Dollar trading generally lower today as markets await Fed’s highly anticipated rate cut. Though, the greenback is just the second weakest. New Zealand Dollar is the worst performing one for today so far on deteriorating business confidence. Swiss Franc is the third weakest as markets turned mixed. Australian Dollar is lifted by slightly higher CPI reading as well as China manufacturing PMI. Yet, there is no turnaround in the Aussie yet. Canadian Dollar follows as the second strongest, then Sterling. The Pound is paring some losses but no-deal Brexit fear will continue to weigh.

Technically, Dollar pairs will be the major focuses today. In particular, EUR/USD is consolidating above 1.1107 key low. USD/CHF is held below 0.9951 resistance. USD/JPY also stays below 108.99 resistance. EUR/USD’s support has to be taken out firmly to confirm Dollar buying, better accompanies by break of resistances in USD/CHF and USD/JPY.

Elsewhere, in Asian, Nikkei dropped -0.8%. Hong Kong HSI dropped -1.31%. China Shanghai SSE dropped -0.72%. Singapore Strait Times is down -1.29%. Japan 10-year JGB yield is down -0.0033 at -0.154. Overnight, DOW dropped -0.09%. S&P 500 dropped -0.26%. NASDAQ dropped -0.24%. 10-year yield rose 0.006 to 2.061.

Dollar softens ahead Fed’s rate cut, is it the beginning of a cycle

Dollar softens mildly in Asian session as markets are preparing for FOMC rate decision in the upcoming US session. Fed fund futures continue to price in 100% chance of easing (-25bps cut at 78.1%, -50bps cut at 21.9%). There is little chance for Fed to upset such firm market expectations even though some policy makers may be reluctant to do so.

A -25bps cut to 2.00-2.25% should very well be priced in. The questions are whether it’s a start of an easing cycle, or just a one-off response to risks. The voting will reflect the split inside the committee. Chair Jerome Powell’s press conference is even more important in framing the cut.

Earlier, former Fed chair Janet Yellen endorsed today’s cut but she “wouldn’t see as the beginning… of a major easing cycle.” Former New York Fed President William Dudley also said “there’s a good chance the Fed won’t be cutting further anytime soon”. Dollar could be given a lift if Powell delivers similar messages today.

Some suggested previews:

UK Johnson: Ready for no-deal Brexit if EU can’t compromise, it’s their call

During a visit to a farm in Wales yesterday, UK Prime Minister Boris Johnson appeared to have no interest in meeting EU, unless they shift their position on Brexit. He said “if they can’t compromise, if they really can’t do it, then clearly we have to get ready for a no-deal exit, and I think we’ll do it …. it’s up to the EU, it’s their call.”

His spokesman also noted that, “the prime minister made clear that the UK will be leaving the EU on October 31, no matter what,” referring to Johnson’s call with Irish Prime minister Leo Varadkar. And, “the government will approach any negotiations which take place with determination and energy and in a spirit of friendship, and that his clear preference is to leave the EU with a deal, but it must be one that abolishes the backstop”.

On the other hand, the Irish government said “the Taoiseach explained that the EU was united in its view that the Withdrawal Agreement could not be reopened.”

Released from UK, Gfk consumer confidence improved to -11 in July, up from -13 and beat expectation of -13. BRC shop price index dropped -0.1% yoy in July.

Australia CPI accelerated to 1.6% on automotive fuel prices

Australia CPI rose 0.6% qoq in Q2, above expectation of 0.5% qoq. Annually, headline CPI accelerated to 1.6% yoy, up from 1.3% yoy and beat expectation of 1.5% yoy. RBA trimmed mean CPI was unchanged at 1.6% yoy versus expectation of 1.5% yoy. RBA weighted median CPI slowed to 1.2% yoy, down from 1.4% yoy, matched expectations.

ABS Chief Economist, Bruce Hockman said: “automotive fuel prices rose 10.2 per cent in the June quarter 2019. This rise had a significant impact on the CPI, contributing half of the 0.6 per cent rise this quarter. Automotive fuel prices returned to levels recorded in late 2018 after falling 8.7 per cent in the March quarter 2019.”

And, “annual growth in the CPI continues to be subdued due to falls in a number of administered prices. Through the year, utility prices have fallen 0.2 per cent and child care has fallen 7.9 per cent following the introduction of the Child Care Subsidy package in July 2018.”

ANZ business confidence dropped to -44.3, two more RBNZ cuts expected this year

New Zealand ANZ Business Confidence dropped to -44.3 in July, down from -38.1. That’s also the worst reading sine August 2018. Among the sectors, agriculture scored worse at -78.5 while retail was best at -30.4. Activity Outlook Index dropped to 5.0, down from 8.0. Construction outlook was worst at -33.3 while services was best at 11.2.

ANZ noted: “The outlook for the economy is deteriorating. Despite generally good commodity prices and interest rates at record lows, the headwinds of a global slowdown and credit and cost constraints appear to be winning out. With the inflation outlook not consistent with the target midpoint we expect two more OCR cuts this year, helping the economy to find its feet once more.”

China PMI manufacturing rose to 49.7, foundation for stabilization still needs to be consolidated

The official China PMI Manufacturing Index rose to 49.7 in July, up from 49.4 and beat expectation of 49.6. Looking at the details, production, new order, new export order, backlog, purchase volume, import, purchase price,, ex-factory price, employment, production and operation improved. But finished goods inventories, raw material inventory and supplier delivered dropped.

Analyst Zhang Liqun noted that: “Economic downturn is slowing down…. activities have been restored…. there are signs of recovery in production and operation activities, indicating that the effect of macroeconomic policy counter-cyclical adjustment has begun to appear.”

However, he also warned that ” downward pressure on the economy is still not to be underestimated. And, the foundation for stabilization still needs to be consolidated.

Also released, official PMI Non-Manufacturing Index dropped to 53.7, down from 54.2 and missed expectation of 54.0.

Looking ahead

Elsewhere, Japan housing starts rose 0.3% yoy in June versus expectation of -2.2% yoy. Consumer confidence index dropped to 37.8, below expectation of 38.5. Germany retail sales rose 3.5% mom in June.

Germany will release unemployment. Eurozone GDP, CPI and unemployment will also be featured in European session. Later in the day, US will release ADP employment, employment cost and Chicago PMI. Canada will release GDP, IPPI and RMPI. Of course FOMC rate cut will catch most attention.

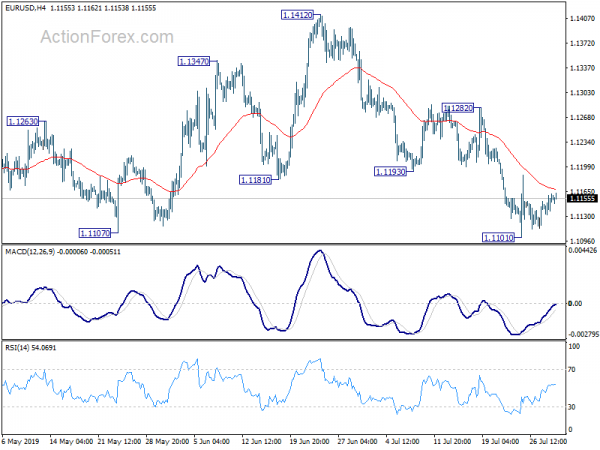

Daily Pivots: (S1) 1.1138; (P) 1.1149 (R1) 1.1167; More…..

EUR/USD is staying in consolidation above 1.1101 temporary low and intraday bias remains neutral first. Another recovery could be seen. But outlook will remain bearish as long as 1.1282 resistance holds. On the downside, sustained break of 1.1107 low will resume larger down trend from 1.2555. Though, firm break of 1.1282 will bring stronger rise to 1.1412 resistance.

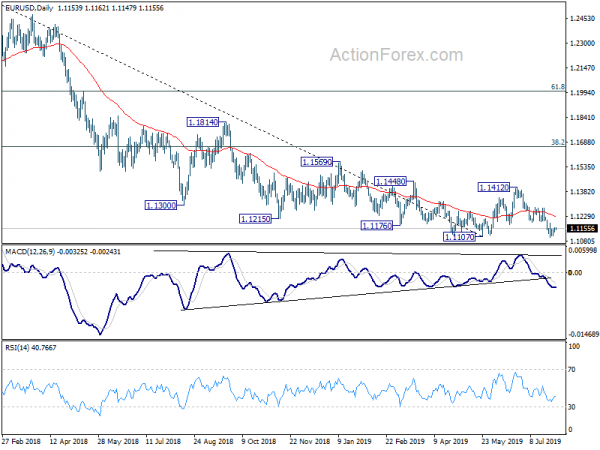

In the bigger picture, on the one hand, 1.1107 is seen as a medium term bottom on bullish convergence condition in weekly MACD. On the other hand, rejection by 55 week EMA retains medium term bearishness. Outlook stays neutral for now. On the downside, break of 1.1107 will resume the down trend from 1.2555 (2018 high) to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Meanwhile, break of 1.1412 will resume the rebound to 38.2% retracement of 1.2555 to 1.1107 at 1.1660.

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Jul | -11 | -13 | -13 | |

| 23:01 | GBP | BRC Shop Price Index Y/Y Jul | -0.10% | -0.10% | ||

| 1:00 | NZD | ANZ Business Confidence Jul | -44.3 | -38.1 | ||

| 1:00 | CNY | Manufacturing PMI Jul | 49.7 | 49.6 | 49.4 | |

| 1:00 | CNY | Non-manufacturing PMI Jul | 53.7 | 54 | 54.2 | |

| 1:30 | AUD | CPI Q/Q Q2 | 0.60% | 0.50% | 0.00% | |

| 1:30 | AUD | CPI Y/Y Q2 | 1.60% | 1.50% | 1.30% | |

| 1:30 | AUD | CPI RBA Trimmed Mean Q/Q Q2 | 0.40% | 0.40% | 0.30% | |

| 1:30 | AUD | CPI RBA Trimmed Mean Y/Y Q2 | 1.60% | 1.50% | 1.60% | |

| 1:30 | AUD | CPI RBA Weighted Median Q/Q Q2 | 0.40% | 0.40% | 0.10% | |

| 1:30 | AUD | CPI RBA Weighted Median Y/Y Q2 | 1.20% | 1.20% | 1.20% | 1.40% |

| 1:30 | AUD | Private Sector Credit M/M Jun | 0.10% | 0.30% | 0.20% | |

| 5:00 | JPY | Housing Starts Y/Y Jun | 0.3% | -2.20% | -8.70% | |

| 5:00 | JPY | Consumer Confidence Index Jul | 37.8 | 38.5 | 38.7 | |

| 6:00 | EUR | German Retail Sales M/M Jun | 3.50% | 0.50% | -0.60% | |

| 7:55 | EUR | German Unemployment Change Jul | 2K | -1K | ||

| 7:55 | EUR | German Unemployment Claims Rate Jul | 5.00% | 5.00% | ||

| 9:00 | EUR | Eurozone Unemployment Rate Jun | 7.50% | 7.50% | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q2 A | 0.20% | 0.40% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y Jul A | 1.00% | 1.10% | ||

| 9:00 | EUR | Eurozone CPI Estimate Y/Y Jul | 1.10% | 1.20% | ||

| 10:00 | EUR | Italian GDP Q/Q Q2 P | -0.10% | 0.10% | ||

| 12:15 | USD | ADP Employment Change Jul | 150K | 102K | ||

| 12:30 | USD | Employment Cost Index Q2 | 0.70% | 0.70% | ||

| 12:30 | CAD | GDP M/M May | 0.10% | 0.30% | ||

| 12:30 | CAD | GDP Y/Y May | 1.30% | 1.50% | ||

| 12:30 | CAD | Industrial Product Price M/M Jun | 0.10% | |||

| 12:30 | CAD | Raw Materials Price Index M/M Jun | -2.30% | |||

| 13:45 | USD | Chicago PMI Jul | 51.5 | 49.7 | ||

| 14:30 | USD | Crude Oil Inventories | -10.8M | |||

| 18:00 | USD | FOMC Rate Decision (Upper Bound) | 2.25% | 2.50% | ||

| 18:00 | USD | FOMC Rate Decision (Lower Bound) | 2.00% | 2.25% | ||

| 18:30 | USD | FOMC Press Conference |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals