Stock market investors may be glad to see August go, but September might not be any better, unless there are some positive developments in the trade war.

Markets enter September, anticipating a Federal Reserve rate cut mid-month and worrying the chilling in the global economy will reach the U.S. There appears to be no progress in the trade war between the U.S. and China, and investors are watching to see if it will begin to hit key data.

The S&P 500 fell about 2% for the month, its worst performance since May. August was a month of rising recession worries and trade headlines moved the market in both directions, starting with the Aug. 1 declaration by President Donald Trump that he would put tariffs on $300 billion in Chinese goods.

“If history repeats itself we could see a selloff in September and then we have some sort of capitulation,” said Samuel Stovall, chief market strategist CFRA. “We’re in the midst of what I call a pullback. The line in the sand is really 2,800. If we break meaningfully through that we could end up having a sharp and swift decline.”

The first week of September includes some important reports, including the August employment report on Friday and the ISM manufacturing survey on Tuesday. The auto industry releases monthly vehicle sales Wednesday. Investors will also be looking for news on whether face-to-face negotiations between U.S. and Chinese officials can take place in September, as expected after the last round of talks.

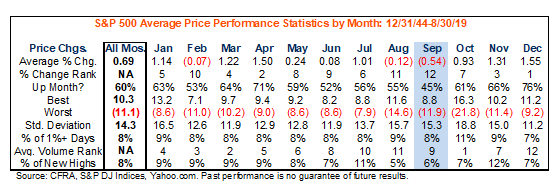

For the stock market, September is historically a worse month than August, in terms of losses. “If you thought August was bad, history says September can be worse because not only is it the month with the largest average decline, but is the only month to fall more frequently than it rises,” said Stovall.

Since World War II, the average move for the S&P for all months is a gain of 0.69%, but the average September move is negative 0.54%. The market has been down 55% of the time in September, making it the worst month of the year, but October, which is up 61% of the time, is a more volatile month with historically steeper losses.

Stock investors will also be watching interest rates, which have been in a steep decline in August. In one month, the 30-year bond has lost 60 basis points, to a level under 2%. The widely watched yield curve, between the 2-year Treasury yield and the 10-year yield inverted. That is a recession warning and means the 10-year yield has gotten lower than the 2-year yield, or investors are demanding more yield for shorter term investments.

Investors will be watching to see how the incoming data affects the bond market and most importantly, the Fed. The Fed meets Sept. 17 and 18, and it is expected to cut rates by a quarter point though some bond strategists say it could cut by a half percentage point if the economy softens or markets are highly volatile.

Next week could provide some clues on future monetary policy with Chairman Jerome Powell set to speak next Friday at 12:30 p.m. ET. Fed Governor Michelle Bowman is also set to speak Wednesday at 12:30 p.m. ET.

“Without offering judgment on Powell’s performance heretofore, investors will be seeking clarity on if 2019 will mirror the 1990s (75 bp of aggregate rate cuts) or if the fallout from the trade war has done more damage to the global economy and therefore warrants even greater accommodation,” said Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, in a note.

Economists expect 155,000 jobs were added in August, down from 164,000 in July, according to Refinitiv. They expect the unemployment rate to hold steady at 3.7% and average hourly earnings to rise by 0.3%.

Luke Tilley, chief economist at Wilmington Trust, said he is watching the ADP private sector payroll report Thursday, ahead of the government’s report Friday, since it includes details on small business hiring. The sector has shown weakness in the ADP data.

“May and June showed declines. That was the only time since 2010 that ADP showed declines for small employers over the course of the recovery. July was really weak too,” he said. Tilley said it’s unclear why that sector of the job market is showing softening, but since it is the first time since the recovery, it bears watching.

Tilley said job growth appears to be at its weakest of the cycle. The government’s Bureau of Labor Statistics recently revised its job data to show 501,000 fewer jobs from March 2018 to March 2019. Tilley said he looked at the adjustment by spreading the reductions over the period, and it shows job growth was reduced by 41,750 in each of those months.

“It means job growth was never as strong in 2018 as we thought, and the slowness is of concern,” he said. “On the other hand, if total wages and total GDP are unchanged, then the slower job growth came with higher average wages and higher productivity than previously thought.”

The strength of the labor market is key, since it’s been helping fuel the consumer, responsible for about two-thirds of the economy.

“If you’re looking for the recovery to keep going, and if you’re looking at this to be pushing it and consumer spending, this would be a red flag,” he said.

Tilley said he is also watching the ISM manufacturing survey, particularly after Markit PMI data, another series of manufacturing data, showed a contraction. ISM is expected at 51.4, up slightly from 51.2 last month. A reading above 50 shows expansion.

Monday

Labor Day holiday

U.S. markets closed

Tuesday

Earnings: Coupa Software

9:45 a.m. Manufacturing PMI

10:00 a.m. ISM Manufacturing

10:00 a.m. Construction spending

Wednesday

Monthly vehicle sales

Earnings: American Eagle Outfitters, Michael Cos, Vera Bradley, Pivotal Software, Slack, Cloudera

8:40 a.m. International Trade

10:00 a.m. QFR Q2

12:30 p.m. Fed Governor Michelle Bowman speaks

2:00 p.m. Beige book

Thursday

Earnings: Ciena, Navistar, Barnes and Noble, John Wiley, Signet Jewelers, Donaldson, Zoom Video, CrowdStrike, Dave and Buster’s, DocuSign

8:15 a.m. ADP employment

8:30 a.m. Initial claims

8:30 a.m. Productivity and costs

9:45 a.m. Services PMI

10:00 a.m. ISM nonmanufacturing

10:00 a.m. Factory orders

Friday

8:30 a.m. Employment

10:00 a.m. QSS Q2

12:30 p.m. Fed Chairman Jerome Powell speaks

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals