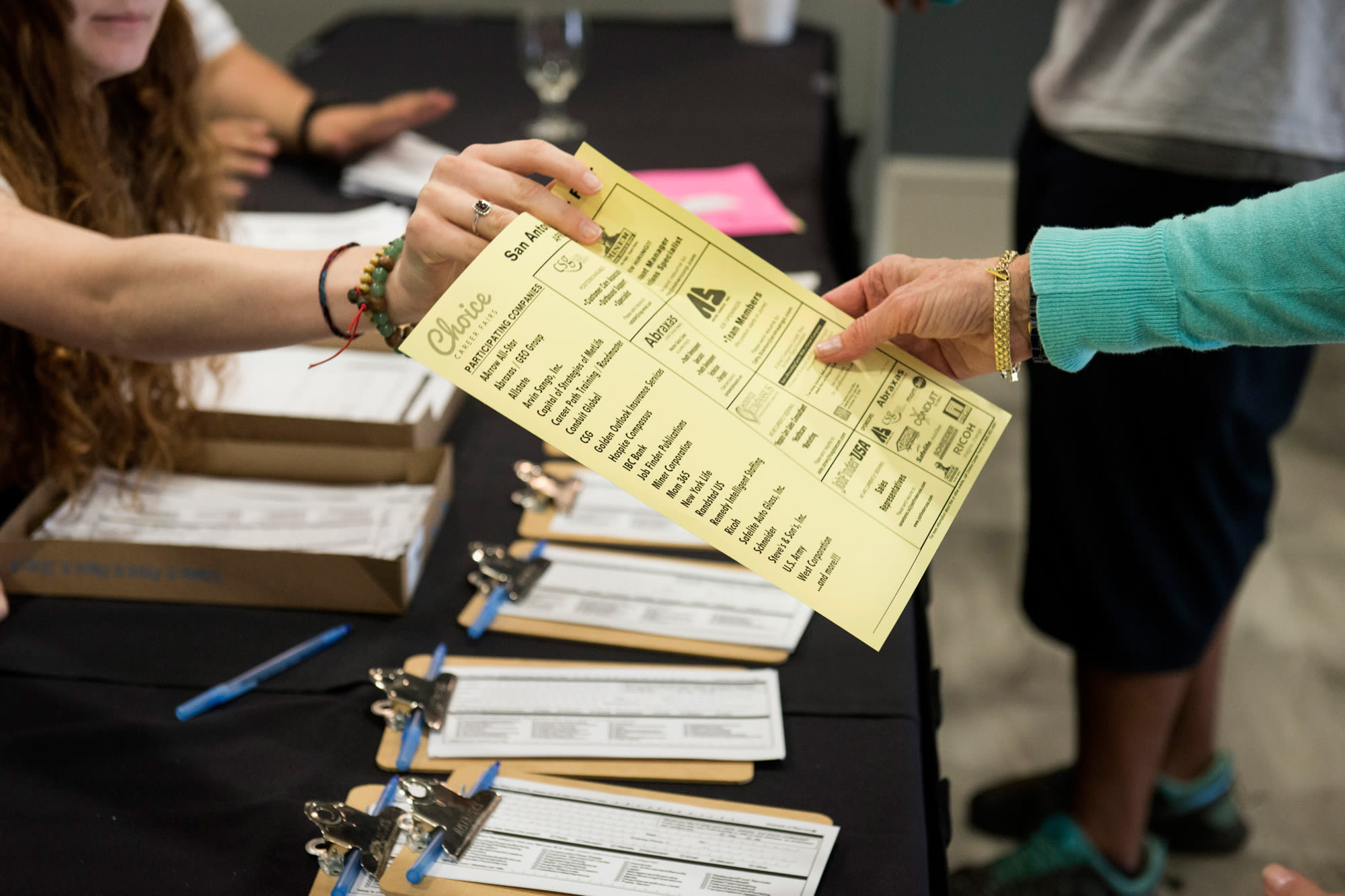

A representative, left, hands a list of employment descriptions to a job seeker during the Choice Career Fair in San Antonio, Texas.

Matthew Busch | Bloomberg | Getty Images

The number of Americans filing applications for unemployment benefits fell last week, but the underlying trend suggested some softening in labor market conditions.

Initial claims for state unemployment benefits declined 15,000 to a seasonally adjusted 213,000 for the week ended Nov. 23, the Labor Department said on Wednesday. Data for the prior week was revised to show 1,000 more claims received than previously reported.

The report was published a day early because of the Thanksgiving holiday on Thursday. Claims had been stuck at a five-month high over the previous two weeks, pointing to some easing in the labor market.

Economists polled by Reuters had forecast claims would decrease to 221,000 in the latest week. The Labor Department said no states were estimated last week.

The four-week moving average of initial claims, considered a better measure of labor market trends as it irons out week-to-week volatility, slipped 1,500 to 219,750 last week.

Employment gains have slowed this year, averaging 167,000 per month compared with an average monthly gain of 223,000 in 2018, in part because of a 16-month trade war between the United States and China, ebbing demand and a shortage of workers.

But the pace of hiring has been more than the roughly 100,000 jobs needed per month to keep up with growth in the working-age population. The unemployment rate is at 3.6%.

Thursday’s claims report also showed the number of people receiving benefits after an initial week of aid fell 57,000 to 1.64 million for the week ended Nov. 16. The four-week moving average of the so-called continuing claims dropped 13,000 to 1.68 million.

The continuing claims data included the week the government surveyed households for November’s unemployment rate. The four-week average of claims rose slightly between the October and November household survey periods, suggesting little change in the unemployment rate this month, even as consumers’ perceptions of the labor market have become less upbeat.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals