The financial markets are generally weighed down by risk aversion. Geopolitical tensions heightened after US blamed Iran for involving in the oil tanker attacks near the entrance to the Persian Gulf on Thursday. But Iranian officials denied any involvement and reiterated calls for a regional dialogue. Adding to that China’s data showed notable slowdown in both fixed asset investments and industrial production, indicating further impact from trade war with the US.

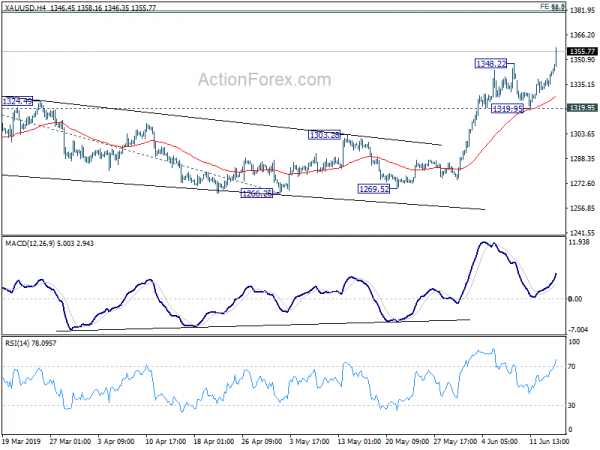

Gold finally breaks through 1348.22 resistance to resume medium term rally, reaching as high as 1358.16 so far. WTI crude oil is hovering at around 52.2 for now, after defending 50 handle again earlier this week. IN the currency markets, commodity currencies are the weakest one, as led by New Zealand Dollar after poor NZ PMI manufacturing. Yen is currently the strongest one, followed by Euro and Swiss Franc.

Technically, EUR/JPY finally breaks 112.10 minor support, which suggests that corrective recovery from 120.78 has completed at 123.18. Deeper fall should be seen back to retest 120.78 low. In terms of down trend resumption, USD/JPY and GBP/JPY could lead the way through 107.81 and 136.55 respectively. These two levels are worth a watch today. For now, EUR/USD is holding above 1.1251 minor support. Thus, Euro is having an upper hand over Dollar. But break will reverse their fortune.

In Europe, major indices open mildly lower with FTSE down -0.28%, DAX down -0.31% and CAC down -0.22%. German 10-year yield is down -0.0021 at -0.260. In Asia, Nikkei closed up 0.40%. Hong Kong HSI is down -0.79%, China Shanghai SSE closed down -0.99%. Singapore Strait Times is down -0.23%. Japan 10-year JGB yield is down -0.016 at -0.126. Overnight, DOW rose 0.39%. S&P 500 rose 0.41%. NASDAQ rose 0.57%. 10-year yield dropped -0.036 to 2.091, back below 2.1 handle.

Gold breaks key resistance as up trend resumes finally

Gold finally resumes recent up trend by breaking through 1346.71 resistance decisively and reaches as high as 1358.16 so far. Further rise should now be seen to 61.8% projection of 1160.17 to 1346.71 from 1266.26 at 1381.54 next. And in any case, near term outlook will remain bullish as long as 1319.95 support holds, in case of retreat. More in this quick comment.

661 US Companies and Associations urged Trump to avoid tariff escalation

In an open letter to Trump, 661 US Companies and Associations urged the administration to avoid tariff escalation with China. Instead, the administration should try to reach resolution with China on trade. The letter came as US Trade Representative is set to start hearings regarding 25% tariffs on USD 300B, essentially all untaxed, Chinese imports. The letter, lead by “Tariffs Hurt the Heartland” campaign,w as signed by 520 companies and 141 trade associations. .

“We remain concerned about the escalation of tit-for-tat tariffs,” the letter states. “We know firsthand that the additional tariffs will have a significant, negative and long-term impact on American businesses, farmers, families and the U.S. economy. Broadly applied tariffs are not an effective tool to change China’s unfair trade practices. Tariffs are taxes paid directly by U.S. companies, including those listed below – not China.”

“We urge your administration to get back to the negotiating table while working with our allies to develop global, enforceable solutions. An escalated trade war is not in the country’s best interest, and both sides will lose,” the companies and associations added.

New Zealand Manufacturing PMI dropped to 50.2, lowest since 2012, downside risks accumulating

New Zealand BusinessNZ Manufacturing PMI dropped to 50.2 in May, down from 52.7. Also, it’s the lowest reading since December 2012. BusinessNZ’s executive director for manufacturing Catherine Beard said that the drop in activity to its lowest point in over six years was obviously a concern, especially when the sub-index values are examined.

She added: “Production (46.4) was at its lowest value since April 2012, while the other key sub-index of new orders (50.4) only just managed to stay in positive territory. Given the latter feeds through into the former, it does not instil a strong belief that the sector will show solid improvement over the next few months”.

BNZ Senior Economist, Doug Steel said that “the PMI sends a warning signal for near term growth via its mix of falling production, near flat new orders, and rising inventory. Next week’s Q1 GDP should be reasonable, but beyond this downside risks are accumulating”.

Euro’s international role recovered in period of trade tensions and protracted slowdown

ECB said in a report yesterday that euro’s international role strengthened in 2018 and early 2019 reversing a declining trend in recent years. Share of Euro as global reserve currency rose 1.2% in 2018, up from 19.5% to 20.8%. The euro’s share in international debt issuance and international deposits also increased, together with its share in the value of outstanding international loans.

ECB President Mario Draghi said that the period was “characterized by growing concerns about the impact of international trade tensions, a protracted slowdown in global growth, reversals in cross-border capital flows and challenges to multilateralism, including the imposition of unilateral sanctions.:

“On balance, these developments, together with progress towards deepening Economic and Monetary Union (EMU), seem to have had a positive effect on the international use of the euro, which showed tentative signs of recovering from historic lows.”

Elsewhere

China fixed asset investment rose 5.6% yoy in May, below expectation of 6.1% yoy. Industrial production rose 5.0% yoy, below expectation of 5.4% yoy. Nevertheless, retail sales rose 8.6% yoy, above expectation of 8.0% yoy. Unemployment rate was unchanged at 5.0% . From Japan, industrial production was finalized at 0.6% mom in April.

Looking ahead, US retail sales will be the major focus. Industrial production, business inventories and U of Michigan sentiment will also be featured.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 122.05; (P) 122.31; (R1) 122.49; More….

EUR/JPY’s break of 122.10 minor support suggests that corrective recovery from 120.78 has completed at 123.18 already. Intraday bias is turned back to the downside for retesting 120.78 first. Break there will resume whole decline from 127.50 and target 118.62 low next. In case of another rise, we’d continue to expect strong resistance form 123.73 to complete the recovery to bring fall resumption.

In the bigger picture, down trend from 137.49 is still in progress with the cross staying inside long term falling channel. Break of 118.62 will extend the fall to 109.48 (2016 low). On the upside, break of 127.50 resistance is needed to be the first sign of medium term reversal. Otherwise, outlook will remain bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing PMI May | 50.2 | 53 | 52.7 | |

| 4:30 | JPY | Industrial Production M/M Apr F | 0.60% | 0.60% | 0.60% | |

| 7:00 | CNY | Fixed Assets Ex Rural YTD Y/Y May | 5.60% | 6.10% | 6.10% | |

| 7:00 | CNY | Industrial Production Y/Y May | 5.00% | 5.40% | 5.40% | |

| 7:00 | CNY | Retail Sales Y/Y May | 8.60% | 8.00% | 7.20% | |

| 7:00 | CNY | Surveyed Jobless Rate May | 5.00% | 5.00% | ||

| 12:30 | USD | Retail Sales Advance M/M May | 0.70% | -0.20% | ||

| 12:30 | USD | Retail Sales Ex Auto M/M May | 0.40% | 0.10% | ||

| 13:15 | USD | Industrial Production M/M May | 0.20% | -0.50% | ||

| 13:15 | USD | Capacity Utilization May | 78.00% | 77.90% | ||

| 14:00 | USD | U. of Mich. Sentiment Jun P | 98 | 100 | ||

| 14:00 | USD | Business Inventories Apr | 0.40% | 0.00% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals