Dollar continues to trade mixed in early US session. Negative effect of ADP job data is more than offset by stronger than expected Q3 GDP growth. The greenback will now look into FOMC rate decision for guidance. The key is whether Fed will signal the end of mid-cycle adjustment after today’s rate cut. Before that, Canadian Dollar will look into BoC rate decision due within an hour.

For the week so far, Yen is the weakest one, followed by Canadian and then New Zealand Dollar. Australian Dollar is the strongest, followed by Sterling. Technically, though, AUD/USD is staying below 0.6894 resistance and near term outlook remains bearish. AUD/JPY breached 74.82 resistance to 74.84 but cannot sustain above there yet. We’re not totally convinced by Aussie’s strength for now.

In Europe, currently, FTSe is up 0.03%. DAX is down -0.23%. CAC is up 0.23%. German 10-year yield is down -0.014 at -0.363. Earlier in Asia, Nikkei dropped -0.57%. Hong Kong HSI dropped -0.44%. China Shanghai SSE dropped -0.50%. Singapore Strait Times rose 0.34%. Japan 10-year yield dropped -0.0098 to -0.119.

Here are some suggested readings on Fed and BoC:

US GDP grew 1.9% annualized in Q3, above expectation of 1.6%

US GDP grew 1.9% annualized rate in Q3, just slightly down from Q2’s 2.0%, and beat expectation of 1.6%. Headline PCE slowed to 1.5% qoq, down form 2.4% qoq, and missed expectation of 2.0% qoq. But Core PCE accelerated to 2.2% qoq, up from 1.9% qoq, and beat expectation of 2.1% qoq.

Looking at some details, GDP growth reflected positive contributions from personal consumption expenditures (PCE), federal government spending, residential fixed investment, state and local government spending, and exports. The were partly offset by negative contribution from nonresidential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

US ADP jobs grew 125k, slowdown most pronounced at manufacturers and small companies

US ADP report showed private sector employment grew 125k in October, slightly below expectation of 132k. Prior month’s figure was revised sharply down from 135k to 93k. Looking at the details, small business jobs added 17k, medium business 64k, large business 44k. By sector, goods-producing jobs dropped -13k while service-providing jobs rose 138k.

“While job growth continues to soften, there are certain segments of the labor market that remain strong,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The goods producing sector showed weakness; however, the healthcare industry and midsized companies had solid gains.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth has throttled way back over the past year. The job slowdown is most pronounced at manufacturers and small companies. If hiring weakens any further, unemployment will begin to rise.”

Eurozone economic sentiment dropped to 100.8, missed expectations

Eurozone Economic Sentiment Indicator dropped to 100.8 in October, down from 101.7, and missed expectation of 101.1. Industrial confidence dropped to -9.5, down form -8.9, missed expectation of -8.9. Services confidence dropped to 9.0, down from 9.5, matched expectation. Consumer confidence was finalized at -7.6.

Looking at the member statements, the ESI remained broadly unchanged in Germany (-0.2), France (-0.1), Italy (+0.1) and the Netherlands (+0.2), while it saw another significant decrease in Spain (-3.0).

Eurozone Business Climate improved to -0.19, up from -0.23, and beat expectation of -0.21.

France GDP grew 0.3% in Q3, household consumption accelerated

France GDP grew 0.3% qoq in Q3, unchanged from Q2’s rate, and beat expectation of 0.2% qoq. Looking at some details, household consumption expenditures accelerated slightly (0.3% after 0.2%), while total gross fixed capital formation decelerated (GFCF: 0.9% after 1.2%). Overall, final domestic demand excluding inventory changes remained dynamic and grew at the same pace as the previous quarter: it contributed 0.5 points to GDP growth.

Swiss KOF rose to 94.7, but stays below long term average

Swiss KOF Economic Barometer rose to 94.7 in October, up from 93.2, and beat expectation of 94.2. The index halted its downward movement, “at least for the time being”, but it’s still well below its long term average.

KOF said the increase is “attributable in particular to bundles of indicators from the banking and insurance sector as well as from accommodation and food service activities”. Also, “indicators regarding foreign demand and other services are pointing in a slightly less negative direction”. But “indicators from the manufacturing sector record a slight decline.”

Australia CPI slowed to 0.5% qoq in Q3, inflation remains subdued

Australia CPI slowed to 0.5% qoq in Q3, down from Q2’s 0.6% qoq, but matched expectations. Annually, CPI rose to 1.7% yoy, up fro 1.6% yoy and matched expectations. RBA trimmed mean CPI rose 0.4% qoq, 1.6% yoy, matched expectations.

ABS Chief Economist, Bruce Hockman said: “Annual inflation remains subdued partly due to price rises for housing related expenses remaining low, and in some cases falling in annual terms. Prices for utilities (-0.3 per cent) and new dwelling purchase by owner-occupiers (-0.1 per cent) both fell slightly through the year to the September 2019 quarter, while rents (0.4 per cent) recorded only a small rise”.

Westpac said that there was some AUD depreciation pass-through to inflation but there is no broader impact of wider inflationary pulse. There is little pressure on the RBA to cut again this year. And Westpac maintains the forecast of another cut in February 2020.

USD/JPY Mid-Day Outlook

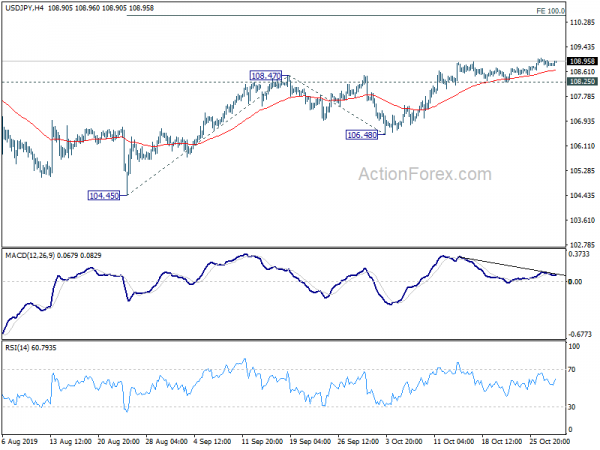

Daily Pivots: (S1) 108.74; (P) 108.90; (R1) 109.06; More…

No change in USD/JPY’s outlook, with 108.25 minor support intact, further rise is expected to 109.31 key resistance. Decisive break there will carry larger bullish implications next target will be 100% projection of 104.45 to 108.47 from 106.48 at 110.50. On the downside, however, break of 108.25 support will indicate short term topping and turn bias back to the downside for 106.48 support next.

In the bigger picture, strong support was seen from 104.62 again. Yet, there is no confirmation of medium term reversal. Corrective decline from 118.65 (Dec. 2016) could still extend lower. But in that case, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. Meanwhile, on the upside, break of 112.40 key resistance will be a strong sign of start of medium term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Sep | 9.10% | 6.90% | 1.80% | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Sep | -0.40% | -0.60% | ||

| 00:30 | AUD | CPI Q/Q Q3 | 0.50% | 0.50% | 0.60% | |

| 00:30 | AUD | CPI Y/Y Q3 | 1.70% | 1.70% | 1.60% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q3 | 0.40% | 0.40% | 0.40% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q3 | 1.60% | 1.60% | 1.60% | |

| 06:30 | EUR | France GDP Q/Q Q3 P | 0.30% | 0.20% | 0.30% | |

| 07:45 | EUR | France Consumer Spending M/M Sep | -0.40% | -0.70% | 0.00% | |

| 08:00 | CHF | KOF Leading Indicator Oct | 94.7 | 94.2 | 93.2 | |

| 08:55 | EUR | Germany Unemployment Rate Oct | 5.00% | 5.00% | 5.00% | |

| 08:55 | EUR | Germany Unemployment Change Oct | 6K | 0K | -10K | |

| 10:00 | EUR | Economic Sentiment Indicator Oct | 100.8 | 101.1 | 101.7 | |

| 10:00 | EUR | Business Climate Oct | -0.19 | -0.21 | -0.22 | -0.23 |

| 10:00 | EUR | Industrial Confidence Oct | -9.5 | -8.9 | -8.8 | -8.9 |

| 10:00 | EUR | Services Sentiment Oct | 9 | 9 | 9.5 | |

| 10:00 | EUR | Consumer Confidence Oct | -7.6 | -7.6 | -7.6 | -6.5 |

| 12:15 | USD | ADP Employment Change Oct | 125K | 132K | 135K | 93K |

| 12:30 | USD | GDP Annualized Q3 P | 1.90% | 1.60% | 2.00% | |

| 12:30 | USD | GDP Price Index Q3 P | 1.70% | 1.90% | 2.60% | |

| 13:00 | EUR | Germany CPI M/M Oct P | 0.10% | 0% | 0% | |

| 13:00 | EUR | Germany CPI Y/Y Oct P | 1.10% | 1.00% | 1.20% | |

| 14:00 | CAD | BoC Interest Rate Decision | 1.75% | 1.75% | ||

| 14:30 | USD | Crude Oil Inventories | 0.5M | -1.7M | ||

| 15:15 | CAD | BoC Press Conference | ||||

| 18:00 | USD | FOMC Rate Decision | 1.75% | 2.00% | ||

| 18:30 | USD | FOMC Press Conference |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals