The Spinning Top candlestick pattern forms part of the vast Japanese candlestick repertoire with its own distinct features. Often associated with indecision in the market, Spinning Top candles can provide valuable supporting information to a trading strategy. The main talking points of this article are:

-

- What is the Spinning Top candlestick pattern?

-

- How is the Spinning candlestick formed?

-

- How to trade the Spinning Top candle

-

- Learn more about trading with candlesticks

What is the Spinning Top candlestick pattern?

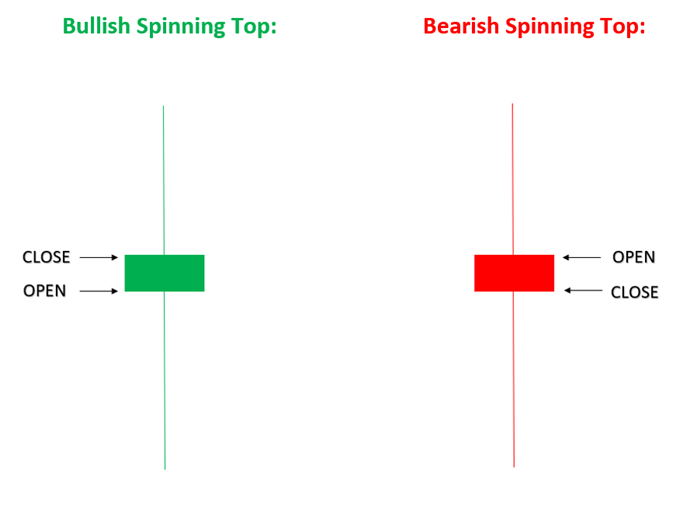

A Spinning Top pattern involves a single candle indicating uncertainty in the market. The candlestick itself is defined by a short body surrounded by long wicks (approximately the same length) on either side. The Spinning Top can be either bullish or bearish at the candle close. This candlestick pattern is often located within an uptrend, downtrend and/or consolidation (sideways movement) signifying possible reversals.

How is the spinning candlestick formed?

The price movement within the Spinning Top candle represents buyers and sellers rescinding each other resulting in a similar open and close price level. The advantage of incorporating the Spinning Top candlestick pattern within a trading strategy is that it is easy to identify with minimal implied time investment.

The logic behind the indecision shown in the market during the formation of a Spinning Top is simple – while the candle was forming, traders moved prices both higher and lower throughout the chart period. This resulted in the closing price reverting back/very close to the opening price.

The Spinning Top pattern follows the same basic structure and logic as the Doji however, the Spinning Top displays a wider candle body which shows a more substantial movement in price during the candle period.

Note: our company created a profitable forex robot with low risk and stable profit 50-300% monthly!

How to Trade the Spinning Top Candle

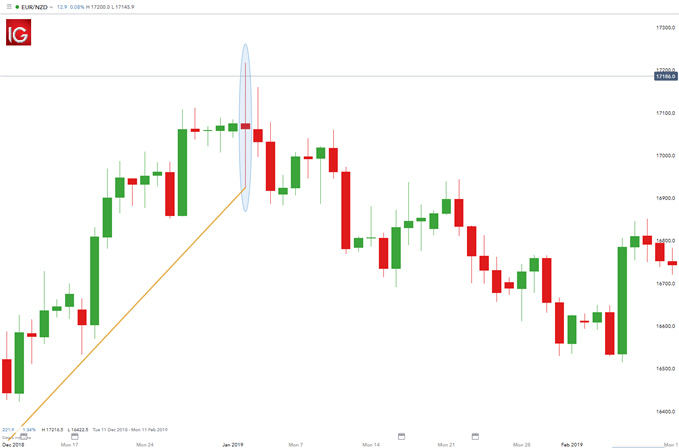

Trading with the Spinning Top candle involves understanding how it is formed and where it sits in relation to the overall market trend. The example below goes through identification, confirmation and execution of a practical forex trade using the Spinning Top.

In the EUR/NZD chart above, the Spinning Top candle (bearish) appears at the top of an uptrend – highlighted by the gold trend line. The indecision from buyers and sellers is apparent and leads to a reversal in trend direction.

Live traders should not look to enter a trade immediately after the Spinning Top has formed, but rather delay the trade to wait for confirmation. Confirmation can come from technical indicators, fundamental factors or oscillators as seen using a stochastic oscillator. The stochastic re-confirms a short entry as indicated by the blue circle.

The most common method used by technical traders to confirm a trend reversal is waiting for the formation of the succeeding candle. Using the example above, the succeeding candle should close lower than the wick of the Spinning Top. Without this confirmation, the signal of trend reversal may not be established, and uncertainty remains in the market.

Key takeaways for trading the Spinning Top candlestick pattern:

-

- Locate candle with a short body and long wicks on both sides

-

- Identify market trend by using trend lines or technical indicators

-

- Wait for confirmation prior to entering trade

-

- If confirmed, place trade in desired direction

In conclusion, the Spinning Top candle depicts market indecision between buyers and sellers which could indicate price reversals. It is important to recognise the positioning of the Spinning Top within the market – within a trend or at key price levels of support and resistance. The Spinning Top candlestick pattern is most effective at these particular points.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals