Euro tumbles sharply today as poor PMI data solidifies the case for ECB easing ahead. The central bank is not expected to act tomorrow yet, but some form of indications would likely be provided by President Mario Draghi, on what stimulus would be adopted. For now, Australian Dollar is even weaker as poor PMI data, with weak employment, argues for more RBA rate cut too.

On the other hand, Sterling is the strongest one for today, partly helped by free fall in EUR/GBP. Also, the Pound continues to digest the impact of Boris Johnson as UK Prime Minister. Yen is the second strongest one. Dollar is mixed even though next week’s US-China trade meeting in Shanghai is confirmed.

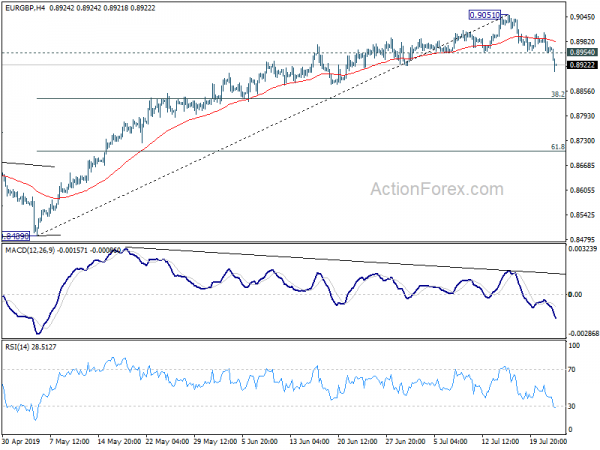

Technically, EUR/GBP’s strong break of 0.8954 confirms short term topping at 0.9501. The cross is now in a corrective phase which could dip below 55 day EMA at 0.8889. AUD/JPY is heading back to 75.13 support. Break will confirm completion of recent corrective recovery from 73.93 and bring retest of this low.

In Europe, currently, FTSE is down -0.82%. DAX is up 0.31%. CAC is down -0.43%. German 10-year yield is down -0.0318 at -0.383. Earlier in Asia, Nikkei rose 0.41%. Hong Kong HSI rose 0.20%. China Shanghai SSE rose 0.80%. Singapore Strait Times dropped -0.14%. Japan 10-year JGB yield dropped -0.0002 to -0.148.

US Mnuchin confirms to travel to Shanghai for trade negotiations next week

US Treasury Secretary Steven Mnuchin confirmed to CNBC that he will travel to China for a trade meeting with Trade Representative Robert Lighthizer next week. Mnuchin noted “there are a lot of issues” but he expected another meeting would follow in Washington afterwards. And, “hopefully we’ll continue to progress”.

The two-day meeting that starts on Tuesday will be held in Shanghai. Mnuchin noted the symbolism of the location, the Shanghai Communique of 1972 was considered an important step in normalizing relations between the U.S. and China.

Eurozone PMIs: Economy relapsed, GDP growth to slow further to 0.1% in Q3

Eurozone PMI manufacturing dropped to 46.4 in July, down from 47.6 and missed expectation of 47.6. That’s also the lowest level in 79 months. PMI services dropped to 53.3, down from 53.6, matched expectations. PMI Composite dropped to 51.5, down from 52.2, a 3-month low.

Chris Williamson, Chief Business Economist at IHS Markit said: “The eurozone economy relapsed in July, with the PMI giving up the gains seen in May and June to signal one of the weakest expansions seen over the past six years. The pace of GDP growth looks set to weaken from the 0.2% rate indicated for the second quarter closer to 0.1% in the third quarter.”

“The manufacturing sector has become an increasing cause for concern…. The more domestically-focused service sector remained the main driver of expansion, though even here the rate of growth has slowed, likely in part due to signs of weaker labour market trends. Hiring was close to a three-year low in July.”

“With growth slowing, job creation fading and price pressures having fallen markedly compared to earlier in the year, the survey will give added impetus to calls for more aggressive stimulus from the ECB.”

Also from Eurozone, M3 money supply growth slowed to 4.5% yoy in June, missed expectation of 4.6% yoy. From UK, BBA mortgage approvals rose to 42.7k in June, but missed expectation of 42.9k.

Germany PMI manufacturing dropped to 84-mth low, from bad to worse

Germany PMI manufacturing dropped to 43.1 in July, down from 45.0 and missed expectation of 45.2. That’s also the lowest level in 84 months. PMI services dropped to 55.4, down from 55.8, beat expectation of 55.2, a 2-month low. PMI Composite dropped to 51.4, down from 52.6, a 4-month low.

Phil Smith, Principal Economist at IHS Markit said: “The health of German manufacturing went from bad to worse in July, according to the flash PMI data, raising the risk of the euro area’s largest member state entering a mild technical recession… “In a further sign of the slowdown in new orders and gloomier outlook affecting firms’ hiring decisions, July’s flash data showed employment rising at the slowest rate for over four years, with factory job losses accelerating.”

France PMIs: Softer growth in July dents hopes of swift recovery to long-run rate

Franc PMI manufacturing dropped to 50.0 in July, down from 51.9, missed expectation of 51.6. PMI services dropped to 52.2, down from 52.9, missed expectation of 52.8. PMI Composite dropped to 51.7, down from 52.7.

Eliot Kerr, Economist at IHS Markit said: “Notably, the rate of expansion in overall business activity remains historically subdued and far weaker than the averages registered during 2017 and 2018. Moreover, softer growth in July dents hopes of a swift recovery to the long-run rate, which were beginning to materialise after June’s solid performance.”

Australia PMI composite dropped to 51.8, sharp fall in employment

Australia CBA PMI manufacturing dropped to 51.4 in July, down from 52.0. PMI services dropped to 51.9, down from 52.6. PMI composite dropped to 51.8, down from 52.5. CBA noted that “Slower growth fed through to staffing levels, which decreased for the first time in three months.” More importantly, employment decreased for the greatest extent since the survey began in May 2016. Reduction in jobs were centered of service sector.

CBA Senior Economist, Belinda Allen said: “Overall the “flash” PMI does suggest business activity should continue to expand in Q3… The sharp fall in employment intentions underlines the importance of the tax cuts now filtering into the economy and calls for more policy stimulus via infrastructure spending and microeconomic reform. Input costs continued to lift and is worth watching if businesses can pass it on, we could see some impact on consumer inflation over 2H 2019 and into 2020″.

Japan PMIs: Fastest expansion in 7 months on services, but manufacturing sector’s plight continued

Japan PMI manufacturing improved to 49.6 in July, up from 49.3, but missed expectation of 49.7. PMI services rose to 52.3, up from 51.9. PMI composite rose to 51.2, up from 50.8.

Joe Hayes, Economist at IHS Markit, noted, “overall private sector output expanded at the fastest pace in seven months on the back of faster growth in services activity”. “The manufacturing sector’s plight continued, however, where production was cut in July for the seventh successive month. ”

Also, “weak demand from China remained a key factor behind sluggish demand for Japanese goods. Heightened frictions between Japan and South Korea also add downside risk to the manufacturing supply chain in Japan, creating additional slack that services may once again have to compensate for.”

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8944; (P) 0.8974; (R1) 0.8996; More…

EUR/GBP drops sharply to as low as 0.8935 so far today. The strong break of 0.8954 support confirms short term topping. Fall from 0.9051 is seen as corrective rise from 0.8489. Intraday bias is back on the downside for 55 day EMA (now at 0.8891) and then 38.2% retracement of 0.8489 to 0.9051 at 0.8836. On the upside, above 0.8954 will turn intraday bias first. But deeper pull back would remain in favor as long as 0.9051 resistance holds.

In the bigger picture, medium term decline from 0.9305 (2017 high) is seen as a corrective move. No change in this view. Current development argues that it might have completed with three waves down to 0.8472, just ahead of 38.2% retracement of 0.6935 (2015 low) to 0.9306 at 0.8400, after hitting 55 month EMA (now at 0.8545). Decisive break of 0.9101 resistance will confirm this bullish case. However, firm break of 55 week EMA (now at 0.8805) would possibly extend the correction another another fall to below 0.8472 before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance Jun | 365M | 100M | 264M | 175M |

| 23:00 | AUD | CBA PMI Manufacturing Jul P | 51.4 | 52 | ||

| 23:00 | AUD | CBA PMI Services Jul P | 51.9 | 52.6 | ||

| 0:30 | JPY | PMI Manufacturing Jul P | 49.6 | 49.7 | 49.3 | |

| 7:15 | EUR | France Manufacturing PMI Jul P | 50 | 51.6 | 51.9 | |

| 7:15 | EUR | France Services PMI Jul P | 52.2 | 52.8 | 52.9 | |

| 7:30 | EUR | Germany Manufacturing PMI Jul P | 43.1 | 45.2 | 45 | |

| 7:30 | EUR | Germany Services PMI Jul P | 55.4 | 55.2 | 55.8 | |

| 8:00 | EUR | Eurozone Manufacturing PMI Jul P | 46.4 | 47.6 | 47.6 | |

| 8:00 | EUR | Eurozone Services PMI Jul P | 53.3 | 53.3 | 53.6 | |

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 4.50% | 4.60% | 4.80% | |

| 8:30 | GBP | BBA Loans for House Purchase Jun | 42.7K | 42.9K | 42.4K | |

| 13:45 | USD | Manufacturing PMI Jul P | 51 | 50.6 | ||

| 13:45 | USD | Services PMI Jul P | 51.8 | 51.5 | ||

| 14:00 | USD | New Home Sales Jun | 659K | 626K | ||

| 14:30 | USD | Crude Oil Inventories | -3.1M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals