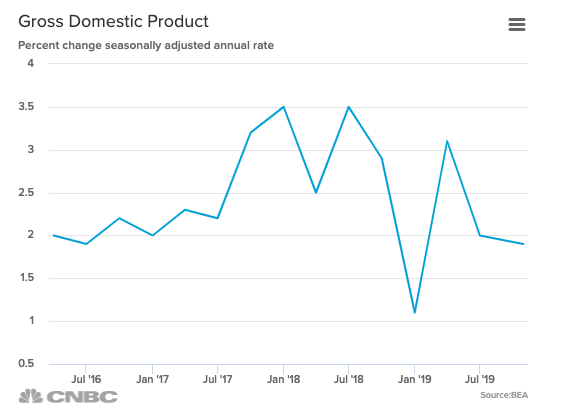

U.S. gross domestic product — the broadest measure of the U.S. economy — grew faster than expected in the third quarter, but slowed slightly as business investment continued to decline.

The Commerce Department said Wednesday that economic activity grew at an annualized rate of 1.9% in the third quarter, down slightly from the 2% pace in the second quarter. Economists polled by Dow Jones had expected the first look at third-quarter economic growth to come in at 1.6%.

The better-than-expected data was the result of continued consumer spending as well as government expenditures, the department said. Personal consumption expenditures, a gauge of spending by American households, rose at a 2.9% annualized rate while government spending grew at a 2% rate.

Growth in gross private domestic investment, however, continued to decline in the three months ended Sept. 30 with a slip of 1.5%, still far better than the 6.3% drop in the second quarter. Business spending in particular weighed on the investment number as spending on structures continued to decline, with a 15.3% fall. The pace of spending on equipment sank 3.8%.

“For manufacturers, the biggest challenges remain finding skilled labor and trade uncertainties, which make it difficult to hire and expand business operations,” said Chad Moutray, chief economist at the National Association of Manufacturers.

Residential investments kept the losses in check, however, rebounding to 5.1% growth from a negative 3% in the prior quarter.

Imports, which are a subtraction in the calculation of GDP, increased during the third quarter. The most recent report on the U.S. trade deficit showed the imbalance at $54.9 billion at the end of August as imports outpaced exports in the last full month of summer.

The slight slowing in economic growth comes as trade uncertainty and fears of a manufacturing slowdown sap private business investment in the United States.

The White House’s aggressive trade tactics, especially the back-and-forth tariff battle with China, have been a drag on business sentiment, with executives expressing concern in surveys and earnings calls.

Consumption, which accounts for more than two-thirds of economic activity, continued to show resilience in the third quarter as one of the few bright spots for growth.

The 2.9% growth in consumption in the third quarter, however, does mark a deceleration from the second quarter’s 4.6% pace. Fears of a global slump weighing on the American economy, coupled with the deceleration in manufacturing, appeared to hit recent retail sales in September, suggesting that American households could be starting to curb their spending habits.

The Commerce Department said earlier this month that retail sales dropped 0.3% in September as households slashed spending on building materials, online purchases and especially automobiles. The decline was the first since February.

The new GDP figure could also have implications for Federal Reserve policymakers, who will conclude their two-day policy meeting in Washington on Wednesday.

Federal Open Market Committee officials have been expressing concern about a potential slowdown and have cut interest rates twice in 2019. The Fed is widely expected to announce another quarter point cut Wednesday afternoon.

Get the market reaction here.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals