Ahead of a pivotal update on trade and the biggest FOMC meeting of the year, the S&P 500 is struggling to deliver any significant moves following last week’s record high close. Trade may dominate the headlines today and the bar is set pretty low for the two-day Shanghai meeting. If we see promises from the Chinese to deliver on more purchases of US agricultural goods and for the US to allow American companies to sell some goods to Huawei, the meetings would be viewed as positive. At the end of last week, President Trump played down any optimism of an immediate trade deal and tried to turn the US-China trade war as a campaigning point. The President implied China might want to wait and see if a Democratic will win the 2020, which means the Chinese could probably get easier terms on a trade deal.

While Trump’s comments are obviously political posturing, the Chinese will likely prefer to deal with Trump as he would be content with most of the current deal as long as it is enforceable, while the Democrats might seek more structural reforms from Beijing. The base case should remain that a deal will get done by within several months, but if we see talks fall apart here, we might have to wait until after the election.

Hong Kong

China’s Hong Kong and Macau Affairs Office briefing delivered no major surprises. Beijing remains loyal to Hong Kong leader Carrie Lam and they urge to punish individuals for taking protests violent. The biggest takeaway was that the People’s Liberation Army (PLA) will not get involved, at least not yet. Central government intervention escalates tensions between by both sides and it seems Beijing is set on waiting this out. No progress was made on breaking the impasse between Hong Kong and Beijing and we should expect to see protests continue.

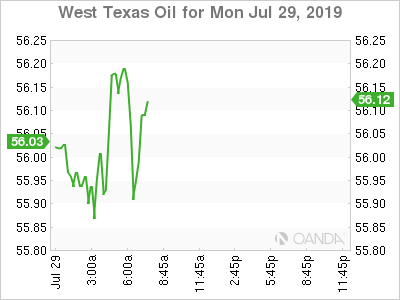

Oil

West Texas Intermediate crude is softer on the day after the UK deploys a warship to escort oil vessels in the Straight of Hormuz and as Iranian-European talks appear set to continue. The 2015 nuclear deal could be salvaged and if we see further optimism in talks, we could see a lot of risk premium come out of crude prices.

Global economic growth prospects remain fragile, so energy traders will closely await updates on both the trade front and Fed policy. Oil could see significant gains as the strong US economy will see a massive commitment to easy policy from the Fed, just like they did in 1995. This week’s big event will be the Fed and while the dollar reaction might be mixed, we could see commodities sharply rally this week.

Gold

Gold prices should struggle for meaningful moves until we get passed this week’s FOMC meeting and face-to-face talks between the Chinese and Americans. Right now, for bullion buyers, it is all about the Fed. The prospects of a strong commitment to fight deflationary conditions from the Fed could be enough to take the yellow metal back towards $1,500 an ounce. Trade is important, but this week’s talks should see both sides offer an olive branch.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals