Yen, Swiss Franc and Dollar remain the strongest ones as Asia led risk aversion continues today. Additionally, treasury yields are back under pressure with some downside acceleration after US 10-year yield lost 1.9 while German 10-year yield lost -0.3. On the other hand, Australian Dollar remains the weakest, followed by New Zealand Dollar. Sterling is following as the third weakest after poor retail sales. Euro was mixed as Germany narrowly escaped technical recession.

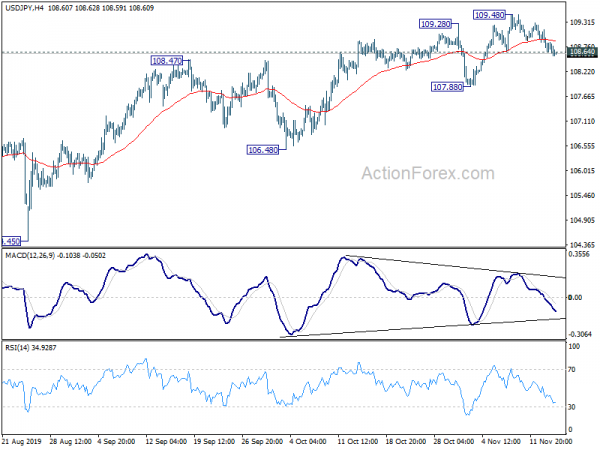

Technically, downside acceleration in AUD/USD affirms that case that corrective rebound from 0.6670 has completed at 0.6929. Further fall is expected to retest 0.6670 low. EUR/AUD is extending the rebound from 1.5976, towards 1.6432 resistance. USD/JPY’s break of 108.64 minor support is taken as the first sign of near term reversal, after failing 109.31 structural resistance. Focus is back on 107.88. EUR/JPY will now look at 119.11 minor support. Break will align the outlook with USD/JPY and target 117.07 support next.

In Europe, currently, FTSE is down -0.43%. DAX is down -0.46%. CAC is down -0.16%. German 10-year yield is down -0.030 at -0.327. Earlier in Asia, Nikkei dropped -0.76%. Hong Kong HSI dropped -0.93%. China Shanghai SSE rose 0.16%. Singapore Strait Times dropped -0.23%. Japan 10-year JGB yield dropped -0.0241 to -0.071.

US initial jobless claims rose to 225k, versus exp. 215k

US initial jobless claims rose 14k to 225k in the week ending November 9, above expectation of 215k. Four-week moving average of initial claims rose 1.75k to 215.25k. Continuing claims dropped -1k to 1.683m in the week ending November 2. Four-week moving average of continuing claims was unchanged at 1.688mm.

Also released. PPI rose 0.4% mom, 1.1% yoy in October, above expectation of 0.2% mom, 0.9% yoy. PPI core rose 0.3% mom, 1.6% yoy, versus expectation of 0.2% mom, 1.6% yoy.

De Guindos said ECB needs wide toolkit, but monetary policy cannot address all problems

ECB Vice President Luis De Guindos said today the central bank has to widen its monetary policy toolkit to ensure its effectiveness. Though, he emphasized that monetary policy alone cannot address all problems. He urged country with fiscal spaces to do more. He added that European economy is not going to fall into recession but growth will be below potential.

Separately,chief economist Philip Lane said euro’s exchange rate is not a policy target for the ECB. But, “It’s plausible that the impact of rate cuts on the euro exchange rate has intensified over time.”

Governing council member Francois Villeroy de Galhau said “markets anticipate, reasonably in my view, that short-term rates are close to bottoming out”. But he also emphasized “these low short-term rates must and will remain in place: it would undeniably be a mistake to raise ECB rates now.”

Eurozone GDP grew 0.2%, Germany avoided recession

Eurozone GDP grew 0.2% qoq in Q3, unchanged from Q2, matched expectations. Over the year, GDP grew 1.2% yoy. Employment grew 0.1% qoq, below expectation of 0.2% qoq. EU 28 GDP grew 0.3% qoq, 1.3% yoy. EU 28 employment grew 0.1% qoq.

Germany GDP grew 0.1% qoq in Q3, beat expectation of -0.1% qoq. Returning to growth suggests that the Eurozone’s largest economy had avoided a technical recession. Over the year, GDP grew 0.5% yoy, price and calendar adjusted. Economy Minister Peter Altmaier said “we do not have a technical recession, but the growth numbers are still too weak.”

UK retail sales dropped -0.1% mom in October while ex-fuel sales dropped -0.3% mom. Over the month, fuel was the only positive contributor to growth in sales, up 0.2% mom. Non-store retailing was flat while non-food and food stores declined.

Swiss PPI dropped -0.2% mom, -2.4% yoy in October, versus expectation of 0.0% mom, -2.1% yoy.

Australia employment contracted, unemployment rate edged up

In seasonally adjusted terms, Australia employment contracted by -19k to 12.9m in October, way below expectation of 16.2k growth. That’s also the largest monthly drop in three years since late 2016. Full-time jobs dropped -10.3k while part time jobs dropped -8.7k. Unemployment rate rose 0.1% to 5.3%, above expectation of 5.2%. At the same time, participation rate dropped -0.1% to 66.0.

Looking at some details, unemployment rate increased by 0.3 pts in New South Wales (4.8%), and by 0.1 pts in Victoria (4.8%). The seasonally adjusted unemployment rate decreased by 0.2 pts in Tasmania (5.9%), and by 0.1 pts in Queensland (6.5%), with Western Australia and South Australia recording no change.

The set of data suggests that Australia remains a long way from RBA’s full employment estimation, i.e., unemployment rate at around 4.5%. More monetary and fiscal stimulus is still needed to support the job and wage markets, and drive up inflation. RBA is still on track for more rate cuts or even QE next year.

RBNZ Bascand: The economy is somewhere near a turning point

RBNZ Deputy Governor Geoff Bascand said in an interview that “we actually think the economy is somewhere near a turning point.” He admitted the economy is “definitely going through a weaker stage” and “near-term risks “are probably more on the downside, but it’s a question of how long they persist,”

However, he added, “we’ve put a lot of stimulus in. We’ve got a bit longer to see how it’s transmitting. There’s time to see how that plays out and make a call in February if needed.”

The central bank surprised the markets by keeping the OCR unchanged at 1.00% yesterday. Governor Adrian Orr described the decision as a “tough one”, and the monetary policy committee had debated whether to “take one more insurance cut.”

Japan GDP grow slowed to just 0.2% annualized in Q3

Japan GDP grew 0.1% qoq in Q3, slowed from Q2’s 0.3% qoq and missed expectation of 0.2% qoq. Annualized rate slowed sharply from 1.8% to just 0.2%, way below expectation of 0.9%. GDP deflator accelerated to 0.6% yoy, up from 0.4% yoy and beat expectation of 0.5% yoy. Private consumption growth slowed to 0.4%, down from 0.6%, despite pre-tax hike purchases. Capital spending, though, accelerated to 0.9%, up from 0.7%.

Economy Minister Yasutoshi Nishimura blamed the weak GDP growth on worsening relations with South Korea. He said that had a “big impact” on exports, while dropped -0.7% from the prior quarter. Also, declines in in-bound tourists from South Korea was a drag, along with some impact form the prolonged trade war between US and China.

China production, retail sales, investment all missed expectations

The batch of October economic data released from China today is way below expectations. Industrial production growth slowed to 4.7% yoy, below expectation of 5.5% yoy. Fixed asset investment slowed to 5.2% ytd yoy, below expectation of 5.4%. That’s also the worst January-October growth since record began in 1996. Retail sales grew 7.2% yoy, missed expectation of 7.8% yoy, matching the more than 16 year low hit in April.

The chance of a recovery in growth momentum hinges on the results of the trade negotiations with US. Tariff rollbacks would be the key for the “easier” phase one deal. Without removing some of the imposed tariffs, in particular the September ones, the deal would be rather meaningless to the real Chinese economy. Of course, the biggest challenges come in the second phase of negotiations when core and fundamental issues, like subsidies to state-owned enterprises, would be addressed.

Suggested reading on China: China Data Reveal Further Downside Risks in Economy.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 108.60; (P) 108.87; (R1) 109.09; More..

USD/JPY’s break of 108.64 minor support suggests short term topping at 109.48, on bearish divergence condition in 4 hour MACD. Also, it’s the first sign that whole rebound from 104.45 has completed after failing to sustain above 109.31 structure resistance. Intraday bias is back on the downside for 107.88 support first. Break there will affirm this bearish case and target 106.48 next. On the upside, firm break of 109.48 is now needed to confirm rally resumption. Otherwise, risk will stay on the downside in case of recovery.

In the bigger picture, strong support was seen from 104.62 again. Yet, there is no confirmation of medium term reversal. Corrective decline from 118.65 (Dec. 2016) could still extend lower. But in that case, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. Meanwhile, on the upside, break of 112.40 key resistance will be a strong sign of start of medium term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q3 P | 0.10% | 0.20% | 0.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q3 P | 0.60% | 0.50% | 0.40% | |

| 00:00 | AUD | Consumer Inflation Expectations Nov | 3.60% | |||

| 00:01 | GBP | RICS Housing Price Balance Oct | -5% | -3% | -2% | -3% |

| 00:30 | AUD | Employment Change Oct | -19.0K | 16.2K | 14.7K | 12.5K |

| 00:30 | AUD | Unemployment Rate Oct | 5.30% | 5.20% | 5.20% | |

| 02:00 | CNY | Retail Sales Y/Y Oct | 7.20% | 7.80% | 7.80% | |

| 02:00 | CNY | Industrial Production Y/Y Oct | 4.70% | 5.50% | 5.80% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Oct | 5.20% | 5.40% | 5.40% | |

| 04:30 | JPY | Tertiary Industry Index M/M Sep | 1.80% | 0.20% | 0.40% | 0.30% |

| 07:00 | EUR | Germany GDP Q/Q Q3 P | 0.10% | -0.10% | -0.10% | |

| 07:30 | CHF | Producer and Import Prices M/M Oct | -0.20% | 0.00% | -0.30% | |

| 07:30 | CHF | Producer and Import Prices Y/Y Oct | -2.40% | -2.10% | -2.00% | |

| 09:30 | GBP | Retail Sales M/M Oct | -0.10% | 0.20% | 0.00% | |

| 09:30 | GBP | Retail Sales Y/Y Oct | 3.10% | 3.70% | 3.10% | |

| 09:30 | GBP | Retail Sales ex-Fuel M/M Oct | -0.30% | 0.30% | 0.20% | |

| 09:30 | GBP | Retail Sales ex-Fuel Y/Y Oct | 2.70% | 3.50% | 3.00% | 2.90% |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 0.20% | 0.20% | 0.20% | |

| 10:00 | EUR | Employment Change Q/Q Q3 P | 0.10% | 0.20% | 0.20% | |

| 13:30 | USD | PPI M/M Oct | 0.40% | 0.20% | -0.30% | |

| 13:30 | USD | PPI Y/Y Oct | 1.10% | 0.90% | 1.40% | |

| 13:30 | USD | PPI Core M/M Oct | 0.30% | 0.20% | -0.30% | |

| 13:30 | USD | PPI Core Y/Y Oct | 1.60% | 1.60% | 2.00% | |

| 13:30 | USD | Initial Jobless Claims (Nov 8) | 225 K | 215K | 211K | |

| 13:30 | CAD | New Housing Price Index M/M Sep | 0.20% | 0.20% | 0.10% | |

| 15:30 | USD | Natural Gas Storage | 2B | 34B | ||

| 16:00 | USD | Crude Oil Inventories | 1.5M | 7.9M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals