New Zealand Dollar is clearly the worst performing one today as selloff intensifies after RBNZ’s surprised -50bps rate cut. Australian Dollar is also dragged down deeply while Canadian Dollar follows as third weakest so far. Asian markets ignore rebound in US stocks overnight and weaken generally. Yen and Swiss franc strengthen on risk aversion, with Euro being lifted too. Dollar is mixed for now as markets continue to digest escalation in US-China trade and currency war. But it’s supported as even a Fed dove prefers to wait and see before another rate cut.

Technically, NZD/USD’s break of 0.6422 support indicates resumption of down trend from 0.7558 (2017 high) to 0.6102 (2015 low). NZD/JPY is also extending the down trend from 94.01 (2014 high). AUD/USD resumes long term down trend from 1.1079 (2011 high) to 0.6008 (2008 low). EUR/AUD is pressing 1.6765 resistance and break will resume up trend from 1.3624 and that from 1.1602 (2012 low). USD/CAD is resuming near term rebound from 1.3016 short term bottom, towards 1.3432/3564 resistance zone.

In Asia, currently, Nikkei is down -0.47%. Hong Kong HSI is down -0.37%. China Shanghai SSE is down -0.01%. Singapore Strait Times is up 0.14%. Japan 10-year JGB yield is down -0.014 at -0.195. Overnight, DOW rose 1.21%. S&P 500 rose 1.30%. NASDAQ rose 1.39%. 10-year yield rose 0.004 to 1.739.

RBNZ surprises with -50bps cut, opted for larger initial monetary stimulus

New Zealand Dollar drops sharply after RBNZ surprised the markets by cutting OCR by -50bps to 1.00%. The central bank noted that both options of cutting by -25bps with easing bias and -50bps were discussed in the meeting. However, consensus was reached that ” larger initial monetary stimulus would best ensure the Committee continues to meet its inflation and employment objectives.”

There was no clear signal in the statement regarding further rate cuts. Though, in the key forecast variables table, OCR could bottom out at 0.9% in second half of 2020 before picking up again in mid-2021. It appears that even if there would be more rate cut ahead, that would only be marginal. As some economists would expect, the next cut, if delivered, would be the last one in the current easing cycle. Full statement here.

BoJ summary of opinions indicates needs to discuss pre-emptive easing

According to Summary of Opinions of July 29-30 BoJ meeting, some policymakers were clearly concerned with risks to economic outlook. And there were calls for discussions on ideas of ramping up monetary stimulus. Some economists took that as a signal that BoJ could deploy pre-emptive easing measures as soon as at the meeting next month.

In the summary, one member warned that “the BOJ must communicate more clearly its resolve to take additional monetary easing steps without hesitation if the momentum to achieve its price target is under threat”. And, “we must also consider in advance what steps we can take if we were to ease.”

Another member urged to use both interest rates and forward guidance to ease policy further. But there was also voice regarding the need to “assess the benefits and demerits of various monetary easing steps”.

Bullard: Fed should wait and see before next move, not respond to each tit-for-tat

Yesterday, St. Louis Fed President James Bullard, one of the most dovish policymaker, said Fed shouldn’t response to every move in trade war. He said that Fed’s shift since the beginning of the year had made monetary policy “considerably” looser already. And, he added, “I don’t think it is realistic for the Fed to respond to each threat and counter threat in a tit-for-tat trade war”.

Bullard also said the economy is still adjusting to the looser stance. And it was appropriate to “wait and see” how upcoming economic data “roll in” before deciding the next move. He noted that “while additional policy action may be desirable, the long and variable lags in the effects of monetary policy suggest that the effects of previous actions are only now beginning to impact macroeconomic outcomes”.

On the data front

Australia AiG Performance of Construction Index dropped to 39.1 in July, down from 43. Home loans dropped -0.9% mom in June, well below expectation of 0.5% mom.

Looking ahead, Germany will release industrial production. Swiss will release foreign currency reserves. Later in the day, Canada will release Ivey PMI.

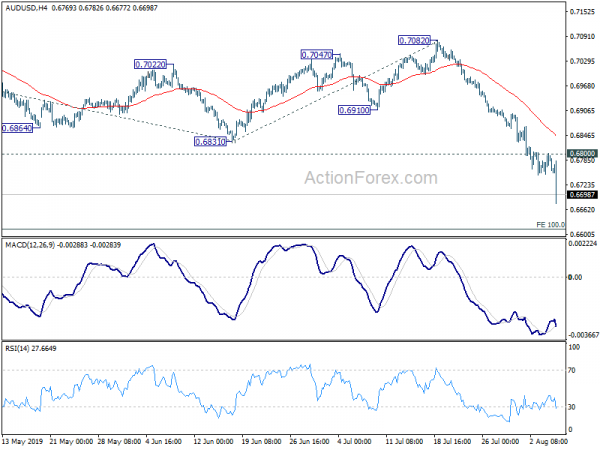

Daily Pivots: (S1) 0.6739; (P) 0.6770; (R1) 0.6790; More…

AUD/USD’s decline resumes after brief consolidation and hits as low as 0.6677 so far. Intraday bias is back on the downside. With 0.6722 support broken, larger down trend has also resumed. Next near term target is 100% projections of 0.7295 to 0.6831 from 0.7082 at 0.6618. On the upside, break of 0.6800 minor resistance will turn intraday bias neutral again for consolidations.

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Firm break of 0.6826 (2016 low) is confirm this bearish view. Further fall should be seen to 0.6008 (2008 low) next. On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Jul | 39.1 | 43 | ||

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 01:30 | AUD | Home Loans M/M Jun | -0.90% | 0.50% | -0.10% | -0.3 |

| 02:00 | NZD | RBNZ Official Cash Rate | 1.00% | 1.25% | 1.50% | |

| 06:00 | EUR | German Industrial Production M/M Jun | -0.50% | 0.30% | ||

| 07:00 | CHF | Foreign Currency Reserves (CHF) Jul | 759B | |||

| 14:00 | CAD | Ivey PMI Jul | 52.7 | 52.4 | ||

| 14:30 | USD | Crude Oil Inventories | -8.5M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals