Canadian recovers notably today following the strong rally in oil prices, after attack on Saudi Arabia’s oil production. Yen follows as the second strongest on mild risk aversion, as sentiments are also weighed down by poor Chinese data. On the other hand, Sterling is the paring some of last week’s rebound, awaiting meeting between UK Prime Minister Boris Johnson and EU President Jean-Claude Juncker. Australian Dollar is the second weakest, then Dollar.

Technically, while cross crosses trade generally lower today, there is not confirmed sign of completion of recent rebound yet. Focuses will be on 107.19 minor support in USD/JPY, 117.55 minor support in EUR/JPY and 132.17 minor support in GBP/JPY. GBP/USD has just hit 1.2502 and might retreats mildly. But further rise will remain in favor as long as 1.2283 minor support holds. Also, despite today’s retreat, further rise will remain in favor in USD/CAD as long as 1.3177 minor support holds, for 1.3382 resistance.

In Asia, Japan is on holiday today. Hong Kong HSI is down -1.08%. China Shanghai SSE is down -0.16%. Singapore Strait Times is down -0.06%.

Oil prices jump after largest production disruption in history

Oil prices surge sharply in response to drone attacks on Saudi Arabia’s oil production on Saturday. State energy producer Saudi Aramco lost about 5.7 million bps of output, which is the largest oil disruptions in history. That’s followed by 5.6m bpd loss in Iranian resolution in late 70s.

Saudi Arabia would need weeks to restore full output capacity even though some halted oil production would be restarted within days. Some noted that the attack highlighted the vulnerability of the infrastructure to attack. Also the tensions have intensified as US President Donald Trump said the US is “locked and loaded depending on verification” that Iran staged the attack.

Chinese Premier Li said very difficult to grow at 6%, data showed deepened slowdown

Chinese Premier Li Keqiang warned that the economy is facing “certain downward pressure” due to global slowdown and rise of protectionism. And, it’s “very difficult” for GDP to grow at 6% rate or higher. He said “for China to maintain growth of 6% or more is very difficult against the current backdrop of a complicated international situation and a relatively high base, and this rate is at the forefront of the world’s leading economies.”

A batch of August data released today showed deepened slowdown in China’s economy. Industrial production growth slowed to 4.4% yoy in August, down from 4.8% yoy and missed expectation of 5.2% yoy. That’s the slowest pace since February 2002. Retail sales growth slowed to 7.5% yoy, down from 7.6% yoy and missed expectation of 8.0% yoy. Fixed assets investments grew 5.5% ytd yoy, below expectation of 5.7% ytd yoy. Surveyed unemployment rate, though, dropped from 5.3% to 5.2%.

UK Johnson to seek Brexit progress in the next few days

UK Prime Minister Boris Johnson will travel to Luxembourg today, to meet outgoing European Commission President Jean-Claude Juncker. Ahead of that, he wrote in the Daily Telegraph that “if we can make enough progress in the next few days, I intend to go to that crucial summit on Oct. 17, and finalize an agreement” for Brexit.

He also criticized the parliament for hampering his negotiation, by approving that law that forces him to seek another delay. He said, “Its effect is completely contrary to the UK’s interests – because it has at least given the impression to our partners that the UK is no longer either fully able or determined to leave on Oct 31.”

Separately, BusinessEurope Director General Markus Beyrer warned that “No deal is a recipe for disaster and should be definitely ruled out. A disorderly, no deal exit of the UK would be extremely harmful for all sides. It would cause massive damage for citizens and businesses in the UK and on the continent alike… The negative consequences would not be limited to the exit date but would drag on, endangering the fruitful and positive future relationship we all aim for.”

Fed rate cut as main event of the week

Four central banks will meet this week Fed, BoJ, SNB and BoE. Fed is undoubtedly the major focus. Markets are still expecting another -25bps cut to 1.75-2.00%, but pricing is no longer 100%. Chair Jerome Powell will likely stick to his scripts that Fed is only doing some “mid-cycle” adjustments”. The main question is whether such adjustment is done after this week’s cut. Powell’s comment and the new economic projections will be watched for such clue. The other three central banks should stand pat and we’re not expecting anything drastic there. RBA will also release meeting minutes.

Here are some highlights for the week:

- Monday: Canada foreign securities purchases; US Empire state manufacturing index.

- Tuesday: RBA minutes, house price index; German ZEW; Canada manufacturing sales; US industrial production, NAHB house price index.

- Wednesday: Japan trade balance; UK CPI, RPI, house price index; Eurozone CPI final; Canada CPI; US building permits, housing starts, FOMC rate decision.

- Thursday: New Zealand GDP; Australia employment; BoJ rate decision, all industry index; Swiss trade balance, SNB rate decision; Eurozone current account; BoE rate decision; US Philly Fed survey, current account, jobless claims, existing home sales.

- Friday: Japan CPI; German PPI; Canada retail sales

USD/CAD Daily Outlook

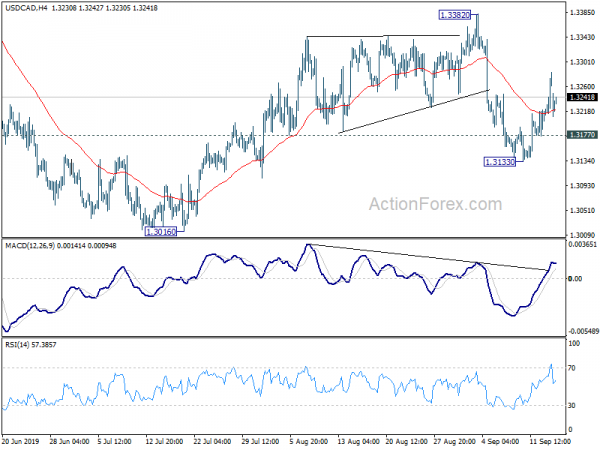

Daily Pivots: (S1) 1.3233; (P) 1.3260; (R1) 1.3314; More…

USD/CAD retreats notably today but with 1.3177 minor support intact, intraday bias remains mildly on the upside. Pull back from 1.3382 should have completed at 1.3133. Rebound from 1.3016 is possibly resuming. Further rise would be seen to 1.3382 resistance first. Break will confirm this bullish case and target 1.3564 resistance next. However, break of 1.3177 will dampen this week and turn bias back to the downside for 1.3016 low.

In the bigger picture, key cluster support of 1.3068 (38.2% retracement of 1.2061 to 1.3664 at 1.3052) remains intact. Medium term rise from 1.2061 low is in favor to resume sooner or later. Firm break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will confirm and target 1.4689 high. However, sustained break of 1.3052/68 will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Sep | -0.20% | -1.00% | ||

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Aug | 5.50% | 5.70% | 5.70% | |

| 2:00 | CNY | Industrial Production Y/Y Aug | 4.40% | 5.20% | 4.80% | |

| 2:00 | CNY | Retail Sales Y/Y Aug | 7.50% | 8.00% | 7.60% | |

| 2:00 | CNY | Surveyed Jobless Rate Aug | 5.20% | 5.30% | ||

| 12:30 | CAD | International Securities Transactions (CAD) Jul | -3.98b | |||

| 12:30 | USD | Empire State Manufacturing Sep | 4 | 4.8 | ||

| 13:00 | CAD | Existing Home Sales M/M Aug | 3.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals