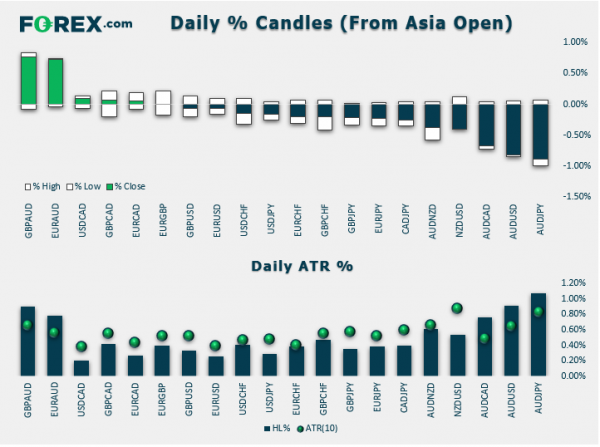

At 13:10 GMT, the GBP was the strongest while the AUD remained the weakest:

Safe-haven government bonds have resumed higher, pushing yields lower. This has helped to underpin low and noninterest-bearing assets such as the CHF, JPY and GOLD.

AUD has been hurt by the weaker-than-expected Aussie and Chinese data, released overnight.

Equity markets in the US seem to have stalled for the time being after repeatedly hitting new record highs: US index futures point to a lower open, tracking the losses seen in European markets so far today:

EUR little-changed despite news Germany managing to avoid a technical recession with an unexpected growth of 0.1% q/q. Here’s today’s most notable data beats and misses (circled):

In company news (by colleague Ken Odeluga):

- Burberry shares surged 9% after meeting half-year sales estimates and beating profit forecasts. The stock later traded +4.8% higher. It sees “significant negative impact in Hong Kong.”

- Merk KGaA, Germany’s drug and pharma giant, fell 1.5% despite raised full-year forecasts after beating core earnings estimates in Q3, helped by a takeover.

- Eventim, another German stand-out, slumped 7% dragging Europe’s media sector. The ticket and live entertainment group’s CEO plans to sell a 4.4% stake.

- Coming up: second-tier US data but plenty of FedSpeak:

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals