Dollar tumbles sharply in early as poor non-farm payroll report affirms the case for Fed rate cut this year. The headline number of 75k is a big miss. Equally importantly, weaker than expected wage growth argues that inflation pressure could remain subdued ahead. The question now is on whether there will be substantial improvement in trade tensions ahead. As Dallas Fed Kaplan put, things could be turned around in a matter of weeks. Though, at least, there is little chance for a deal between US and China in the near term. Hope is more on whether Mexico could avert the tariffs due Monday.

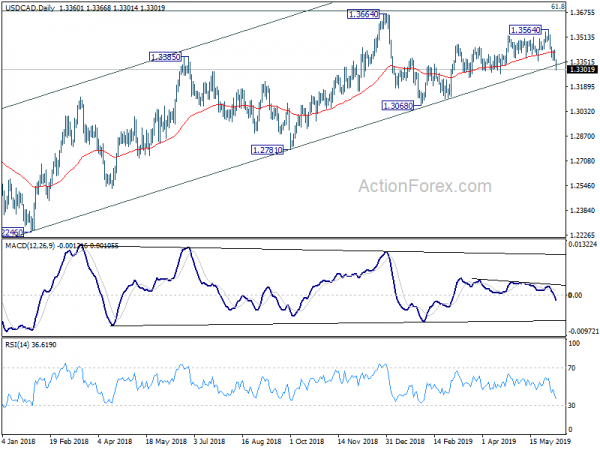

Technically, the biggest mover is found in USD/CAD, which plummets on strong Canadian job data. Current development firstly confirms completion of rise from February’s low of 1.3068. More importantly, there is sign of reversing the medium term trend from 2017 low of 1.2061 too. EUR/USD also breaks through yesterday’s high of 1.1309. Rebound from 1.1107 is now expected to extend towards 1.1448 key resistance Though, for now, Dollar is held above this week’s low again Swiss, Yen and Aussie. We’d see if there is breakout before weekly close.

In other markets, DOW futures is still trading up 0.1% at the time of writing. But 10-year yield extends recent decline to as low as 2.059. In Europe, currently, FTSE is up 0.57%. DAX is up 0.37%. CAC is up 1.17%. German 10-year yield is down -0.016 at -0.252, extending the run for record lows. Earlier in Asia, Nikkei rose 0.53%. Hong Kong and China were on holiday. Singapore Strait Times rose 0.64%. Japan 10-year JGB yield rose 0.0048 to -0.116.

Big miss in US NFP, Canadian unemployment rate dropped to lowest since 1976

US non-farm payroll grew 75k in May, well below expectation of 180k. monthly job gains have averaged 164k in 2019, notably lower than 223k monthly average in 2018. Unemployment rate was unchanged at 3.6% while participation rate was unchanged at 62.8%. Average hourly earnings rose 0.2% mom, below expectation of 0.3% mom.

Canada employment grew 27.7k in May, well above expectation of -5.5k contraction. Unemployment dropped to 5.4%, well below expectation of 5.7%. That’s the lowest level since record began in 1976.

USD/CAD dives sharply after the release and breaks medium term channel support decisively. The development now suggests medium term bearish reversal and focus will be on 1.3068 support for confirmation.

Bundesbank slashes 2019 German growth forecasts to 0.6% (down from 1.6%), lacklustre export growth taking a toll

Bundesbank sharply slashed German growth forecasts to just 0.6% in 2019 and said the economy is “currently experiencing a marked cool down”. That is “mainly due to the downturn in industry, where lacklustre export growth is taking a toll. Nevertheless, “a more protracted, clear decline in economic output currently seems an unlikely prospect, though.” And, “once foreign demand picks up, German economic growth will be more broadly based again.”

Still, risks are tilted to the downside. And, it warned “additional negative external developments could intensify or prolong the downturn in Germany’s strongly export-driven economy.” In particular, the experts warn that an escalation of protectionist measures around the world could place considerable strain on German industry. In addition, they highlight the possibility of a disorderly Brexit as well as uncertainties surrounding the fiscal policy stance of the Italian government as risk factors for economic growth in Germany.

On GDP growth: 2019 at 0.6% (down from Dec projection of 1.6%); 2020 at 1.2% (down from 1.6%); 2021 at 1.3% (down from 1.5%). On HICP: 2019 at 1.4% (unchanged); 2020 at 1.5% (down from 1.8%); 2021 at 1.7% (down from -0.1%;

Also released from Germany, industrial production dropped -1.9% mom in April, much worse than expectation of -0.5% mom. Trade surplus narrowed to EUR 17.0B in April. From Swiss, foreign currency reserves dropped CHF -16B to CHF 760B. Unemployment rate was unchanged at 2.4%.

ECB Vasle: TLTRO keeps favorable financing conditions and supports transmission of monetary policy

ECB Governing Council member Bostjan Vasle said the biggest risks for Eurozone growth is that worsening global condition could slow trade. However, the current favorable financing conditions and robust domestic demand will support Eurozone economy.

He emphasized that “it is of key importance that the instrument (TLTRO) keeps favorable conditions of financing for banks and thus supports transmission of monetary policy into banks’ credit activity”. Also ECB stand ready to use “other available measures” if needed.

Vasle also noted that persistent low inflation is a result of moderation in growth, weaker energy prices and lower wage pressures. He said “the council of governors has responded to these movements by adjusting its decrees with a purpose of ensuring the necessary accommodation line of its monetary policy also in worsened conditions.”

Separately, another Governing Council member Vitas Vasiliauskas said inflation outlook is “not bad”. And, the council still needs time to see however the economy developments in the second half of the year. Also a Governing Council member, Ewald Nowotny said there is no risk of recession, just a slowdown.

BoE survey: 5-year inflation expectation hits decade high

The BoE Inflation Attitudes Survey showed the public’s five year inflation expectation jumped sharply to 3.8% in May, hitting the highest level in more than a decade.

Looking at somes details: Current inflation rate is seen at 3.1% (median), up from February’s 2.9%. One year inflation expectation is at 3.0%, up from 2.9%. 5-year inflation expectation is at 3.8%, up from 3.4%.

On interest rates: 18% said rates should go up, up from 17%. 19% said rates should go down, up from 17%. 35% said no change, down from 37%.

PBoC Yi: Tremendous room in fiscal and monetary policy to counter trade war

People’s Bank of China Governor Yi Gang said in a Bloomberg interview that China has “tremendous” room for adjusting its fiscal and monetary policy to counter the impact of trade war with US. And, there is no red line in Yuan’s exchange rate.

“We have plenty of room in interest rates, we have plenty of room in required reserve ratio rate, and also for the fiscal, monetary policy toolkit, I think the room for adjustment is tremendous,” Yi said. He also noted that China’s fiscal policy this year is “probably the largest and strongest fiscal reform package”. That include tax cuts and fiscal resources allocation. If situation is getting “a little bit worse”, the current fiscal package “is able to cover”. But it situations gets “tremendously worse”, they will “open the discussion”.

On Yuan exchange rate, Yi said “trade war would have a temporary depreciation pressure on renminbi”. However, he insisted “after the noise, renminbi will continue to be very stable and relatively strong compared to emerging market currencies, even compared to convertible currencies.” Meanwhile, Yi also emphasized there is no red line in the exchange rate, and no “numeric number” is more important than the others.

Released in Asian session, Australia home loans dropped -1.2% mom in April versus expectation of -0.3% mom. AiG Performance of Construction index dropped further to 40.4 in May, down from 42.6. From Japan, household spending rose 1.3% yoy in April versus expectation of 2.7% yoy. Labor cash earnings dropped -0.1% yoy versus expectation of -0.7% yoy. Leading indicator dropped to 95.5, down from 95.9.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1217; (P) 1.1263; (R1) 1.1322; More…..

EUR/USD’s rebound from 1.1107 resumes after brief consolidation and breaks 1.1309 temporary top. Intraday bias is back on the upside. Further rally should be seen towards 1.1448 key resistance next. Decisive break there will carry larger bullish implications. On the downside, break of 1.1200 support is needed to confirm completion of the rebound. Otherwise, further rise will remain in favor in case of retreat.

In the bigger picture, down trend from 1.2555 (2018 high) might still be in progress. Such decline would target 78.6% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.0813 on resumption. However, break of 1.1448 resistance would confirm medium term bottoming, on bullish convergence condition in daily MACD. In such case, stronger rebound should be seen to 38.2% retracement of 1.2555 to 1.1107 at 1.1660. We’d look at the structure of the rebound to decide whether it’s a corrective rise later.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index May | 40.4 | 42.6 | ||

| 23:30 | JPY | Overall Household Spending Y/Y Apr | 1.30% | 2.70% | 2.10% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | -0.10% | -0.70% | -1.90% | -1.30% |

| 01:30 | AUD | Home Loans M/M Apr | -1.20% | -0.30% | -2.80% | -2.30% |

| 05:00 | JPY | Leading Index CI Apr P | 95.5 | 96 | 95.9 | |

| 05:45 | CHF | Unemployment Rate May | 2.40% | 2.40% | 2.40% | |

| 06:00 | EUR | German Industrial Production M/M Apr | -1.90% | -0.50% | 0.50% | |

| 06:00 | EUR | German Trade Balance (EUR) Apr | 17.0B | 18.7B | 20.0B | |

| 07:00 | CHF | Foreign Currency Reserves (CHF) May | 760B | 772B | ||

| 12:30 | CAD | Net Change in Employment May | 27.7K | -5.5K | 106.5K | |

| 12:30 | CAD | Unemployment Rate May | 5.40% | 5.70% | 5.70% | |

| 12:30 | USD | Change in Non-farm Payrolls May | 75K | 180K | 263K | 224K |

| 12:30 | USD | Unemployment Rate May | 3.60% | 3.60% | 3.60% | |

| 12:30 | USD | Average Hourly Earnings M/M May | 0.20% | 0.30% | 0.20% | |

| 14:00 | USD | Wholesale Inventories M/M Apr F | 0.70% | 0.70% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals