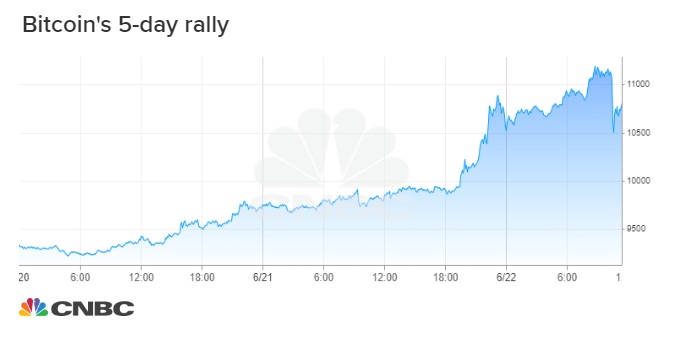

Bitcoin is closing in on its highest level in more than a year after soaring above $11,000 over the weekend.

The world’s first and largest cryptocurrency hit a high of above $11,307.69 Sunday evening, bringing its one-week gains to more than 20%, according to data from industry site CoinDesk. Prices scaled back slightly Monday, and were trading at $10,970 as of midday Monday.

Analysts largely attributed bitcoin’s price bump to more awareness of the digital asset class following Facebook’s ambitious cryptocurrency project announced last week.

“It’s clearly a positive for bitcoin, ” Bart Smith, head of Susquehanna’s digital asset group, told CNBC’s “Squawk Box ” on Monday. “If 2 billion users are on Facebook, some percentage of them start to kind of look at Libra and try to understand how it is different and similar to bitcoin — that is a positive.”

Facebook unveiled a cryptocurrency project last week that will be run by a Swiss nonprofit called the Libra Association. The cryptocurrency, which is expected to go live in 2020, will not be controlled or fully run by Facebook, according to its white paper. Stripe, Uber, Mastercard, Visa, PayPal and Spotify are among the dozens of others with stakes in the project.

Circle CEO Jeremy Allaire said Facebook’s involvement brought more brand recognition to blockchain — the technology that underlies bitcoin — and its potential from retail and institutional buyers.

“There’s a broader understanding of crypto as an asset class,” Allaire told “Squawk Box” on Monday. “Anticipation that next generation of blockchains, including what we heard about last week with Libra Association, really indicates what is ultimately going to be a massive mainstream phenomenon touching billions of people.”

But it also brought attention to the possible downside. The announcement quickly caught the wary attention of Democratic and Republican lawmakers.

“We’re going to move aggressively and very quickly to deal with what is going on with this new cryptocurrency,” Rep. Maxine Waters, D-Calif., chairwoman of the House Financial Services Committee, told CNBC on Thursday. “I think it’s very important for them to stop right now what they’re doing so that we can get a handle on this.”

Note: our programmers have developed a profitable forex robot with low risk and stable profit!

While Facebook and other corporate giants entering the space may have helped lead to an initial bump, Smith said the majority of the rise was due to technical levels being broken. Once the “psychological barrier” of $10,000 was broken, bitcoin “shot up,” he said.

“Most of the people who trade bitcoin for profit trade it on technicals,” Smith said. “There was a lot of resistance area in the upper $9,000s and that got broken.”

Some have attributed bitcoin’s rally this year to safe-haven buying. The cryptocurrency’s volatility and transaction cost have largely kept it from being used as an everyday payment method. Instead, it’s seen by some believers as a store of value, or “digital gold.” That global hedge use-case seemed unlikely in 2018 after it ended the year down more than 73 percent.

But bitcoin’s 190% rebound this year has coincided with the ongoing U.S.-China trade war and increased tensions with Iran. Allaire said many investors see bitcoin as being similar to gold, which has a limited and predictable supply. Gold hit a six-year high Monday.

“As a safe-haven asset, they have a lot of similarities,” Allaire said.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals