The US markets were sold off deeply overnight after after poor ISM manufacturing data and renewed tariff threats. Dollar also suffered deep selling pressure, together with Canadian. Though, there was no clear fund flows into the Japanese Yen, as risk aversion was countered by surge in major treasury yields. On the other hand, Australian and New Zealand Dollars are the stronger ones instead.

After yesterday’s strong selloff, focus is now on weakness in the greenback. AUD/USD’s break of 0.6834 resistance now suggests short term bottoming at 0.6754. Further rise could be seen back to 0.6929 resistance. EUR/USD is now eyeing 1.1097 resistance. Break will indicate completion of pull back from 1.1179 and bring further rise to this resistance. USD/CHF is extending the consolidation form 1.0027 with another fall but we’d expect strong support around 0.9868 to contain downside. However, firm break there would add to the case of overall bearishness in Dollar.

In Asia, Nikkei is down -0.66%. Hong Kong HSI is down -0.15%. China Shanghai SSE is down -0.11%. Singapore Strait Times is down -0.40%. Japan 10-year JGB yield is up 0.0226 at -0.019, heading back to 0%. Overnight, DOW dropped -0.96%. S&P 500 dropped -0.86%. NASDAQ dropped -1.12%. 10-year yield rose 0.060 to 1.836, back above 1.8%.

Trump still believes China wants a trade deal

US President Donald Trump indicated he still believed China wants a trade deal with the US. But the passage of the Hong Kong Human Rights and Democracy Act “doesn’t make it better”. “The Chinese are always negotiating. I’m very happy where we are,” he added, The Chinese want to make a deal. We’ll see what happens.”

Separately, Commerce Secretary Wilbur Ross indicated that the next batch of tariffs on China is going to taken effect “if nothing happens between now and then”. US is set to impose 15% of around USD 156B of Chinese imports on December 15. Meanwhile, whether there will be tariff rollbacks also all depends on China’s “behavior between now and then”.

Also, Trump’s administration announced a series of tariffs actions yesterday. Firstly, steel and aluminum tariffs on Brazil and Argentine were restored. The US Trade Representative said it would review raising tariffs on EU products and added new ones because of the “lack of progress” in resolving the aircraft subsidies disputes. USTR also said it planned to raise tariffs on USD 2.4B in French products, including Champagne and handbags by 100%, as measures to France’s new digital services tax.

Trump blames weak manufacturing on Fed, urges rate cuts

DOW closed down -0.96%, or -268.37, overnight as weighed down by new tariff threats and poor ISM manufacturing index. Trump blamed that “manufacturers are being held back by the strong Dollar, which is being propped up by the ridiculous policies of the Federal Reserve”. He went on further to urge Fed to “lower rates” and “loosen”, as “there is almost no inflation”. And that would make the US “competitive with other nations, and manufacturing will SOAR!”

RBA kept cash rate unchanged at 0.75% as expected, prepared to ease if needed

RBA kept cash rate unchanged at 0.75% as widely expected. It noted in the statement that given “the long and variable lags in the transmission of monetary policy”, the central bank was on hold to monitor developments, “including in the labour market”. Though, it reiterated that due to both global and domestic factors, ” it was reasonable to expect that an extended period of low interest rates will be required”. RBA is also “prepared to ease monetary policy further” if needed.

Suggested reading: RBA Holds the Cash Rate Steady; Emphasises Scope to Ease Further.

On the data front

Japan monetary base rose 3.3% yoy in November, versus expectation of 3.4% yoy. UK BRC retail sales monitor dropped -4.9% yoy in November versus expectation of -0.4% yoy. Australia current account surplus widened to AUD 7.9B in Q3, above expectation of AUD 6.3B. Looking ahead, Swiss will release CPI in European session. UK will release construction PMI while Eurozone will release PPI.

AUD/USD Daily Report

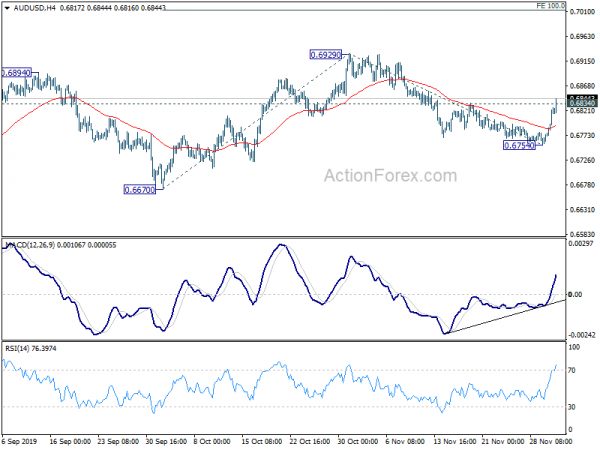

Daily Pivots: (S1) 0.6779; (P) 0.6802; (R1) 0.6843; More…

AUD/USD’s strong rebound and break of 0.6834 resistance suggests that pull back from 0.6929 has completed at 0.6754, on bullish convergence condition in 4 hour MACD. Intraday bias is now mildly on the upside for retesting 0.6929 resistance first. Break there will resume the rebound from 0.6670 and target 100% projection of 0.6670 to 0.6929 from 0.6754 at 0.7013. On the downside, break of 0.6754 will resume the fall form 0.6929 to retest 0.6670 low.

In the bigger picture, with 0.7082 resistance intact, there is no clear confirmation of trend reversal yet. That is, down trend from 0.8135 (2018 high) is still expect to continue to 0.6008 (2008 low). However, decisive break of 0.7082 will confirm medium term bottoming and bring stronger rally back to 55 month EMA (now at 0.7525).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Nov | 3.30% | 3.40% | 3.10% | |

| 00:01 | GBP | BRC Retail Sales Monitor Y/Y Nov | -4.90% | -0.40% | 0.10% | |

| 00:30 | AUD | Current Account Balance (AUD) Q3 | 7.9B | 6.3B | 5.9B | 4.7B |

| 03:30 | AUD | RBA Interest Rate Decision | 0.75% | 0.75% | 0.75% | |

| 07:30 | CHF | CPI M/M Nov | -0.10% | -0.20% | ||

| 07:30 | CHF | CPI Y/Y Nov | -0.10% | -0.30% | ||

| 09:30 | GBP | Construction PMI Nov | 44.5 | 44.2 | ||

| 10:00 | EUR | Eurozone PPI M/M Oct | 0.00% | 0.10% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Oct | -1.90% | -1.20% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals