The financial markets are relatively quiet today with Japan and Singapore on holiday. Yen and Swiss franc generally firmer but there is no clear follow through buying to extend last week’s rally yet. On the other hand, Dollar is soft, but focus should be more on weakness in Sterling and New Zealand Dollar. The economic calendar is near empty today and without fresh stimulus, we’d expect last week’s risk aversion trend to continue.

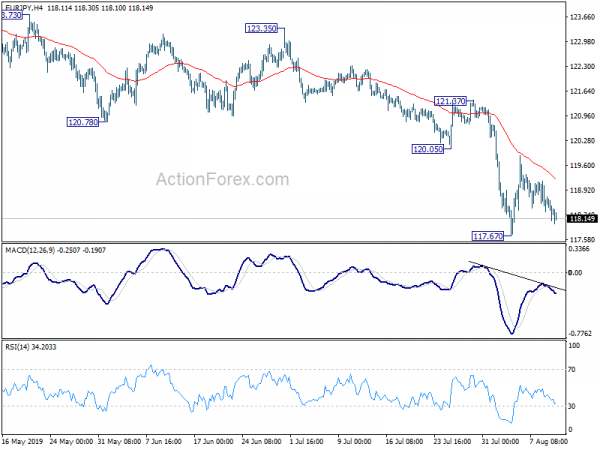

Technically, both USD/JPY and GBP/JPY are extending recent decline. 117.67 temporary low in EUR/JPY would be watched to further confirm broad based strength in the Yen. Meanwhile, 1.0863 temporary low in EUR/CHF will also be watched for weakness in Euro and strength in Swiss.

In Asia, currently, Hong Kong HSI is up 0.01%. China Shanghai SSE is up 0.70%. Japan and Singapore are on holiday.

Goldman Sachs: No US-China trade deal expected before 2020 presidential election

Goldman Sachs warned in a note released on Sunday that they expect tariffs targeting the remaining USD 300B of US imports from China to go into effect on September 1. And, a trade deal between US and China is no longer expected before 2020 US presidential election. Also, it expects a 0.6% drag on the US economy while “fears that the trade war will trigger a recession are growing.” For Q4, Goldman Sachs lowered US GDP growth forecast by 20 basis points to 1.8% annualized.

The note added “overall, we have increased our estimate of the growth impact of the trade war”. Supply chain disruption could lead US companies to reduce their domestic activity. “The drivers of this modest change are that we now include an estimate of the sentiment and uncertainty effects and that financial markets have responded notably to recent trade news.”

Also, “relatedly, the business sentiment effect of increased pessimism about the outlook from trade war news may lead firms to invest, hire, or produce less.”

Ireland reiterated no renegotiation stance on backstop and Brexit agreement

UK Prime Minister Boris Johnson and Irish Prime Minister Leo Varadkar are scheduled to meet in early September. But ahead of that, Varadkar’s spokesman clearly indicated there is no prospect of renegotiating the Irish backstop in Brexit withdrawal agreement. The spokesman noted that the discussions “would give both sides an opportunity to gain a better understanding of their respective positions. As has repeatedly been made clear, the withdrawal agreement and the backstop are not up for negotiation.”

In the other hand, Johnson’s chief EU adviser, David Frost, is expected to visit Brussels again in the coming days. Previously, it’s reported that Frost has told EU of the new, central scenario of no-deal Brexit of Johnson. But that was denied by Downing Street. Johnson will also meet the European commission president, Jean-Claude Juncker, for the first time at a G7 meeting in Biarritz at the end of this month.

RBNZ could cut to -0.35% theoretically, during crisis

According to a Bloomberg report, RBNZ has begun scoping a project to refresh its unconventional monetary policy strategy and implementation this year. Though it’s said o be “at a very early stage” and the central bank declined to made no further comment, nor release any further information.

On interest rate, RBNZ expected rates could drop to as low as -0.35%”before risking the hoarding of physical cash. And this will “only partially mitigate any large economic shock”. Large scale asset purchase is another option but such measures are unlikely to fully delivered the desired results in a major downturn. “targeted use of fiscal policy” is likely required to support any unconventional policy.

Looking ahead

Economic data is back on center of attention this week. US CPI, retail sales and regional Fed surveys will be featured. Eurozone will release GDP and German ZEW. UK will release employment, CPI and retail sales. Australia will release employment and business confidence. A couple of Chinese data including investment, production and retail sales will also be featured.

Here are some highlights for the week ahead:

- Monday: US federal budget balance

- Tuesday: Japan PPI, tertiary industry index, machine tools orders; Australia NAB business confidence; German CPI final, ZEW economic sentiment; UK employment; US CPI.

- Wednesday: Japan machine orders; Australia Westpac consumer sentiment, wage price index; China fixed asset investment, industrial production, retail sales, unemployment; German GDP; UK CPI, RPI, PPI; Eurozone employment, GDP, industrial production; US import prices.

- Thursday: Australia employment; Swiss PPI; UK retail sales; US retail sales, Empire state manufacturing, Philly Fed survey, non-farm productivity, jobless claims, industrial production, business inventories, NAHB housing index.

- Friday: New Zealand BusinessNZ manufacturing index; Eurozone trade balance; Canada foreign securities purchases; US housing starts and building permits, U of Michigan sentiments.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 118.04; (P) 118.39; (R1) 118.69; More….

EUR/JPY drops mildly today but stays above 117.67 temporary low. Intraday bias remains neutral for the moment and more consolidations could be seen. But even in case of another recovery, upside should be limited below 120.05 support turned resistance to bring fall resumption. On the downside, break of 117.67 will resume recent fall from 127.50 to 114.84 support next.

In the bigger picture, down trend from 137.49 is still in progress. It’s seen as a falling leg of multi-year sideway pattern. Deeper fall could be seen to 109.48 (2016 low and below). On the upside, break of 127.50 resistance is needed to be the confirm medium term reversal. Otherwise, outlook will remain bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | CHF | Total Sight Deposits CHF (AUG 9) | 582.7B | |||

| 18:00 | USD | Monthly Budget Statement (USD) Jul | -120.0B | -8.5B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals