Sterling is attempting to resume recent rally even though there is no clear break through in Brexit negotiations yet. European Council President Donald Tusk said it may take another seven to eight hours before knowing when Brexit may happen. As news and rumors come in, we may seen more commitment from Pound traders. Meanwhile, Dollar shrugs off rather poor retail sales data and trades mixed. Yen continues to pare back some of this week’s losses. Commodity currencies remain the worst performing ones.

Technically, intraday bias in Sterling remains on the upside as long as these levels holds: 1.2655 minor support in GBP/USD, 137.51 minor support tin GBP/JPY, and 0.8716 minor resistance in EUR/GBP. Traders might want to tighten up their stops ahead of any Brexit announcements. AUD/USD continues to spiral downward towards 0.6710 minor support. Break will be the first sign of down trend resumption and target 0.6670 low.

In Europe, currently, FTSE is down -0.40%. DAX is up 0.33%. CAC is down -0.11%. German 10-year yield is up 0.031 at -0.384. Earlier in Asia, Nikkei rose 1.20%. Hong Kong HSI is up 0.61%. China Shanghai SSE dropped -0.41%. Singapore Strait Times is up 0.59%. Japan 10-year JGB yield rose 0.0111 to -0.160.

US retail sales dropped -0.3%, first contraction in seven months

US retail sales dropped -0.3% mom in September, much worse than expectation of 0.3% mom rise. That’s also the first decline in seven months since February. Ex-auto sales dropped -0.1% mom, also worse than expectation of 0.2% mom. Annually, retail sales rose 0.4% yoy over September 2018. Total sales for the July 2019 through September 2019 period were up 4.0% from the same period a year ago.

Canada CPI unchanged at 1.9%, but core CPI accelerated

Canada headline CPI dropped -0.4% mom in September, much worse than expectation of 0.0%. Annually, CPI was unchanged at 1.9% yoy, below expectation of 2.0% yoy. However, CPI core common rose to 1.9% yoy, up from 1.8% yoy and beat expectation of 1.8% yoy. CPI core median rose to 2.2% yoy, up from 2.1% yoy and beat expectation of 2.1% yoy. CPI core trimmed also rose to 2.1% yoy, up from 2.0% yoy, matched expectations.

Brexit negotiations still ongoing, Varadkar hopes to complete today

UK Prime Minister Boris Johnson’s spokesman said Brexit negotiations with EU were still ongoing with issues to be resolved. At the same time, discussions also continued with Conservative and Northern Ireland’s DUP MPs.

Irish Prime Minister Leo Varadkar also said that “we are making progress but there are issues yet to be resolved and hopefully that can be done today.” “But if it’s not, there is still more time. October 31 is still a few weeks away and there is the possibility of an additional summit before that if we need one”.

EU chief Brexit negotiator delayed the briefing to EU leaders to 1500GMT today, from 1200GMT.

UK CPI unchanged at 1.7%, core CPI rose to 1.7%

UK CPI was unchanged at 1.7% yoy in September, missed expectation of 1.8% yoy. Core CPI, on the other hand, accelerated to 1.7% yoy, up from 1.5% yoy, matched expectations. RPI, however, slowed to 2.4% yoy, down from 2.6% yoy and missed expectation of 2.7% yoy.

Also from UK, PPI input dropped to -2.8% yoy, down from -0.9% yoy and missed expectation of -1.8% yoy. PPI output dropped to 1.2% yoy, down from 1.6% yoy and missed expectation of 1.3% yoy. PPI output core dropped to 1.7% yoy, down from 2.0% yoy, missed expectation of 1.9% yoy.

Eurozone CPI finalized at 0.8%, core CPI at 1.0%

Eurozone CPI was finalized at 0.8% yoy in September, down form 1.0% yoy in August. Core CPI was finalized at 1.0% yoy, up from 0.9% yoy. The highest contribution to the annual euro area inflation rate came from services (0.66%), followed by food, alcohol & tobacco (0.29%), non-energy industrial goods (0.06%) and energy (-0.18 %).

EU28 CPI was finalized at 1.2% yoy, down from 1.4% yoy in August. The lowest annual rates were registered in Cyprus (-0.5%), Portugal (-0.3%), Greece, Spain and Italy (all 0.2%). The highest annual rates were recorded in Romania (3.5%), Slovakia (3.0%) and Hungary (2.9%). Compared with August, annual inflation fell in twenty Member States, remained stable in five and rose in two.

New Zealand CPI slowed to 1.5%, RBNZ expected to cut further

New Zealand CPI rose 0.7% qoq in Q3, above expectation of 0.6% qoq. Annually, CPI slowed to 1.5% yoy, down from 1.7% yoy, but beat expectation of 1.4% yoy. The trimmed-mean measures – which exclude extreme price movements – ranged from 1.7% to 1.8% for the year. This indicates that underlying inflation is higher than the 1.5% overall increase in the CPI. On a quarterly basis, trimmed means ranged from 0.5% to 0.6%.

Separately, RBNZ Deputy Governor Geoff Bascand said in a speech that New Zealand remains vulnerable to external shocks. And, “lower rates still may be needed to achieve our inflation and maximum sustainable employment objectives”. He added that there is reasonable prospect for the cash rate to go lower.

Despite slightly stronger than expected inflation data, RBNZ is still generally expected to cut interest rate further from the current 1.00% level. The need for another shocking -50bps cut, like the one in August, is less likely though. The central bank is now expected to cut another -25bps in November, and probably another -25bps in February.

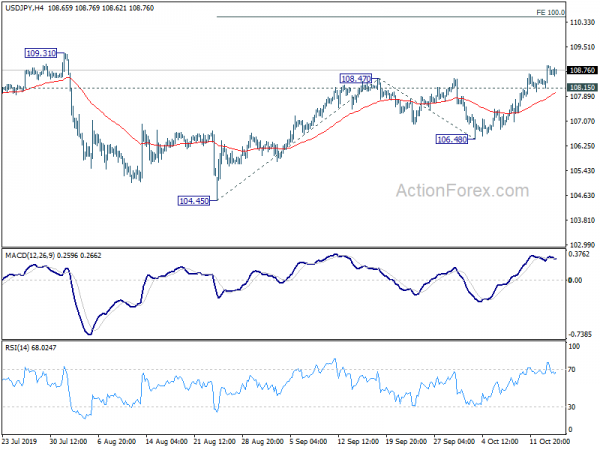

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 108.38; (P) 108.64; (R1) 109.12; More…

Intraday bias in USD/JPY remains on the upside for 109.31 key resistance. Decisive break there will carry larger bullish implications next target will be 100% projection of 104.45 to 108.47 from 106.48 at 110.50. On the downside, below 108.15 minor support will turn intraday bias neutral first. But outlook will stay bullish as long as 106.48 support holds.

In the bigger picture,strong support was seen from 104.62 again. Yet, there is not confirmation of medium term reversal. Corrective decline from 118.65 (Dec. 2016) could still extend lower. But in that case, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. Meanwhile, on the upside, break of 112.40 key resistance will be a strong sign of start of medium term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q3 | 0.70% | 0.60% | 0.60% | |

| 21:45 | NZD | CPI Y/Y Q3 | 1.50% | 1.40% | 1.70% | |

| 23:30 | AUD | Westpac Leading Index M/M Sep | -0.08% | -0.28% | ||

| 08:30 | GBP | DCLG House Price Index Y/Y Aug | 1.30% | 1.20% | 0.70% | 0.80% |

| 08:30 | GBP | CPI M/M Sep | 0.10% | 0.20% | 0.40% | |

| 08:30 | GBP | CPI Y/Y Sep | 1.70% | 1.80% | 1.70% | |

| 08:30 | GBP | Core CPI Y/Y Sep | 1.70% | 1.70% | 1.50% | |

| 08:30 | GBP | RPI M/M Sep | -0.20% | -0.10% | 0.80% | |

| 08:30 | GBP | RPI Y/Y Sep | 2.40% | 2.70% | 2.60% | |

| 08:30 | GBP | PPI – Input M/M Sep | -0.80% | 0.30% | -0.10% | -0.30% |

| 08:30 | GBP | PPI – Input Y/Y Sep | -2.80% | -1.80% | -0.80% | -0.90% |

| 08:30 | GBP | PPI – Output Y/Y Sep | 1.20% | 1.30% | 1.60% | |

| 08:30 | GBP | PPI – Output M/M Sep | -0.10% | 0.10% | -0.10% | 0.00% |

| 08:30 | GBP | PPI – Core Output M/M Sep | -0.10% | 0.10% | 0.20% | |

| 08:30 | GBP | PPI – Core Output Y/Y Sep | 1.70% | 1.90% | 2.00% | |

| 09:00 | EUR | Trade Balance (EUR) Aug | 20.3B | 18.6B | 19.0B | 17.5B |

| 09:00 | EUR | CPI M/M Sep F | 0.20% | 0.20% | 0.10% | |

| 09:00 | EUR | CPI Y/Y Sep F | 0.80% | 0.90% | 0.90% | 1.00% |

| 09:00 | EUR | CPI – Core Y/Y Sep F | 1.00% | 1.00% | 1.00% | 0.90% |

| 12:30 | USD | Retail Sales M/M Sep | -0.30% | 0.30% | 0.40% | 0.60% |

| 12:30 | USD | Retail Sales ex Autos M/M Sep | -0.10% | 0.20% | 0.00% | 0.20% |

| 12:30 | CAD | CPI M/M Sep | -0.40% | 0.00% | -0.10% | |

| 12:30 | CAD | CPI Y/Y Sep | 1.90% | 2.00% | 1.90% | |

| 12:30 | CAD | CPI Core – Common Y/Y | 1.90% | 1.80% | 1.80% | |

| 12:30 | CAD | CPI Core – Median Y/Y | 2.20% | 2.10% | 2.10% | |

| 12:30 | CAD | CPI Core – Trimmed Y/Y | 2.10% | 2.10% | 2.10% | 2.00% |

| 14:00 | USD | Business Inventories Aug | 0.30% | 0.40% | ||

| 14:00 | USD | NAHB Housing Market Index Oct | 68 | 68 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals