Much of Wall Street was maligned about both the developments that occurred during the start of the free agency window for the New York Knicks and to the outcome from the Trump-Xi meeting. Some traders are saying as we approach 2020 election mode, Trump on trade, would rather look good and lose than look bad and win. The US could fight for significant SOE reform here and leverage the Hong Kong situation, but it appears Trump will be happy to secure only additional purchases and delivering on reforms that the Chinese were eventually going to move forward on.

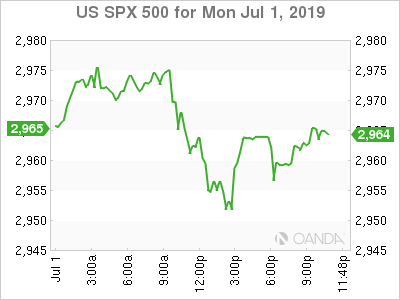

Markets ended well off their highs as investors weighed the lack of substance from the US-China trade truce that was reached this weekend. While not much progress was made on the remaining 10% that is needed to finalize a trade deal, China emerged as the clear winner. Trump secured additional agricultural purchases, while confirming no new tariffs on Chinese goods for the time being along with promises of softening restrictions on what goods could be sold to Huawei.

With most of the market pricing in some concessions regarding Huawei and to delay of the next round of tariffs on additional $300 billion worth of Chinese imports, stocks may see the next catalysts stem from deteriorating economic data that will support the arguments for the Fed to deliver a stronger commitment to easing and for the other major central banks to step up their efforts.

US stocks closed in record territory despite giving up half of its gains as the focus has shifted back to the falling expectations of earnings growth in the second quarter. Surveys and sentiment indicators are pointing to a only a slight gain with earnings, down from 3.5% seen a couple months ago and almost 7% at the beginning of the year. The dollar rallied mainly on euro weakness.

Oil

Oil traders are following the market adage of buying the rumor and selling the news. Crude prices were off to a strong start to the trading week after OPEC + signaled they will agree upon a nine-month extension of oil production cuts. At the end of last week, expectations were high for a six-month extension as weakening global demand and rising American output have hurt prices. Committing to an extension of production cuts beyond the next OPEC extraordinary meeting is pointless, which will likely occur before year end. Tomorrow, OPEC’s allies will need to approve the production cut extension, but with Russia signalling over the weekend they are on board, in theory Tuesday should go smoother than today.

Both WTI and Brent prices fell early in the afternoon as OPEC ministers struggled to deliver the OPEC + charter. The morning headlines all pointed to a positive outcome, but the hold up came from Iran, who stated they would not support the charter unless OPEC had a unanimous agreement. Oil prices turned negative on the day but then rallied off the lows after Iran approved the compromise on the OPEC + charter.

Crude prices should struggle in the short-term on a stronger dollar and despite OPEC + determination to rebalance the supply side as demand outlooks are waning due to softer than expected manufacturing data globally.

Gold

Gold is having its worst day since November 2016 as the US-China trade détente and surging US dollar gave little demand for havens. The yellow metal did rebound earlier in NY after the ISM manufacturing index in the US fell to lowest level since September 2016, following a trend of softer factory output data globally. It appears investors may be patient on this pullback that is occurring after making a six-year high last week. The markets may take a few days to process the lack of substance with the trade truce and ultimately gold will be supported on speculation the Fed along with the other major central banks will deliver more stimulus to fend off the global slowdown. The $1,360 an ounce level should provide major support for gold traders.

Bitcoin

Bitcoin is almost down 30% from last week’s high as interest for wobbles and skepticism grows for the meteoric rise to continue. The largest cryptocurrency is up over 270% since the start of the year and further adoption from other major institutions and possibly central banks should keep digital coins supported.

The recent slump has seen most of the Libra driven gains wiped away and the key gap mid-June gap nearly filled. In the short-term we could see initial support at current levels, with major support falling at the $9,000 level.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals