Commodity currencies are generally softer today, as led by New Zealand Dollar. Euro also turned softer despite slightly better than expected German ZEW economic sentiment. US-China trade deal appears to be in question again, but reactions are so far mild. On the other hand, Sterling appears to be slightly strong despite weaker than expected job data. UK and EU appear to be working hard on a deal before October 31 to avert no-deal Brexit. Yen is currently the second strongest.

Technically, major pairs and crosses are staying in consolidation for now. GBP/USD is looking at 1.2707 temporary top and break will resume recent strong rise to 1.2819 projection level. GBP/JPY is also looking at 137.88 temporary top. Break will resume recent rise too, towards 140.33 fibonacci level.

In Europe, currently, FTSE is down -0.30%. DAX is up 0.40%. CAC is up 0.49%. German 10-year yield is down -0.010 at -0.464. Earlier in Asia, Nikkei rose 1.87%. Hong Kong HSI dropped -0.07%. China Shanghai SSE dropped -0.56%. Singapore Strait Times dropped -0.27%. Japan 10-year JGB yield rose 0.0079 at -0.171.

China said to tie US farm purchases to tariff removal

Uncertainties regarding the so-called phase 1 US-China trade deal surfaced today. According to a Bloomberg, China’s purchases of US farm products wouldn’t hit the USD 40B to USD 50B level as touted by Trump under the current term. To achieve the figure, China would need to remove some of its retaliatory tariffs. And with that in mind, China would request same reciprocal action by Trump. As we noted before, the phase 1 trade deal remains highly unsure, at least until both sides have put the agreement into texts.

Earlier today, Chinese Foreign Ministry Geng Shuang confirmed that China has bought 320,000 tonnes of cotton, 230,000 tonnes of wheat and 20 million tonnes of soybeans from the U.S. However, it’s also noted by analysts that not all orders would be delivered to China this year. And there are risks that some of the orders could be cancelled if trade tension intensifies again.

Bullard: Fed may decide to provide additional accommodation, on meeting-by-meeting basis

In a prepared speech at a London Conference, St. Louis Fed President James Bullard warned “a sharper-than-expected slowdown could materialize in the quarters ahead.” “Trade policy uncertainty creates a disincentive for global investment. Accordingly, the global growth environment looks weaker in recent quarters,” he said, adding, “Slower global growth may feed back into slower growth in the U.S.”

And, that “may make it more difficult for the Federal Open Market Committee (FOMC) to achieve its 2% inflation target.” He added “the FOMC may choose to provide additional accommodation going forward, but decisions will be made on a meeting-by-meeting basis”.

EU Barnier and UK Barclay said a Brexit deal this week still possible

EU chief Brexit negotiator Michel Barnier said, on arriving in Luxembourg for EU summit, that “even if an agreement (Brexit) has been difficult, more and more difficult, it’s still possible this week.” He added, “Reaching an agreement is still possible. Obviously, any agreement must work for all. The whole of the UK and the whole of the EU. Let me add also that it is high time to turn good intentions in a legal text.”

UK Brexit Minister Stephen Barclay said, “I am looking forward to … an opportunity to discuss these issues with my EU counterparts… The talks are ongoing we need to give them space to proceed. Detailed conversation are underway and a deal is still very possible.”

UK unemployment rate edged higher to 3.9%, wage growth slowed

UK unemployment rate rose to 3.9% in the three month to August, up from 3.8% and above expectation of 3.8%. That figure was slightly lower than 4.0% a year ago. Unemployment rate for men came at 4.0% while unemployment rate for women was at 3.7%. Average weekly earnings (including bonus) growth slowed to 3.8%, down from 3.9% and missed expectation of 3.9%. Average earnings (excluding bonus) growth also slowed to 3.8%, down from 3.9% but beat expectation of 3.7%.

German ZEW dropped to -22.8, US-China trade settlement doesn’t diminish economic scepticism

German ZEW Economic Sentiment dropped to -22.8 in October, down from -22.5 and beat expectation of -27.0. Current Situation Index, however, dropped to -25.3, down from -19.9, below expectation of -25.5. Eurozone ZEW Economic Sentiment dropped to -23.5, down from -22.4, better than expectation of -26.7. Eurozone Current Situation also dropped sharply by -10.8 to -26.4.

“The slight decrease in both the ZEW Indicator of Economic Sentiment and the situation indicator shows that financial market experts continue to expect a further deterioration of the German economy. The recent settlement in the trade dispute between the USA and China does not seem to diminish economic scepticism at this stage,” comments ZEW President Professor Achim Wambach.

BoJ: Domestic demand on uptrend, upgrade Hokkaido assessment

In its Regional Economic Report, BoJ, upgraded assessment on Hokkaido and described the economy as “expanding moderately”, instead of “recovering moderately. Assessment on other eight regions were kept unchanged, as recovering, expanding, or expanding moderately.

BoJ also said that “domestic demand had continued on an uptrend, with a virtuous cycle from income to spending operating in both the corporate and household sectors, although exports, production, and business sentiment had been affected by the slowdown in overseas economies.”

RBA minutes suggest no hurry for another rate cut despite easing bias

The minutes for October RBA meeting were clearly dovish. There, the central bank cut benchmark interest rate by -25bps to new historical low of 0.75%. Most importantly, RBA said, , “the Board would continue to monitor developments, including in the labour market, and was prepared to ease monetary policy further, if needed.”

Yet, the minutes revealed detailed arguments in favor of keeping the policy rate unchanged. But in the end, these factors ” did not outweigh the case for a further easing” at the meeting. Lower rates would help “reduce spare capacity”, and provide “greater confidence” that inflation would meet target. Additionally, RBA noted “the trend to lower interest rates globally”, and the effect on the economy and inflation outcomes.

Overall, another rate cut is still likely subject to the developments in employment and inflation. But the minutes suggested that RBA is more likely to stand pat for the rest of the year, for the effect of this year’s three rate cuts to play out.

Suggested readings:

Strong Inflation Could Affect PBOC’s Policy to Stimulate Growth

Headline CPI in China rose to 3% y/y in September, reaching PBOC’s target for first time since December 2013. However, this was driven by elevated pork price rather than improvement in household spending. Food price jumped 11.2%, accelerating from 10% in August. This was predominantly driven by pork price which soared 69.3% y/y in September. This is compared with a 46.7% increase in the prior month. Non-food CPI added only 1%, easing from 1.1% in August. Core CPI, excluding food and energy, steadied at 1.5% . PPI contracted to -1.2% y/y in September. Upstream deflation deepened as trade war continues. More in this report.

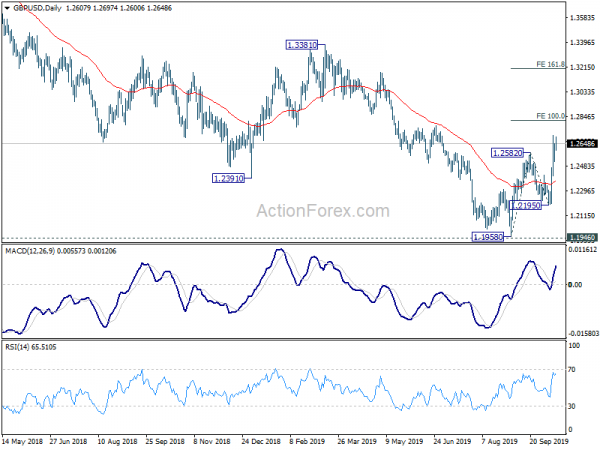

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2527; (P) 1.2589; (R1) 1.2661; More….

GBP/USD is staying in consolidation from 1.2707 temporary top and intraday bias remains neutral. Another retreat cannot be ruled out. But downside should be contained well above 1.2195 support to bring another rally. On the upside, break of 1.2707 will resume the rise from 1.1958 low to 100% projection of 1.1958 to 1.2582 from 1.2195 at 1.2819. Break will target 161.8% projection at 1.3205.

In the bigger picture, current development affirms the case of medium term bottoming at 1.1958, ahead of 1.1946 (2016 low). At this point, rise from 1.1958 is seen as the third leg of consolidation from 1.1946. Further rise would be seen back towards 1.4376 resistance. For now, this will remain the favored case as long as 1.2195 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 01:30 | CNY | CPI Y/Y Sep | 3.00% | 2.90% | 2.80% | |

| 01:30 | CNY | PPI Y/Y Sep | -1.20% | -1.20% | -0.80% | |

| 04:30 | JPY | Tertiary Industry Index M/M Aug | 0.40% | 0.60% | 0.10% | |

| 04:30 | JPY | Industrial Production M/M Aug F | -1.20% | -1.20% | -1.20% | |

| 06:30 | CHF | Producer and Import Prices M/M Sep | -0.30% | -0.10% | -0.20% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Sep | -2.00% | -2.00% | -1.90% | |

| 08:30 | GBP | Claimant Count Change Sep | 21.1K | 21.3K | 28.2K | 16.3K |

| 08:30 | GBP | Claimant Count Rate Sep | 3.30% | 3.30% | ||

| 08:30 | GBP | ILO Unemployment Rate 3M Aug | 3.90% | 3.80% | 3.80% | |

| 08:30 | GBP | Average Earnings Including Bonus 3M/Y Aug | 3.80% | 3.90% | 4.00% | 3.90% |

| 08:30 | GBP | Average Earnings Excluding Bonus 3M/Y Aug | 3.80% | 3.70% | 3.80% | 3.90% |

| 09:00 | EUR | Germany ZEW Economic Sentiment Oct | -22.8 | -27 | -22.5 | |

| 09:00 | EUR | Germany ZEW Current Situation Oct | -25.3 | -25.5 | -19.9 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Oct | -23.5 | -26.7 | -22.4 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals