Major global treasury yield tumbled sharply last week on expectations of policy easing by central banks. In particular, ECB Governing Council member Olli Rehn issued panic call for further monetary stimulus “now”. German 10-year bund yield hit as low as -0.407, below ECB’s -0.40% deposit rate. UK 10-year gilt yield also dropped to as low as 0.655, before closing at 0.739, below BoE’s benchmark rate of 0.75%. US 10-year yield also dropped to as low as 1.943.

However, stronger than expected US job data prompted rethink in, at least, Fed’s policy path. Treasury yields also staged strong rebound to close the week. In the currency markets, Canadian Dollar ended as the strongest one, followed by Dollar., and then Yen. Swiss Franc was the weakest one as geopolitical tensions seemed to have eased. New Zealand Dollar was the second weakest, then Sterling.

US data indicated slowdown but no disaster, with solid NFP

To recap some of last week’s data from US, non-farm payroll report showed 224k growth in the job market in June, notably above expectation of 164k. Prior month’s dismal figure was revised slightly down from 75k to 72k. Unemployment rate rose 0.1% to 3.7%, above expectation of 3.6%. But, participation rate also rose 0.1% to 62.9%. Average hourly earnings rose 0.2% mom, below expectation of 0.3% mom. But prior month’s wage growth was revised up from 0.2% mom to 0.3% mom.

ISM Manufacturing Index dropped to 51.7 in June, down slightly from 52.1 but beat expectation of 51.0. On the negative side, New Orders dropped -2.7 to 50.0. Prices dropped sharply by -5.3 to 47.9. However, Production rose 2.8 to 54.1. Employment also rose 0.8 to 54.7. ISM Non-Manufacturing Composite dropped to 55.1 in June down from 56.9 and missed expectation of 56.0. Looking at some details, Business Activity dropped -3.0 to 58.2. New Orders dropped -2.8 to 55.8. Employment dropped -3.1 to 55.0.

Overall, the set of data suggested that while momentum of the US economy was slowing down, there was no steep deterioration. Indeed, NFP was back above 200k handle, arguing that May’s poor number was just a blip. It should also be noted that the “sudden” threat of Mexico is now gone. US and China also agreed to return to negotiation table. Confidence might start to return for US businesses.

Fed Powell has the last chance to correct expectations on July cut

After last week’s development, markets finally seem too be convinced that Fed won’t adopt a 50bps rate cut on July 31. Still, fed fund futures suggest there is 100% chance of at least 25bps cut to 2.00-2.25%. One argument is that Fed has repeatedly emphasized that the inflation target is “symmetric”. That is, most policymakers could allow inflation to overshoot temporarily. And thus, they have the room to opt for an insurance cut to guard against deeper slowdown in economy and job growth.

However, we’d like to emphasize that just back in June, eight FOMC policymakers expected interest rates to be unchanged for the whole of 2019, with one expected a rate hike. It’s beyond imagination that those nine members could change their mind within just a matter of weeks, when developments were generally positive. On other hand, a total of eight policy markers expected rate cut this year, with seven expected total of 50bps cut. Yet, it’s unsure how many of these eight wanted an imminent cut. Thus, to us, it’s still more likely than not that Fed will stand pat this month.

If market pricing of rate cut for July is way off the mark, Fed will have, probably the last, chance to correct the expectations this week. FOMC June meeting minutes will reveal how urgent the members are regarding rate cut. So far, only St. Louis Fed President James Bullard has openly called for immediate action. More importantly, Fed Chair Jerome Powell will have his two-day Congressional Testimony on Wednesday and Thursday. If a July cut is not a done deal, he’d better be clearcut and straightforward.

Dollar index medium term bullishness revived

Dollar index’s rebound from 95.83 extended higher last week and took out 55 day EMA decisively. The development affirmed the case that fall from 98.37 is a correction that’s completed with three waves down to 95.83. Strong support was also seen from 55 week EMA and 55 month EMA. Thus, the development is reviving medium term bullishness. Focus will be turned back to 97.76 resistance first. Break will likely resume the up trend from 88.25 (2018 low), through 98.37 high.

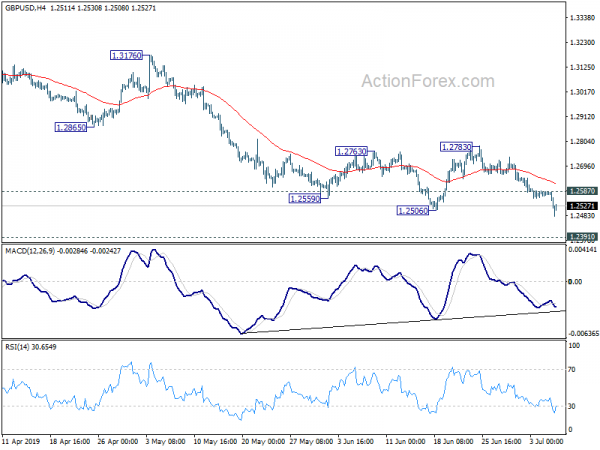

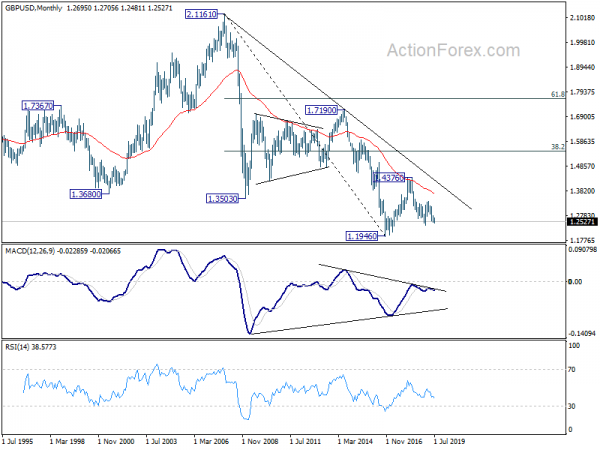

GBP/USD dropped further to as low as 1.2481 last week. Break of 1.2506 support indicate resumption of whole fall from 1.3381. The pair is also kept comfortably below falling 55 day EMA, maintaining near term bearishness. Initial stays on the downside this week for 1.2391 low. Firm break there will resume larger down trend. On the upside, above 1.2587 minor resistance will turn intraday bias neutral first. But near term outlook will stay bearish as long as 1.2783 resistance holds.

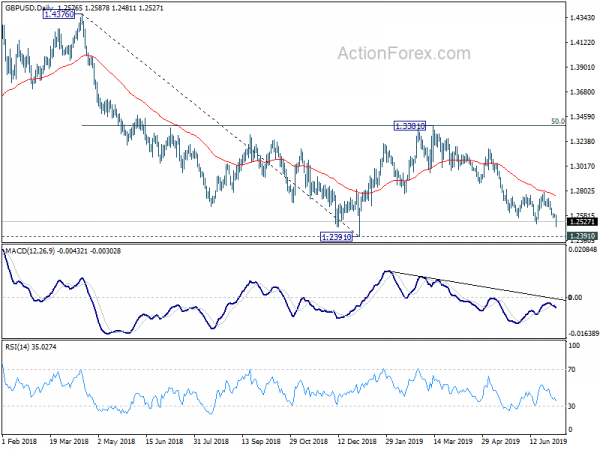

In the bigger picture, down trend from 1.4376 (2018 high) is still in progress. Break of 1.2391 would target a test on 1.1946 long term bottom (2016 low). For now, we don’t expect a firm break there yet. Hence, focus will be on bottoming signal as it approaches 1.1946. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of strong rebound.

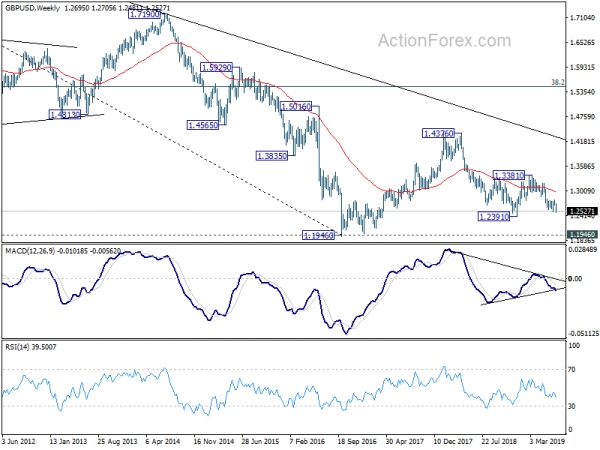

In the longer term picture, consolidative pattern from 1.1946 (2016 low) could still extend with another rising leg. But after all, decisive break of 38.2% retracement of 2.1161 (2007 high) to 1.1946 at 1.5466 is needed to indicate long term reversal. Otherwise, an eventual downside breakout will remain in favor.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals