FOMO – Fear of Missing Out – is a relatively recent addition to the English language, but one that is intrinsic to our day-to-day lives. A true phenomenon of the modern digital age, FOMO affects 69% of millennials, but it can also have a significant bearing upon trading practices.

For instance, the feeling of missing out could lead to the entering of trades without enough thought, or to closing trades at inopportune moments because it’s what others seem to be doing. It can even cause traders to risk too much capital due to a lack of research, or the need to follow the herd. For some, the sense of FOMO created by seeing others succeed is only heightened by fast-paced markets and volatility; it feels like there is a lot to miss out on.

To help traders better understand the concept of FOMO in trading and why it happens, this article will identify potential triggers and how they can affect a day trader’s success. It will cover key examples and what a typical day trade looks like when it is driven by FOMO. There are various tips on how to overcome the fear, and the other emotions which can affect consistency in trading – one of the most important traits of successful traders.

Main Talking Points:

- What is FOMO in trading?

- What characterizes a FOMO Trader?

- Factors that can Trigger FOMO

- FOMO Trading vs Disciplined Trading: The Cycle

- DailyFX analysts share their FOMO experiences

- Tips to overcome FOMO

What is FOMO in Trading?

FOMO in trading is the Fear of Missing Out on a big opportunity in the markets and is a common issue many traders will experience during their careers. FOMO can affect everyone, from new traders with retail accounts through to professional forex traders.

In the modern age of social media, which gives us unprecedented access to the lives of others, FOMO is a common phenomenon. It stems from the feeling that other traders are more successful, and it can cause overly high expectations, a lack of long-term perspective, overconfidence/too little confidence and an unwillingness to wait.

Emotions are often a key driving force behind FOMO. If left unchecked, they can lead traders to neglect trading plans and exceed comfortable levels of risk.

Common emotions in trading that can feed into FOMO include:

- Greed

- Fear

- Excitement

- Jealousy

- Impatience

- Anxiety

The psychology of trading is a key theme covered in our webinars, where our analysts share expert tips to keep emotions in check, maintain consistency and maximze trading success. Sign up to a webinar with our analyst, Paul Robinson, where he discusses FOMO and the psychology of trading in depth.

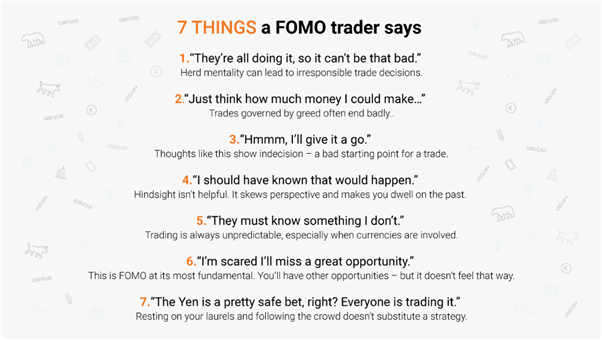

What Characterises a FOMO Trader?

Traders who act on FOMO will likely share similar traits and be driven by a particular set of assumptions. Below is a list of the top things a FOMO trader might say, which sheds light on the emotions that can affect trading:

Become a better trader with our analyst Paul Robinson – learn to overcome the FOMO and trade more successfully.

What Factors Can Trigger FOMO Trading?

FOMO is an internal feeling, but one that can be caused by a range of situations. Some of the external factors that could lead to a trader experiencing FOMO are:

- Volatile markets. FOMO isn’t limited to bullish markets where people want to hop on a trend – it can creep into our psyche when there is market movement in any direction. No trader wants to miss out on a good opportunity.

- Big winning streaks. Buoyed up by recent wins, it is easy to spot new opportunities and get caught up in them. And it’s fine, because everyone else is doing it, right? Unfortunately, winning streaks don’t last forever.

- Repetitive losses. Traders can end up in a vicious cycle: entering a position, getting scared, closing out, then re-entering another trade as anxiety and disappointment arise about not holding out. This can eventually lead to bigger losses.

- News and rumors. Hearing a rumor circulating can heighten the feeling of being left out –traders might feel like they’re out of the loop.

- Social media, especially financial Twitter (#FinTwit). The mix of social media and trading can be toxic when it looks like everyone is winning trades. It’s important not to take social media content at face value, and to take the time to research influencers and evaluate posts. We recommend using the FinTwit hashtag for inspiration, not as a definitive planning tool.

As well as affecting traders on an individual level, FOMO can have a direct bearing on the markets. Moving markets might be emotionally driven – traders look for opportunities and seek out entry points as they perceive a new trend to be forming.

This chart uses the S&P 500 index as an example of how markets can move due to mass trader sentiment. Steady bullish markets can quickly spike when people begin jumping on the bandwagon, for fear of missing out. They can crash too, as seen here directly after the sharp rise. People who entered a long position late would have lost money, which is the worst-case scenario in FOMO trading.

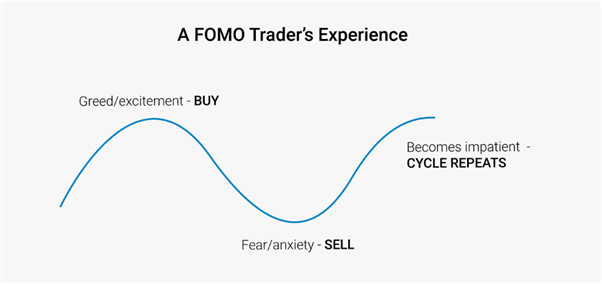

FOMO Trading vs Disciplined Trading: The Cycle

As explored above, the process of placing a trade can be very different depending on the situation in hand and the factors that are driving a trader’s decisions. Here is the journey of a FOMO trader vs a disciplined trader – as you will see, there are some fundamental differences that can lead to very different outcomes.

DailyFX Analysts Share their FOMO Advice

Traders of all levels of experience have dealt with FOMO, including our DailyFX analysts. Here are some simple pointers from the team:

“Trade according to your strategy, not your feelings” – Peter Hanks, Junior Analyst

“Strategize. Execute. Stick to the plan and don’t be greedy. All types of traders make money; pigs get slaughtered” – Christopher Vecchio, Senior Strategist

“Trade decisions are not binary, long vs. short. Sometimes doing nothing is the best trade you can make” – IIya Spivak, Senior Currency Strategist

“It is tempting to take others’ tales of trading success at face value. Don’t chase others into a trade on curated testimonials” – John Kicklighter, Chief Strategist

“No one trade should make or break you. With that said, if you miss an opportunity there is always another one around the corner” – Paul Robinson, Currency Strategist

Can you relate to our analysts’ tips? Leave a comment below, or tweet us: @DailyFX

Tips to Overcome FOMO

Overcoming FOMO begins with greater self-awareness, and understanding the importance of discipline and risk management in trading. While there is no simple solution to preventing emotions from impacting trades and stopping FOMO in its tracks, there are various techniques that can help traders make informed decisions and trade more effectively.

Here are some tips and reminders to help manage the fear factor:

- There will always be another trade. Trading opportunities are like buses – another one will always come along. This might not be immediate, but the right opportunities are worth the wait.

- Everyone is in the same position. Recognizing this is a breakthrough moment for many traders, making the FOMO less intense. Join a DailyFX webinar and share experiences with other traders – this can be a useful first step in understanding and improving trading psychology.

- Stick to a trading plan. Every trader should know their strategy, create a trading plan, then stick to it. This is the way to achieve long-term success

- Taking the emotion out of trading is key. Learn to put emotions aside – a trading plan will help with this, improving trading confidence.

- Traders should only ever use capital they can afford to lose. They can also use a stop to minimise losses if the market moves unexpectedly.

- Knowing the markets is essential. Traders should conduct their own analysis and use this to inform trades, taking all information on board to be aware of every possible outcome.

- FOMO isn’t easily forgotten, but it can be controlled. The right strategies and approaches ensure traders can rise above FOMO.

- Keeping a trading journal helps with planning. It’s no coincidence that the most successful traders use a journal, drawing on personal experience to help them plan.

Overcoming FOMO doesn’t happen overnight; it’s an ongoing process. This article has provided a good starting point, highlighting the importance of trading psychology and managing emotions to prevent FOMO from affecting decisions when placing a trade.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals