Markets are in mild risk seeking mode in Asian session, following record run in the US. China’s GDP data slowed to 27-year low in Q2, but strong June data offered glimpse of hope. New Zealand and Australian Dollar follow the trend and strength today. Yen and Swiss Franc soften naturally. A large number of important economic data are featured ahead, which will surely make it an interesting week.

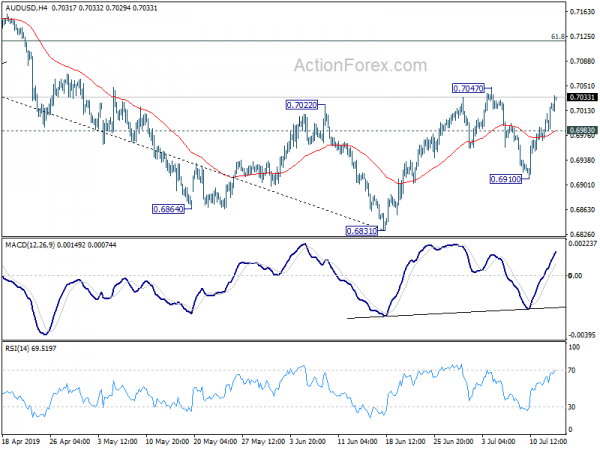

Technically, immediate focus will be on 0.7047 resistance in AUD/USD. Firm break will confirm resumption of recent rebound from 0.6831 for 0.7118 fibonacci level next. EUR/AUD is also pressing 1.6025 support and firm break will resume the fall from 1.6448 towards 1.5683 low. 0.8954 in EUR/GBP is another focus. Break will be an early sign of near term bearish reversal. That is, fortune of Euro and Sterling would start to reverse in that case.

In Asia, currently, Japan is on holiday. Hong Kong HSI is up 0.08%. China Shanghai SSE is up 0.30%. Singapore Strait Times is down -0.07%.

China Q2 GDP slowed to 27-year low, but June data beat expectations

GDP growth slowed to 6.2% yoy in Q2, down from Q1’s 6.4% yoy, matched expectations. That’s also the slowest pace in at least 27 years. However, quarterly growth actually accelerated to 1.6% qoq, up from Q1’s 1.4% qoq and beat expectation of 1.5% qoq.

Also June’s data come in stronger than expected. But it remains to be seen if the momentum towards the end of the quarter could sustain. Headwinds from US tariffs and weaker global growth would still likely drag down China’s growth ahead.

Fixed assessment investment, excluding rural, rose 5.8% ytd yoy in June, up from 5.6% and beat expectation of 5.6%. Industrial production rose 6.3% yoy in June, up from 5.0% and beat expectation of 5.2%. Retail sales jumped 9.8% yoy, up from 8.6% yoy and beat expectation of 8.5% yoy. Surveyed unemployment rate rose from 5.0% to 5.1%.

USD/CNH (offshore Yuan), dips mildly in Asian session but that’s mainly due to mild weakness in Dollar. Recent consolidation from 6.9620 is still in progress and would extend further in range.

Important data for many currencies ahead

More Fed officials will speak this week and it’s important to see how the neutrals/doves split in FOMC. At the same time economic data from US will play an important role in Fed’s rate cut decision on July 31. Some fed officials have noted that consumer spending has been resilient recently but business investments slowed due to lower confidence. Thus, while retail sales are watched closely, industrial productions and regional fed surveys might carry a bigger weight.

Elsewhere, the high profile events are also featured for many other major currencies, including UK employment, CPI and retail sales. German ZEW, Canada CPI and retail sales, Japan CPI, Australian employment and RBA minutes, New Zealand employment will also be featured. It’s surely an interesting week.

Here are some highlights for the week:

- Monday: Swiss PPI; US Empire state manufacturing.

- Tuesday New Zealand CPI; RBA minutes; UK employment; German ZEW; Eurozone trade balance; Canada foreign securities purchases; US retail sales, import prices, industrial production, business inventories, NAHB housing index.

- Wednesday: UK CPI, PPI; Canada CPI, manufacturing sales; US building permits and housing starts, Fed’s Beige Book.

- Thursday: Japan trade balance; Australia employment, NAB business confidence; Swiss trade balance; UK retail sales; US Philly Fed survey, jobless claims.

- Friday: Japan national core CPI, all industrial index; Germany PPI; Eurozone current account; UK public sector net borrowing; Canada retail sales; US U of Michigan consumer confidence.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.6986; (P) 0.7006; (R1) 0.7040; More…

Intraday bias in AUD/USD remains on the upside for 0.7047 resistance. Break will resume the rebound from 0.6831 and target 61.8% retracement of 0.7295 to 0.6831 at 0.7118. Sustained trading above will pave the way to 0.7205 resistance next. On the downside, break of 0.6983 minor support will turn bias to the downside for 0.6910 support instead.

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Jul | -0.20% | 0.30% | ||

| 2:00 | CNY | GDP Y/Y Q2 | 6.20% | 6.20% | 6.40% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Jun | 5.80% | 5.60% | 5.60% | |

| 2:00 | CNY | Industrial Production Y/Y Jun | 6.30% | 5.20% | 5.00% | |

| 2:00 | CNY | Retail Sales Y/Y Jun | 9.80% | 8.50% | 8.60% | |

| 2:00 | CNY | Surveyed Jobless Rate Jun | 5.10% | 5.00% | ||

| 6:30 | CHF | Producer & Import Prices M/M Jun | 0.00% | 0.00% | ||

| 6:30 | CHF | Producer & Import Prices Y/Y Jun | -0.90% | -0.80% | ||

| 12:30 | USD | Empire State Manufacturing Jul | 2 | -8.6 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals