The accepted wisdom that European banking is an unmitigated basket case has become even more entrenched over the past year. While most banks in the region traded well below book value a year ago, since then their shares have fallen by about a third, and despite a brief rally early in early 2019, they have since fallen back to roughly the level of late 2018.

It is easy to see why.

Negative central bank interest rates bring the fundamentals of banking into question and erode the time value of money. The likelihood of higher base rates in Europe has become more remote while money-laundering scandals and fines have hit even the well-performing Nordic exceptions.

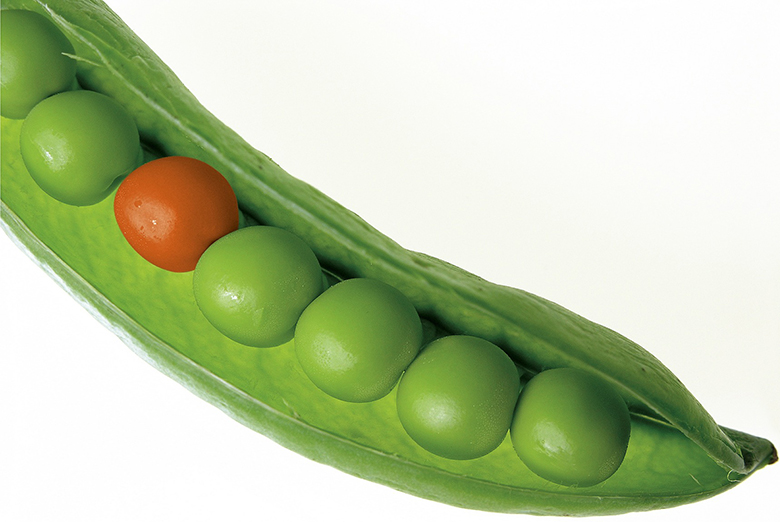

No wonder there is an increasing tendency to paint all European banks with the same brush – unless there is a big and blindingly obvious reason to do otherwise (such as Asia, for HSBC).

Sentiment will always move markets, but in Europe’s case perceptions rather than fundamentals are more influential because of the underdevelopment of its capital markets. This is a problem for bank business models, as it makes their balance sheets less dynamic, and it makes European issuers more reliant on American equity investors, who are more likely to look at the continent as a whole.

Note: our programmers have developed a profitable forex robot with low risk and stable profit!

Diverse

Banks – especially large and vertically integrated institutions – are hard to understand at the best of times, and US-based investors are maybe less well placed to understand the nuances of Europe’s diverse economies. They will have to work harder to understand systems that are different to their own. Patriotic prejudices mean they are less likely to make the effort.

But it is obviously wrong to assume that a US bank will always be better than a European one. The Harvard Business Review ranks a European – Belgium’s Johan Thijs, of KBC – as the only bank chief executive in the top ten, and even the top 20, best-performing CEOs in the world in 2018 (JPMorgan’s Jamie Dimon is at number 22 and indeed KBC’s high teens return on equity over the past three years has been markedly better than that at JPMorgan).

However, the poor performance of many banks in Europe is penalizing some better peers. This is also true in investment banking, where Deutsche Bank, and to a lesser extent Société Générale, have become symbolic of European firms’ inability to make money and compete. But even BNP Paribas has proved much better able to sustain its ambitions in wholesale banking than SocGen.

The profitability of other big European investment banks, notably Barclays, is not as good as it should be, but much better than that at Deutsche Bank. The US business of Barclays (like that of Credit Suisse) is far better than the equivalent at its German peer. While all the top three players by global fixed income trading market share are US banks, Barclays ranks fourth, ahead of joint fifth Morgan Stanley and Bank of America, according to Greenwich Associates. Moreover, Barclays’ revenue trajectory in its markets business has been better than its US peers for six consecutive quarters, according to Berenberg.

There are plenty of other examples – UniCredit’s status as a proxy for the Italian banking sector would probably stand out, even though it is arguably doing more than any other big bank in Europe to turn around its business. In fact, UniCredit is more geographically diverse than any other big or mid-sized Italian lender, and despite macroeconomic volatility in Turkey, central and eastern Europe has been a major bulwark to its profitability.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals