Sterling stays soft in Asian session and remain the second worst performing one for the week. Risk of no-deal Brexit continues to weigh on the Pound. UK GDP and production data could add more selling pressure. For the week, New Zealand Dollar remains the weakest one after the surprised 50bps rate cut by RBNZ earlier. Swiss Franc is currently the strongest for the week, followed by Euro and the Yen. While stocks and yield stabilized somewhat after this week’s steep decline, sentiments remain generally cautious on increasing tensions between US and China.

Technically, Sterling pairs will be a major focus in European session. GBP/USD is still holding on to 1.2079 temporary low. But weak recovery so far favors decline resumption. Similarly, GBP/JPY is also holding above 128.11 temporary low but downside breakout looks imminent. EUR/GBP is extending recent rise, with weaker upside momentum. But as long as 0.9088 support holds, it’s still on tract to 0.9305 resistance next. EUR/CHF turns softer after failing to break through 4 hour 55 EMA. Break of 1.0863 will resume recent decline and could prompt more broad based selling in Euro.

In Asia, Nikkei is currently up 0.60%. Hong Kong HSI is down -0.18%. China Shanghai SSE is down -0.37%. Japan 10-year JGB yield is down -0.019 at -0.209. Overnight, DOW rose 1.43%. S&P 500 rose 1.88%. NASDAQ rose 2.24%. 10-year yield rose 0.032 to 1.716.

RBA Lowe said economy reached a gentle turning point, but growth forecasts revised down

In the “Opening Statement to the House of Representatives Standing Committee on Economics“, RBA Governor Philip Lowe said “there are signs the economy may have reached a gentle turning point”. The economic outlook is supported by lower interest rates, tax cuts, weaker exchange rate, stabilization of housing markets, improvement in resources sector and infrastructure spending. Thus, “consistent with this, we are expecting the quarterly GDP growth outcomes to strengthen gradually after a run of disappointing numbers,” Lowe said.

Though, for now, Lowe reiterated that “It is reasonable to expect an extended period of low rates will be needed to achieve the Board’s employment and inflation objectives,.” And, at the Q&A session, Lowe also noted that “it’s possible we end up at the zero lower bound” on interest rates. He added “it’s unlikely but it is possible” and RBA is “prepared to do unconventional things if circumstances warranted.”.

In the new economic forecasts, 2019 year end growth was revised down from 2.75% to 2.50%. 2020 year-end growth was unchanged at 2020%. 2021 year-end growth was expected to pick up to 3.00%. Unemployment rate forecasts for 2019 and 2002 year-end were revised up from 5.00% to 5.25%. Unemployment was expected to drop to 5.00% in 2021 year end. Headline CPI forecasts were also revised down from 2.00% to 1.75% at both 2019 and 2020 year-end, before picking up to 2.00% at 2021 year-end.

Japan GDP grew 0.4% in Q2, solid investments despite weak exports

Japan GDP grew 0.4% qoq in Q2, well above expectation of 0.1% qoq. Annualize growth rate slowed from 2.8% to 1.8%, but beat expectation of 0.5%. Looking at some details, private consumption, which accounts for around 60% of GDP, grew 0.6% qoq. Capital expenditure was solid and grew 1.5% qoq, accelerated from 0.4% qoq in Q1. Exports were weak but contracted just 0.1% qoq.

The set of data argues that uncertainty from global trade war has relatively controlled impacts on the economy. In particular, companies were not prompted to rein in investment spending. This echoed BoJ’s assessment that global uncertainties had so far limited impact on the Japanese economy. Though, domestic demand would weaken ahead later in the year due to the planned sales tax hike. That’s something BoJ policymakers need to continue to monitor.

Also from Japan, M2 rose 2.4% yoy in July versus expectation of 2.3% yoy. From China, CPI accelerated to 2.8% yoy in July versus expectation of 2.7% yoy. PPI dropped to -0.3% yoy versus expectation of 0.0% yoy.

UK Raab: No-deal Brexit is EU’s responsibility to bear

UK Foreign Minister Dominic Raab warned in a Reuters interview that it’s EU’s call on no-deal Brexit. And, it’s EU’s responsibility to take if that happens. He also reiterated that UK will leave at the end of October “preferably with a deal”. But, if “there’s no movement or flexibility from the EU side, then we’ll leave on what’s called WTO terms.”

Raab said, “If the position from the EU is that the withdrawal agreement can’t be changed – whether it’s add-ons or subtractions – full stop, which is their position today, then let’s face it, they will be taking the decision to see the UK leave on no-deal terms, and that’s a responsibility they will have to bear.”

He also reiterated the new government’s stance that “the backstop, certainly in its current form, is undemocratic and it’s something that will have to be removed.” The alternative is to move toward an “operational backstop” that ensured that “any checks that are done wouldn’t be at the border” but could be managed with “technology and goodwill and operational cooperation.”

Looking ahead

UK June and Q2 GDP will be the major focus today, along with productions, construction output and trade balance. Germany will release trade balance and swiss will release unemployment. Later in the day, Canada employment will take center stage. US will release PPI inflation.

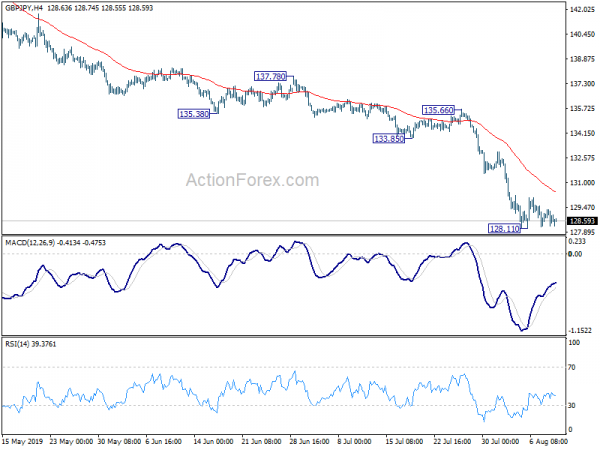

Daily Pivots: (S1) 128.23; (P) 128.78; (R1) 129.29; More…

GBP/JPY is staying in consolidation from 128.11 temporary low and intraday bias remains neutral first. Another recovery cannot be ruled out. But upside should be limited below 133.85 support turned resistance to bring fall resumption. On the downside, break of 128.11 will extend the decline from 148.84 to 122.36 low next.

In the bigger picture, outlook remains clearly bearish with GBP/JPY staying well below 55 week and 55 month EMA. Medium term fall from 156.59 (2018 high) is still in progress. Next target is 122.36 (2016 low). We’d be cautious on bottoming there. But break of 135.66 resistance is needed to be the first sign of reversal. Sustained break of 122.36 will target next key level at 116.83 (2011 low).

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jul | 2.40% | 2.30% | 2.30% | |

| 23:50 | JPY | GDP Q/Q Q2 P | 0.40% | 0.10% | 0.60% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | 0.40% | 0.40% | 0.10% | |

| 1:30 | CNY | CPI Y/Y Jul | 2.80% | 2.70% | 2.70% | |

| 1:30 | CNY | PPI Y/Y Jul | -0.30% | 0.00% | 0.00% | |

| 1:30 | AUD | RBA Statement on Monetary Policy | ||||

| 5:45 | CHF | Unemployment Rate Jul | 2.30% | 2.30% | ||

| 6:00 | EUR | German Trade Balance (EUR) Jun | 18.5B | 18.7B | ||

| 8:30 | GBP | GDP M/M Jun | 0.10% | 0.30% | ||

| 8:30 | GBP | GDP Q/Q Q2 P | 0.00% | 0.50% | ||

| 8:30 | GBP | GDP Y/Y Q2 P | 1.40% | 1.80% | ||

| 8:30 | GBP | Industrial Production M/M Jun | -0.20% | 1.40% | ||

| 8:30 | GBP | Industrial Production Y/Y Jun | -0.30% | 0.90% | ||

| 8:30 | GBP | Manufacturing Production M/M Jun | -0.20% | 1.40% | ||

| 8:30 | GBP | Manufacturing Production Y/Y Jun | -1.10% | 0.00% | ||

| 8:30 | GBP | Construction Output M/M Jun | -0.40% | 0.60% | ||

| 8:30 | GBP | Construction Output Y/Y Jun | 0.20% | 1.70% | ||

| 8:30 | GBP | Index of Services 3M/3M Jun | 0.20% | 0.30% | ||

| 8:30 | GBP | Visible Trade Balance (GBP) Jun | -11.3B | -11.5B | ||

| 12:15 | CAD | Housing Starts Jul | 210K | 246K | ||

| 12:30 | CAD | Net Change in Employment Jul | 10.0K | -2.2K | ||

| 12:30 | CAD | Unemployment Rate Jul | 5.50% | 5.50% | ||

| 12:30 | USD | PPI M/M Jul | 0.20% | 0.10% | ||

| 12:30 | USD | PPI Y/Y Jul | 1.70% | 1.70% | ||

| 12:30 | USD | PPI Core M/M Jul | 0.20% | 0.30% | ||

| 12:30 | USD | PPI Core Y/Y Jul | 2.30% | 2.30% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals