Dollar jumps broadly in early US session after solid gain in retail sales in May, with upward revision in April figures. Yen is following as the second strongest on risk aversion, followed by Canadian Dollar. Geopolitical tensions heightened after US blame Iran for attacks on oil tankers yesterday. New Zealand Dollar is currently the weakest one, as pressured by poor manufacturing PMI. Australian Dollar is the second weakest, followed by Sterling.

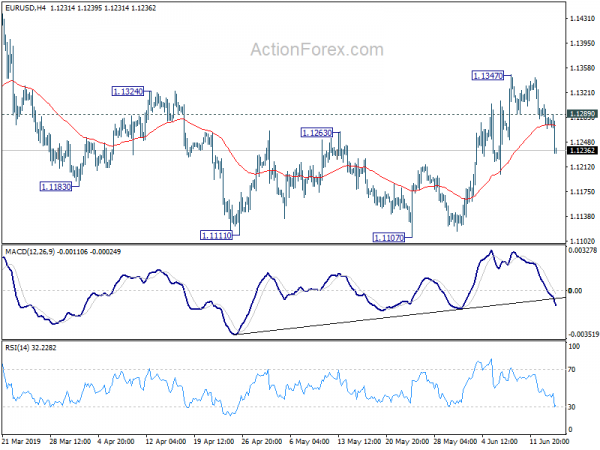

Technically, EUR/USD’s break of 1.1251 minor support suggests that recovery from 1.1107 has completed. And more decline could be seen back to retest 1.1107 low. This follows the break of 122.10 support in EUR/JPY earlier today, which indicates completion of recovery from1 20.78. Focus is now firstly on 136.55 support in GBP/JPY for indicating decline resumption. Nevertheless, USD/JPY looks safe for now with today’s recovery.

In Europe, FTSE is currently down -0.43%. DAX is down -0.54%. CAC is down -0.26%. German 10-year yield is down -0.005 at -0.244. Earlier in Asia, Nikkei rose 0.40%. Hong Kong HSI dropped -0.65%. China Shanghai SSE dropped -0.99%. Singapore Strait Times rose 0.06%. Japan 10-year JGB yield dropped -0.0154 to -0.125.

US retail sales rose 0.5%, ex-auto sales rose 0.5%, April’s figure revised up

US retail sales rose 0.5% mom in May, below expectation of 0.7% mom. But ex-auto sales rose 0.5% mom, above expectation of 0.4% mom. April’s headline sales was revised up from -0.2% mom to 0.3% mom. April’s ex-auto sales was also revised up from 0.1% mom to 0.5% mom.

Also from US, industrial production rose 0.4% mom in May, above expectation of 0.2% mom. Capacity utilization rose to 78.1%, above expectation of 78.0%.

ECB Draghi: Policy has neutral effect of bank profitability, lower-income households are main beneficiaries

ECB President Mario Draghi sent separate letters to four Members of the European Parliaments today, explaining the impact of the central bank’s monetary policy. There Draghi noted the “overall effect” of ECB’s monetary policy on bank profitability has so far been “broadly neutral”. The negative impact on banks’ net interest margins has been offset by an improvement in the economic outlook that has led to an “increase in the total volume of loans” and, moreover,” improved credit quality”, which has reduced provisioning costs. Though, he also pledged to carefully monitor the overall effects of negative interest rates.

Draghi also said lending to non-financial corporations (NFCs) “recovered significantly” since the ECB introduced its non-standard monetary policy measures. And overall, the non-standard measures “have contributed to a more uniform transmission of monetary policy to bank lending rates across euro area countries and firm sizes.”

Moreover, taking into account both financial and macroeconomic effects, ECB research finds that “lower-income households have been among the main beneficiaries of the ECB’s non-standard monetary policy measures, through their positive impact on growth and employment creation.”

New Zealand Manufacturing PMI dropped to 50.2, lowest since 2012, downside risks accumulating

New Zealand BusinessNZ Manufacturing PMI dropped to 50.2 in May, down from 52.7. Also, it’s the lowest reading since December 2012. BusinessNZ’s executive director for manufacturing Catherine Beard said that the drop in activity to its lowest point in over six years was obviously a concern, especially when the sub-index values are examined.

She added: “Production (46.4) was at its lowest value since April 2012, while the other key sub-index of new orders (50.4) only just managed to stay in positive territory. Given the latter feeds through into the former, it does not instil a strong belief that the sector will show solid improvement over the next few months”.

BNZ Senior Economist, Doug Steel said that “the PMI sends a warning signal for near term growth via its mix of falling production, near flat new orders, and rising inventory. Next week’s Q1 GDP should be reasonable, but beyond this downside risks are accumulating”.

Elsewhere

China fixed asset investment rose 5.6% yoy in May, below expectation of 6.1% yoy. Industrial production rose 5.0% yoy, below expectation of 5.4% yoy. Nevertheless, retail sales rose 8.6% yoy, above expectation of 8.0% yoy. Unemployment rate was unchanged at 5.0% . From Japan, industrial production was finalized at 0.6% mom in April.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1259; (P) 1.1282; (R1) 1.1299; More……

EUR/USD’s break of 1.1251 minor support indicates completion of rebound from 1.1107 at 1.1347. Intraday bias is turned to the downside for retesting 1.1107 first. But decisive break there is needed to confirm resumption of larger down trend from 1.2555. Otherwise, more consolidation from 1.1107 might still extend further. On the upside, above 1.1289 minor resistance will turn intraday bias neutral first.

In the bigger picture, current development argues that a medium term bottom could be in place at 1.1107, on bullish convergence condition in daily MACD. Decisive break of 1.1448 resistance would confirm this case. And stronger rebound would be seen to 38.2% retracement of 1.2555 to 1.1107 at 1.1660. At this point, it’s early to judge whether rise from 1.1107 is a corrective move or the start of an medium term up trend. We’d look at the structure of the rebound to decide later. But in any case, for now, risk will remain on the upside as long as 1.1107 low holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing PMI May | 50.2 | 53 | 52.7 | |

| 04:30 | JPY | Industrial Production M/M Apr F | 0.60% | 0.60% | 0.60% | |

| 07:00 | CNY | Fixed Assets Ex Rural YTD Y/Y May | 5.60% | 6.10% | 6.10% | |

| 07:00 | CNY | Industrial Production Y/Y May | 5.00% | 5.40% | 5.40% | |

| 07:00 | CNY | Retail Sales Y/Y May | 8.60% | 8.00% | 7.20% | |

| 07:00 | CNY | Surveyed Jobless Rate May | 5.00% | 5.00% | ||

| 12:30 | USD | Retail Sales Advance M/M May | 0.50% | 0.70% | -0.20% | 0.30% |

| 12:30 | USD | Retail Sales Ex Auto M/M May | 0.50% | 0.40% | 0.10% | 0.50% |

| 13:15 | USD | Industrial Production M/M May | 0.40% | 0.20% | -0.50% | -0.40% |

| 13:15 | USD | Capacity Utilization May | 78.10% | 78.00% | 77.90% | |

| 14:00 | USD | U. of Mich. Sentiment Jun P | 98 | 100 | ||

| 14:00 | USD | Business Inventories Apr | 0.40% | 0.00% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals