June FOMC meeting would reveal if there would be a shift in the board.

Suggested readings on FOMC minutes:

Japan PMI manufacturing dropped to 49.6, re-escalation of US-China trade frictions heightened concern

Japan PMI manufacturing dropped to 49.6 in May, down from 50.2 and missed expectation of 50.5. The reading is also back in contraction territory. Markit noted that output and new orders decrease for fifth successive month. Businesses cast pessimistic outlook towards the coming year for the first time in six-and-a-half year.

Joe Hayes, Economist at IHS Markit, said: “Following some tentative signs that the downturn in Japan’s manufacturing sector had softened in April, flash data for May revealed these were short-lived, as output and export orders fell at stronger rates. The re-escalation of US-China trade frictions has heightened concern among Japanese goods producers. Underlying growth weakness across much of Asia led to struggling exports, which fell at the sharpest rate in four months. Difficulties on the international front merely add to uncertainties domestically, with upcoming upper house elections in July, and the impending sales tax hike later this year. Subsequently, sentiment turned negative in May for the first time in six-and-a-half years.”

Brexit crisis deepens as Leadsom resigns on second referendum

Brexit crisis in UK deepened further after a key Cabinet Minister resigned in opposition to Prime Minister Theresa May’s inclusion of a second referendum in the new Brexit plan.

Andrea Leadsom Leader of the House of Commons, said “I no longer believe that our approach will deliver on the referendum result”. And, “I do not believe that we will be a truly sovereign United Kingdom through the deal that is now proposed”.

Leadsom went further and said “I have always maintained that a second referendum would be dangerously divisive and I do not support the government willingly facilitating such a concession.”

May’s spokesman just praised Leadsom and expressed disappointment at her decision, but added: “The prime minister remains focused on delivering the Brexit people voted for.”

There is practically no chance for May to get her Brexit deal through the Commons. The question now is who will take her place and lead Brexit after she steps down as promised. Sterling remains the weakest one for the week as markets are pricing in the chance of a pro-Brexit hardliner leading UK to a no-deal Brexit.

Looking ahead

Eurozone PMIs and German Ifo are the major focus of the data. The data will need to show more evidence of stabilization in the economy Q2 to support Euro. Germany will release Q1 GDP final. ECB monetary policy accounts will also be featured. Later in the day, Canada will release wholesale trade sales. US will release PMIs and new home sales.

USD/CHF Daily Outlook

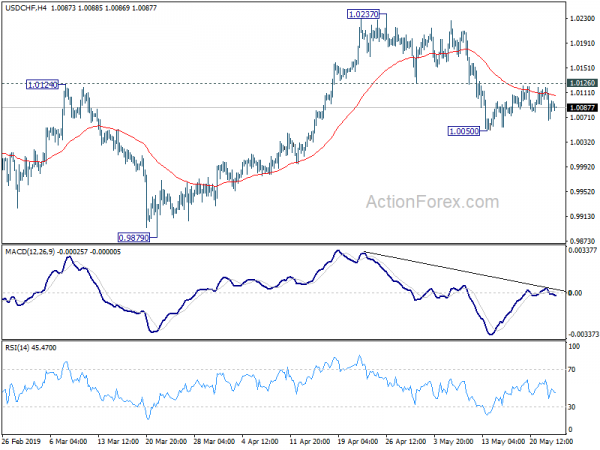

Daily Pivots: (S1) 1.0068; (P) 1.0094; (R1) 1.0122; More…

USD/CHF dipped notably overnight but stays above 1.0050 temporary low. Intraday bias remains neutral for the moment. With 1.0126 support turned resistance intact, another decline is mildly in favor. On the downside, break of 1.0050 will resume the fall from 1.0237 to retest 0.9879 key support. However, firm break of 1.0126 will turn bias back to the upside for 1.0237 resistance.

In the bigger picture, as long as 0.9879 support holds, medium term up trend form 0.9186 is still in progress. Break of 1.0237 will target 1.0342 resistance next. For now, we’d be cautious on strong resistance from there to limit upside, until we see medium term upside acceleration. However, decisive break of 0.9879 will be a strong sign of medium term reversal. Focus will be turned back to 0.9716 support for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | JPY | PMI Manufacturing May P | 49.6 | 50.5 | 50.2 | |

| 6:00 | EUR | German GDP Q/Q Q1 F | 0.40% | 0.40% | ||

| 7:15 | EUR | France Manufacturing PMI May P | 50 | 50 | ||

| 7:15 | EUR | France Services PMI May P | 50.8 | 50.5 | ||

| 7:30 | EUR | Germany Manufacturing PMI May P | 44.8 | 44.4 | ||

| 7:30 | EUR | Germany Services PMI May P | 55.4 | 55.7 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI May P | 48.1 | 47.9 | ||

| 8:00 | EUR | Eurozone Services PMI May P | 53 | 52.8 | ||

| 8:00 | EUR | German IFO Business Climate May | 99.1 | 99.2 | ||

| 8:00 | EUR | German IFO Expectations May | 95 | 95.2 | ||

| 8:00 | EUR | German IFO Current Assessment May | 103.5 | 103.3 | ||

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | CAD | Wholesale Trade Sales M/M Mar | 0.80% | 0.30% | ||

| 12:30 | USD | Initial Jobless Claims (MAY 18) | 215K | 212K | ||

| 13:45 | USD | Manufacturing PMI May P | 52.7 | 52.6 | ||

| 13:45 | USD | Services PMI May P | 53.5 | 53 | ||

| 14:00 | USD | New Home Sales Apr | 678K | 692K | ||

| 14:00 | USD | New Home Sales M/M Apr | -2.50% | 4.50% | ||

| 14:30 | USD | Natural Gas Storage | 106B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals