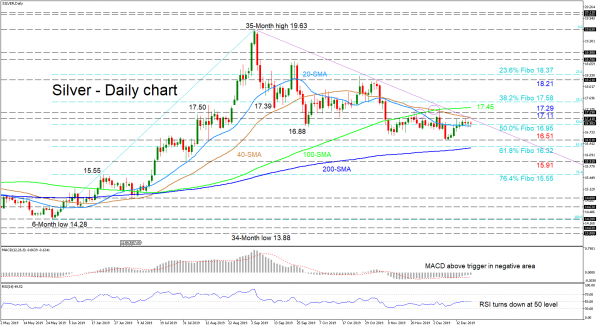

Silver is attempting to move below the 16.95 level, which is the 50.0% Fibonacci retracement of the up leg from 14.28 to 19.63 and where the 20-day simple moving average (SMA) presently lies. Even though negative momentum has weakened, the bearish demeanor of the commodity appears to be assisted by the bearish crossovers and the capping of the price by the downward sloping 50-day SMA and restrictive trendline drawn from the 35-month high of 19.63.

The short-term oscillators reflect the dry up in directional momentum but are negatively skewed. The MACD is above its red trigger line but below the zero point, while the RSI is at the neutral mark leaning towards bearish regions.

To the downside, if sellers dive below the 16.95 area, the 16.51 low of December 9 may be next to restrict the drop. Steering lower, the fortified 16.32 barrier – consisting of the 61.8% Fibo and 200-day SMA – could prevent further declines towards the trough of 15.91 from August 1 and 76.4% Fibo of 15.55.

Alternatively, a more decisive push from buyers would be needed to overcome the immediate resistance obstacles coming from the 17.11 to 17.45 region. Those being the restrictive trendline joined by the 50-day SMA, the fresh high of 17.29 and the 100-day SMA. Conquering these, the 38.2% Fibo could be next to deter the climb for the 18.21 high of November 4 and nearby 23.6% Fibo of 18.37.

Overall, the short-term bias is bearish below the restrictive trendline and the 17.29 high. Moreover, a breach below 16.51 would reinforce belief in the decline, while a break below 16.32 would cement it.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals