Dollar is mixed for today as markets head toward weekly close. Economic data from the US are generally disappointing, but sentiments seemed to be lifted by comments regarding US-China trade deal. Global stock markets also stabilized while US equities are set to extend record run. For the week, New Zealand Dollar remain the strongest one, followed by Sterling and then Swiss Franc. Australian Dollar is the weakest, followed by Canadian and then Dollar.

Technically, the markets are reversing earlier moves in general. EUR/USD formed a temporary low at 1.0989 and recovers notably today. EUR/JPY also recovers notably ahead of 119.11 support. EUR/GBP, however, remains weak and is on track to 0.8472 support.

In Europe, currently, FTSE is down -0.19%. DAX is up 0.20%. CAC is up 0.36%. German 10-year yield is up 0.011 at -0.337. Earlier in Asia, Nikkei rose 0.70%. Hong Kong HSI rose 0.01%. China Shanghai SSE dropped -0.64%. Singapore Strait Times rose 0.22%. Japan 10-year JGB yield rose 0.0014 to -0.070.

US retail sales rose 0.3%, ex-auto sales rose 0.2%

US headline retail sales rose 0.3% mom in October to USD 526.6B, above expectation of 0.1% mom. But ex-auto sales rose 0.2% mom, missed expectation of 0.3% mom.

Import price index dropped -0.5% mom in October, versus expectation of -0.2% mom. Over the year, import price index dropped -3.0% yoy.

Empire State Manufacturing Index dropped to 2.9, down from 4 and missed expectation of 6.1. “The general business conditions index was sluggish for the sixth consecutive month”.

Eurozone CPI finalized at 0.7%, core at 1.1%

Eurozone CPI was finalized at 0.7% yoy in October, core CPI at 1.1%. The highest contribution to the annual Eurozone inflation rate came from services (+0.69%), followed by food, alcohol & tobacco (+0.29%), non-energy industrial goods (+0.07%), and energy (-0.32%),.

EU28 CPI was finalized at 1.1% yoy. The lowest annual rates were registered in Cyprus (-0.5%), Greece (-0.3%) and Portugal (-0.1%). The highest annual rates were recorded in Romania (3.2%), Hungary (3.0%) and Slovakia (2.9%). Compared with September, annual inflation fell in fifteen Member States, remained stable in eight and rose in five.

New Zealand BusinessNZ PMI jumped to 52.6, new orders and production put manufacturing back on track

New Zealand BusinessNZ Performance of Manufacturing Index improved drastically to 52.6 in October, up from 48.8. It’s now back in expansion after three months of contraction from July to September. Production rose notably from 46.6 to 52.6. New Orders also jumped from 50.9 to 56.2. But Employment stayed sluggish, up from 50.1 to 50.2.

BusinessNZ’s executive director for manufacturing Catherine Beard said: “After a five month period of both lacklustre and negative growth, the pick-up in both new orders and production put the sector back on track. If the remaining two months for 2019 are to keep up the momentum, it is important these key sub-indexes remain positive to finish the year on a more upbeat note.

However, BNZ Senior Economist, Doug Steel said that “the October PMI is hardly what you would call strong. But it is certainly much better than the previous three months where the index languished below 50 which indicated a sector going backwards”.

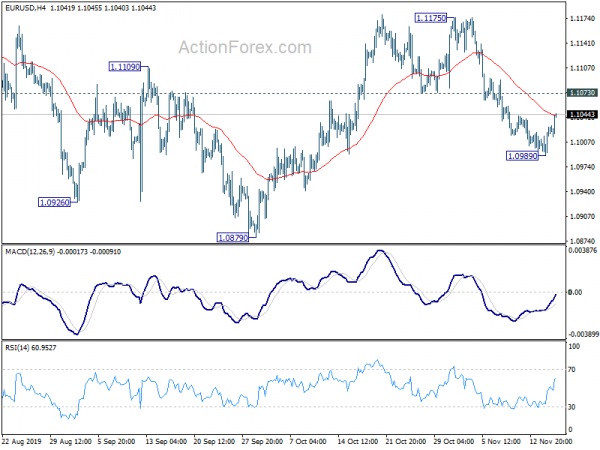

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0998; (P) 1.1012; (R1) 1.1036; More…

Intraday bias in EUR/USD remains neutral for consolidation above 1.0989 temporary low. But further decline will remain in favor as long as 1.1073 resistance holds. Corrective rebound from 1.0879 should have completed at 1.1175 already. Below 1.0989 will extend the fall from 1.1173 to retest 1.0879 low. Break will resume larger down trend from 1.2555. On the upside, above 1.1073 minor resistance will turn bias back to the upside for 1.1175 resistance.

In the bigger picture, at this point, rebound from 1.0879 is seen as a corrective move first. in case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ Manufacturing Index Oct | 52.6 | 48.4 | 48.8 | |

| 04:30 | JPY | Industrial Production M/M Sep F | 1.70% | 1.40% | 1.40% | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Sep | 18.3B | 18.7B | 20.3B | |

| 10:00 | EUR | CPI Y/Y Oct F | 0.70% | 0.70% | 0.70% | |

| 10:00 | EUR | CPI – Core Y/Y Oct F | 1.10% | 1.10% | 1.10% | |

| 13:30 | USD | Empire State Manufacturing Index Nov | 2.9 | 6.1 | 4 | |

| 13:30 | USD | Retail Sales M/M Oct | 0.30% | 0.10% | -0.30% | |

| 13:30 | USD | Retail Sales ex Autos M/M Oct | 0.20% | 0.30% | -0.10% | |

| 13:30 | USD | Import Price Index M/M Oct | -0.50% | -0.20% | 0.20% | |

| 13:30 | CAD | Foreign Securities Purchases (CAD) Sep | 4.76B | 4.22B | 4.99B | 4.62B |

| 14:15 | USD | Industrial Production M/M Oct | -0.40% | -0.40% | ||

| 14:15 | USD | Capacity Utilization Oct | 77.20% | 77.50% | ||

| 15:00 | USD | Business Inventories Sep | 0.10% | 0.00% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals