New Zealand rises broadly even though RBNZ hints on an August rate cut. The easing bias is actually well priced in and traders responds to the positive reference to the economy instead. Dollar also trying to extend yesterday’s rebound as even the most dovish Fed official dismissed an aggressive 50bps cut in July. On the other hand, Yen is currently the softest one for today, followed by Sterling and then Swiss Franc. Focus will turn to US durable goods orders to see if Dollar could extend current rebound.

Technically, after some volatility, NZD/USD is staying below 0.6681 resistance and maintains near term bearish outlook. That is, another fall is still expected through 0.6481 low at a later stage. While Dollar rebounded, there is no confirmation of bottoming yet. As long as these levels holds, more downside will remain in favor in Dollar: 1.1317 support in EUR/USD, 1.2642 support in GBP/USD, 0.9854 resistance in USD/CHF, 107.73 resistance in USD/JPY, 0.6903 support in AUD/USD. Separately, 0.8975 resistance in EUR/GBP will be watched and break will indicate resumption of recent rise for 0.9101 key resistance.

In Asia, Nikkei closed down -0.68%. Hong Kong HSI is up 0.06%. China Shanghai SSE is down -0.37%. Singapore Strait Times is down -0.27%. Japan 10-year JGB yield is up 0.0103 at -0.141. Overnight, DOW dropped -0.67%. S&P 500 dropped -0.95%. NASDAQ dropped -1.51%. 10-year yield dropped -0.027 to 1.994.

Fed Bullard dismissed 50bps rate cut, Powell emphasized independence

Dollar rebounded notably overnight after St Louis Fed President James Bullard, the most dovish Fed official, dismissed a 50bps rate cut in July, in a Bloomberg interview. He said “just sitting here today I think 50 basis points would be overdone. And, “I don’t think the situation really calls for that but I would be willing to go to 25. Though, Bullard emphasized that ” I hate to pre-judge meetings – things can change by the time you get there – but if I was just going today that’s what I would do.”

Separately, Fed Chair Jerome Powell emphasized Fed’s independence in a prepared speech. He said “the Fed is insulated from short-term political pressures—what is often referred to as our ‘independence.’ Congress chose to insulate the Fed this way because it had seen the damage that often arises when policy bends to short-term political interests. Central banks in major democracies around the world have similar independence.”

On the economy, Powell said “the baseline outlook of my FOMC colleagues, like that of many other forecasters, remains favorable”. But inflation would return to target “at a somewhat slower pace than we foresaw earlier in the year.” And, ” risks to this favorable baseline outlook appear to have grown.” Hence, Fed will now “closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion.”

Powell also emphasized “we are also mindful that monetary policy should not overreact to any individual data point or short-term swing in sentiment. Doing so would risk adding even more uncertainty to the outlook.”

When asked if a rate cut is needed this year, Richmond Fed President Thomas Barkin said “I don’t know”. Though, he warned there’s a risk US could talk itself into a recession but added he saw no sign of this happening yet.

G20 said to call for free trade promotion, but refrain to mention protectionism

Japan’s Ashai newspaper reported that G20 leaders would include “promotion of free trade” in the joint communique to be released as the summit in Osaka ends on June 29. The communique will emphasize free trade as as the core element of global growth, along with technological innovation such as economic digitization .

There are calls from Europe and other countries, for stronger languages against protectionism. However, the group will likely avoid the terms like “resisting protectionism” due to disagreement from US. Instead, Japan is opting for something in the middle as “promotion of free trade”.

RBNZ hints on Aug rate cut, But NZD rebounds on positive references in statement

RBNZ left Official Cash Rate unchanged at 1.50% as widely expected. It also adopted an easing bias by repeatedly saying ” a lower OCR may be needed”. It’s taken by a strong signal that another rate cut is underway in August. However, on the brighter side, RBNZ noted that “GDP growth had held up more than projected” in Q1. And “some of the factors supporting growth in the quarter would continue.” Also, while risks are “tilted to the downside”, resolution of trade tensions “could see uncertainty ease”. New Zealand Dollar spiked lower after the release by quickly rebounded on the positive references.

Some suggested readings:

On the data front

German Gfk consumer sentiment for July dropped to 9.8, missed expectation of 10.0. UK will release BBA mortgage approvals. Meanwhile, US will release durable goods orders, goods trade balance and wholesale inventories.

GBP/USD Daily Outlook

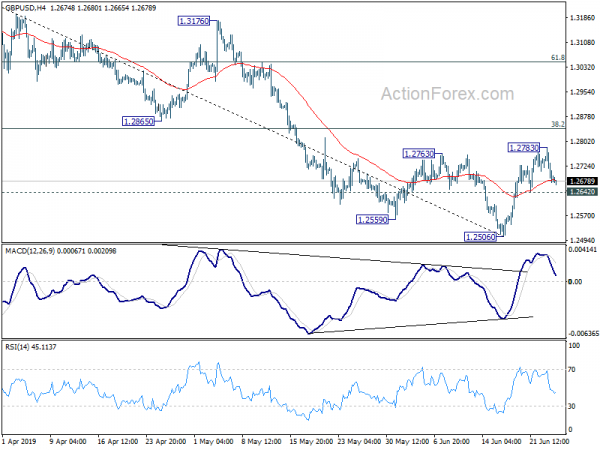

Daily Pivots: (S1) 1.2645; (P) 1.2715; (R1) 1.2757; More….

Intraday bias in GBP/USD is turned neutral with current retreat. Rebound from 1.2506 could still extend. But upside should be limited by 38.2% retracement of 1.3381 to 1.2506 at 1.2840. On the downside, break of 1.2642 minor support will turn intraday bias back to retest 1.2506 low. However, sustained break of 1.2840 will bring stronger rise to 61.8% retracement at 1.3047 next.

In the bigger picture, down trend from 1.4376 (2018 high) is still in progress. Break of 1.2391 would target a test on 1.1946 long term bottom (2016 low). For now, we don’t expect a firm break there yet. Hence, focus will be on bottoming signal as it approaches 1.1946. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 2:00 | NZD | RBNZ Official Cash Rate | 1.50% | 1.50% | 1.50% | |

| 6:00 | EUR | German GfK Consumer Confidence (JUL) | 9.8 | 10 | 10.1 | |

| 8:30 | GBP | BBA Mortgage Approvals May | 43.2K | 43.0K | ||

| 12:30 | USD | Durable Goods Orders May P | -0.10% | -2.10% | ||

| 12:30 | USD | Durables Ex Transportation May P | 0.10% | 0.00% | ||

| 12:30 | USD | Advance Goods Trade Balance (USD) May | -71.8B | -72.1B | ||

| 12:30 | USD | Wholesale Inventories M/M May P | 0.50% | 0.80% | ||

| 14:30 | USD | Crude Oil Inventories | -3.1M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals