Market sentiments staged a strong rebound overnight after US Trade Representative announced to delay tariffs on some Chinese imports. However, there seems to be no committed follow through buying/selling yet. DOW hit as high as 26426.97 but closed at 26279.91, up just 1.44%. It’s also technically limited below 55 day EMA at 26500. Asian markets opened generally higher but none of the major indices are up more than 1% . Big miss in Chinese data is also capping return of risk appetite.

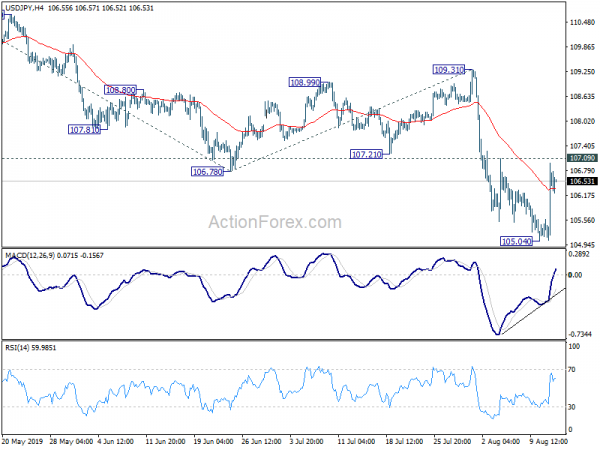

In the currency markets, Yen was sold off sharply overnight but quickly recovers today. USD/JPY, EUR/JPY and GBP/JPY are all limited below near term resistance at 107.09, 119.87 and 130.06 respectively. Thus, there is no confirmation of short term bottoming yet. Also, AUD/USD is held below 0.6822 minor resistance. USD/CAD is held above 1.3177 minor support. These development argues that trade remain generally cautious.

In Asia, Nikkei is up 0.88%. Hong Kong HSI is up 0.54%. China Shanghai SSE is up 0.78%. Singapore Strait Times is up 0.23%. Japan 10-year JGB yield is up 0.010 at -0.224. Overnight, DOW rose 1.44%. S&P 500 rose 1.50%. NASDAQ rose 1.95%. 10-yer yield rose 0.041 to 1.680.

Delay of new tariffs on China cautiously well received

US announcement to delay new tariffs on some Chinese products was well received. Yet, traders remained cautious as it would take more time to see the real implications. The move was generally cheered by industry groups. But some analysts criticized that it’s merely an incremental positive sign. It’s too late and insufficient.

In short, the tariffs on a 21-page list of products would be delayed until December 15, subject to further negotiations between US and China. Both sides are continuing telephone conversations in preparation for a meeting in Washington in September. According to Wells Fargo‘s estimation, the tariff delay involves around 60%, or roughly USD 155B worth of goods. The products range from cellphones, laptops and other consumer goods including baby monitors and strollers, microwaves, instant print cameras, doorbells, high chairs, musical instruments, ketchup dispensers, baby diapers, fireworks, sleeping bags, nativity scenes, fishing reels, paint rollers and food products.

In response to the news, Retail Industry Leaders Association said “removing some products from the list and delaying additional 10% tariffs on other products, such as toys, consumer electronics, apparel and footwear, until Dec. 15 is welcome news as it will mitigate some pain for consumers through the holiday season.”

The Consumer Technology Association also welcomed the the delay on some items, but added: “Next month, we’ll begin to pay more for some of our favorite tech devices – including TVs, smart speakers and desktop computers. The administration should permanently remove these harmful tariffs and find another way to hold China accountable for its unfair trading practices.”

Australia Westpac Consumer Confidence rose 3.6%, superficially a surprise

Australia Westpac Consumer Confidence rose 3.6% to 100 in August, up from 96.5. Westpac said: “Superficially this result comes as somewhat of a surprise given that the survey was conducted against a turbulent backdrop with global financial markets roiled by escalating trade tensions between the US and China, the ASX down 3.4% and the AUD off 3¢ US since the July survey.” However, it’s came in the “aftermath” of the unexpected -4.7% fall in July, despite back-to-back RBA rate cuts. Also, there was political certainty restoration following the May Federal election.

Regarding RBA, Westpac expects the central bank to stand page in September, before delivering another -25bps rate cut in October. Also, there wold be a final -25bps move to take Cash Rate to 0.50% in February. Westpac noted that the “signals from the RBA are quite clear”. And, In its recent Statement on Monetary Policy the RBA lowered its forecasts for inflation, wages and growth, while lifting its forecasts for the unemployment rate. Those forecasts were despite basing them on the technical assumption of adopting market pricing, which anticipates two more rate cuts.

Australia wage price index rose 3.6% qoq, on the back of strong public sector growth

Australia Wage Price Index rose 3.6% qoq in Q2, but couldn’t reverse the -4.1% fall in Q1. Annually, Wage Price Index rose 2.3% yoy comparing to Q2 2018. ABS Chief Economist, Bruce Hockman said: “Wage growth continues at a steady rate in the Australian economy on the back of strong public sector growth over the quarter. The most significant contribution to wage growth this quarter came from the public sector component of the health care and social assistance industry, where a number of large increases were recorded in Victoria under a plan to ensure wage parity with other states.”

China industrial production slowed to 4.8%, lowest in 17 year, other data missed too

In July, industrial production grew merely 4.8% yoy, down from 6.3% yoy and missed expectation of 6.0% yoy. It’s also the slowest growth rate in more than 17 years. Retail sales grew 7.6% yoy, down from 9.8% yoy and missed expectation of 8.6% yoy. Fixed assets investment ex rural grew 5.7% yoy, down from 5.8% yoy and missed expectation of 5.9% yoy. Surveyed unemployment rate rose from 5.1% to 5.3%.

The National Bureau of Statistics of China insisted in a statement that the national economy performed “within the reasonable range” and “sustained generally stable growth while making further progress.” NBS spokesmen Liu Aihua also said the impact of the Sino-U.S. trade war on China’s economy is controllable.

Looking ahead

UK inflation data will be the main focus in European session, with CPI, RPI, PPI and house price index featured. Equally importantly, Germany will release GDP, Eurozone will release GDP, employment and industrial production. Later in the day, US will release import price index.

USD/JPY Daily Outlook

Daily Pivots: (S1) 105.55; (P) 106.26; (R1) 107.46; More…

USD/JPY’s rebound, while strong, is limited below 107.09 minor resistance so far. Initial bias remains neutral for the moment. As long as 107.09 holds, further decline is still in favor. Break of 105.04 will resume larger decline from 112.40 to 104.69 low. Break will target 100% projection of 112.40 to 106.78 from 109.31 at 103.69. On the upside, though, break of 107.09 resistance will indicate short term bottoming. In this case, stronger rebound would be seen back to 55 day EMA (now at 107.94).

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress and the pair is staying well inside long term falling channel. Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. In any case, break of 112.40 is needed to the first serious sign of medium term bullishness. Otherwise, further decline will remain in favor in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machine Orders M/M Jun | 13.90% | -1.00% | -7.80% | |

| 00:30 | AUD | Westpac Consumer Confidence Aug | 3.60% | -4.10% | ||

| 01:30 | AUD | Wage Price Index Q/Q Q2 | 0.60% | 0.50% | 0.50% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Jul | 5.70% | 5.90% | 5.80% | |

| 02:00 | CNY | Industrial Production Y/Y Jul | 4.80% | 6.00% | 6.30% | |

| 02:00 | CNY | Retail Sales Y/Y Jul | 7.60% | 8.60% | 9.80% | |

| 02:00 | CNY | Surveyed Jobless Rate Jul | 5.30% | 5.10% | ||

| 06:00 | EUR | German GDP Q/Q Q2 P | -0.10% | 0.40% | ||

| 08:30 | GBP | CPI M/M Jul | -0.10% | 0.00% | ||

| 08:30 | GBP | CPI Y/Y Jul | 1.90% | 2.00% | ||

| 08:30 | GBP | Core CPI Y/Y Jul | 1.80% | 1.80% | ||

| 08:30 | GBP | RPI M/M Jul | 0.00% | 0.10% | ||

| 08:30 | GBP | RPI Y/Y Jul | 2.80% | 2.90% | ||

| 08:30 | GBP | PPI Input M/M Jul | 0.60% | -1.40% | ||

| 08:30 | GBP | PPI Input Y/Y Jul | 0.30% | -0.30% | ||

| 08:30 | GBP | PPI Output M/M Jul | 0.10% | -0.10% | ||

| 08:30 | GBP | PPI Output Y/Y Jul | 1.70% | 1.60% | ||

| 08:30 | GBP | PPI Output Core M/M Jul | 0.10% | 0.10% | ||

| 08:30 | GBP | PPI Output Core Y/Y Jul | 1.70% | 1.70% | ||

| 08:30 | GBP | House Price Index Y/Y Jun | 1.00% | 1.20% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Jun | -1.40% | 0.90% | ||

| 09:00 | EUR | Eurozone Employment Q/Q Q2 P | 0.30% | 0.30% | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.20% | 0.20% | ||

| 12:30 | USD | Import Price Index M/M Jul | -0.10% | -0.90% | ||

| 14:30 | USD | Crude Oil Inventories | -2.5M | 2.4M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals