Dollar remains broadly weak, suffering heavy selling pressure after Fed turned dovish yesterday and opened the door for rate cut. Though, Swiss Franc and Canadian Dollar steal the show today on escalating middle tensions. WTI crude oil rises over 4% on news that a US drone was shot down by Iran, (in international airspace according to US, over southern Iran according to Iran). Loonie, also firm on strong inflation reading, was give further lift by oil prices. Fears over military confrontation military confrontation drove safe haven flow into Franc.

Staying in the currency markets, Sterling follows Dollar as second weakest after BoE toned down growth outlook a bit after keeping interest rate unchanged at 0.75%. Yen is the third weakest, mainly due to strong rally in stocks. Though, we might see a come back in Yen any time should major treasury yields drop further. New Zealand Dollar is the third strongest, with help from GDP data.

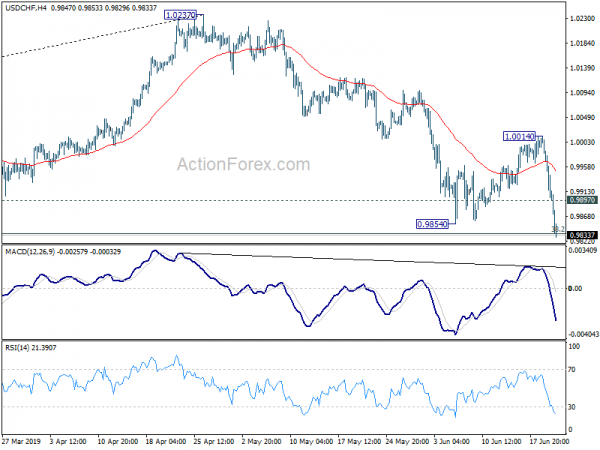

Technically, USD/CHF’s break of 0.9854 support confirms resumption of recent fall from 1.0237 towards 0.9716 support next. EUR/CHF’s break of 1.1119 indicates resumption of fall from 1.1476 and larger down trend from 1.2004. USD/CAD’s decline is accelerating towards 1.3068 key support next. EUR/CAD also breaks 1.4877 support for 1.4759 low. EUR/GBP recovers ahead of 0.8871 minor support, keeping Euro’s upper ahead against Sterling for now.

In other markets, S&P 500 opens sharply higher by 0.9% and would very likely take on record high of 2954.13 soon. US 10-year yield is currently down -0.026 at 1.999, below 2% handle. In Europe, FTSE is up 0.68%. DAX is up 0.94%. CAC is up 0.75%. German 10-year yield is down -0.0333 at -0.319. Earlier in Asia, Nikkei rose 0.60%. Hong Kong HSI rose 1.23%. China Shanghai SSE rose 2.38%. Singapore Strait Times rose 0.80%. Japan 10-year JGB yield dropped -0.0313 to -0.166.

Note: our company created a profitable forex robot with low risk and stable profit 50-300% monthly!

US initial jobless claims dropped to 216k, Philly Fed outlook dropped to 0.3

US initial jobless claims dropped -6k to 216k in the week ending June 15, below expectation of 220k. Four-week moving average of initial claims dropped -1k to 281.75k. Continuing claims dropped -37k to 1.662M in the week ending June 8. Four week moving average of continuing claims dropped -5.25k to 1.679M.

Philadelphia Fed Manufacturing Business Outlook diffusion index dropped sharply from 16.6 to 0.3 in June, missed expectation of 10.4. It’s also the lowest level since February. The results suggest weaker regional manufacturing conditions compared with last month. The indexes for current activity, new orders, shipments, and employment remained positive but decreased from their May readings. The survey’s price indexes suggest a notable moderation in price pressures. The survey’s future indexes indicate that respondents continue to expect growth over the remainder of the year.

China insists core concerns must be resolved before trade agreement with US

China continues to talk down expectations of upcoming Xi-Trump summit at G20 in Osaka next week. Chinese commerce ministry spokesman Gao Feng said “the heads of the two trade teams will communicate, according to instructions passed down from the two presidents.” And, “we hope (the United States) will create the necessary conditions and atmosphere for solving problems through dialogue as equals.”

But most importantly, Gao insisted that “China’s principles and basic stance on Sino-U.S. economic and trade consultations have always been clear and consistent, and China’s core concerns must be properly resolved.” He was clearly referring to disagreement on the three matters of principle that led to the collapse of trade negotiation earlier this year.

To recap, the three main differences include removal of all additional tariffs with the agreement. The among of additional Chinese purchases of US goods have to be realistic. And text of the agreement must be balanced without intrusion of sovereignty. It’s believed that the third one, regarding removal of texts that force China to implement the agreement in domestic laws, is the most crucial red line.

BoE stands pat, warns of intensifying trade tensions and increased likelihood of no-deal Brexit

BoE left Bank Rate unchanged at 0.75% as widely expected. Asset purchase target was also held at GBP 435B. Both decisions were made by unanimous 9-0 vote.

BoE noted that near-term data have been “broadly in line” with projections in May Inflation report. However, “downside risks to growth have increased”. Globally, “trade tensions have intensified” and “contributed to volatility in global equity prices and corporate bond spreads”. Also forward interest rates in major economies “have fallen materially further. Additionally, “perceived likelihood of a no-deal Brexit has risen”, putting downward pressure on UK forward interest rates and Sterling exchange rates.

On growth, BoE now expects Q2 GDP growth to be flat. H2 underlying growth appears to have “weakened slightly” to “a little” below potential. On Inflation, BoE said core inflation “has remained slightly below” target. But job market “remains tight” and wage growth has remained at “target-consistent levels”.

BoE also reiterated that economic outlook depends significantly on Brexit, timing and nature, and new trading arrangement. Also, policy response to Brexit “will not be automatic and could be in either direction.

UK retail sales dropped -0.5% in May, ex-auto fuel dropped -0.3%

UK retail sales data for May came in mixed. No sector reported growth during the month. But the contraction was not as bad as expected. Retail sales including auto and fuel: -0.5% mom, 2.3% yoy versus expectation of -0.5% mom, 2.7% yoy. Retail sale excluding auto and fuel: -0.3% mom, 2.2% yoy versus expectation of -0.5% mom, 2.4% yoy.

BoJ warns of significant downside risks concerning overseas economies

BoJ left monetary policy unchanged today as widely expected. Under the yield curve control framework, short-term policy interest rate was kept at -0.1%. JGB purchase will continue continue to keep 10-year JGB yield at around zero percent, with some flexibility depending on developments. Monetary base is expected to increase at around JPY 80T per annum. Y. Harada and G. Kataoka dissented again in 7-2 vote.

In the accompanying statement, BoJ warned that “downside risks concerning overseas economies are likely to be significant”. Risks include US macroeconomic policies, consequences of protectionist moves and their effects, emerging markets such as China, global adjustments in IT-related goods, Brexit and geopolitical risks.

Though, BoJ maintained that Japan’s economy is “likely to continue on a moderate expanding trend”. Domestic demand is expected to follow an uptrend. Exports are projected to show some weakness, but would stay on a “moderate increasing trend”. CPI is likely to increase gradually toward 2 percent, mainly on the back of the output gap remaining positive and medium- to long-term inflation expectations rising.

Also from Japan, all industry activity index rose 0.9% mom in April, above expectation of 0.70% mom.

RBA Lowe: Not unrealistic to expect more rate cut

In a speech on “The Labour Market and Spare Capacity” delivered today, RBA Governor Philip Lowe reaffirmed that the central bank is on track for further rate cuts again. He said that would be “unrealistic to expect that lowering interest rates by ¼ of a percentage point will materially shift the path we look to be on.” And, “the most recent data – including the GDP and labour market data – do not suggest we are making any inroads into the economy’s spare capacity.”

Therefore, “it is not unrealistic to expect a further reduction in the cash rate as the Board seeks to wind back spare capacity in the economy and deliver inflation outcomes in line with the medium-term target.” Though, he also emphasized that Australia should also look into other options to get closer to full employment, including fiscal policy and structural policies.

New Zealand GDP grew 0.6% in Q1, weak details keeps RBNZ on dovish side

New Zealand GDP grew 0.6% qoq in Q1, unchanged from prior quarter, and matched expectations. Looking at the sectors, growth were driven by 2.0% expansion in goods producing industries. Services growth slowed to 0.2% while primary industries contracted -0.7%. On the components, household spending was up 0.5%, investment spending was up 2.4%, exports of goods and services was up 2.8%

While the headline number was a little stronger than expected, slowdown in services, which accounted for two thirds of GDP, remained a concern. Also, investment growth was mainly driven by residential and nonresidential buildings. Contractions were seen in all other components. RBNZ might be granted some more room to wait-and-see with today’s data. But bias will remain towards easing beyond next week’s meeting.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9899; (P) 0.9958; (R1) 0.9999; More…

USD/CHF drops to as low as 0.9830 so far today and break of 0.9854 support confirms resumption of fall from 1.0237. Rejection by 55 day was also a clear near term bearish signal. Intraday bias remains on the downside for 0.9716 support next. On the upside, break of 0.9897 minor resistance will turn intraday bias neutral and bring consolidations. But recovery should be limited well below 1.0014 resistance to bring fall resumption.

In the bigger picture, USD/CHF’s break of long term trend line support is the first indication of medium term reversal. That is, rise from 0.9186 (2018 low) could have completed at 1.0237 already). Sustained break of 38.2% retracement of 0.9186 to 1.0237 at 0.9836 will confirm and target 61.8% retracement at 0.9587. However, strong rebound from 0.9836 will revive medium term bullishness for 1.0237 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q1 | 0.60% | 0.60% | 0.60% | |

| 01:30 | AUD | RBA Bulletin | ||||

| 02:45 | JPY | BOJ Rate Decision | -0.10% | -0.10% | -0.10% | |

| 05:30 | JPY | All Industry Activity Index M/M Apr | 0.90% | 0.70% | -0.40% | -0.30% |

| 06:00 | CHF | Trade Balance (CHF) May | 3.41B | 2.87B | 2.29B | |

| 08:00 | EUR | ECB Monthly Bulletin | ||||

| 08:30 | GBP | Retail Sales Ex Auto Fuel M/M May | -0.30% | -0.50% | -0.20% | -0.30% |

| 08:30 | GBP | Retail Sales Ex Auto Fuel Y/Y May | 2.20% | 2.40% | 4.90% | 4.70% |

| 08:30 | GBP | Retail Sales Inc Auto Fuel M/M May | -0.50% | -0.50% | 0.00% | -0.10% |

| 08:30 | GBP | Retail Sales Inc Auto Fuel Y/Y May | 2.30% | 2.70% | 5.20% | 5.10% |

| 11:00 | GBP | BoE Bank Rate | 0.75% | 0.75% | 0.75% | |

| 11:00 | GBP | BOE Asset Purchase Target Jun | 635B | 435B | 435B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:30 | USD | Current Account (USD) Q1 | -130.4B | -125B | -134B | -143.9B |

| 12:30 | USD | Initial Jobless Claims (JUN 15) | 216K | 220K | 222K | |

| 12:30 | USD | Philadelphia Fed Business Outlook Jun | 0.3 | 10.4 | 16.6 | |

| 14:00 | USD | Leading Index May | 0.10% | 0.20% | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jun A | -6.5 | -6.5 | ||

| 14:30 | USD | Natural Gas Storage | 102B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals