Yen is trading broadly higher today as buying rushes in after weaker than expected US economic data. Nevertheless US stocks open mildly higher while 10-year yield is also trading up. Australian Dollar is currently the second strongest for today, still feeling the support from employment data. On the other hand, Sterling is trading as the weakest one as traders seem to be making up their mind after rather uneventful BoE rate decision.

Technically, GBP/USD ‘s break of 1.3050 should suggest that fall from 1.3514 is a near term correction that’s heading back to 1.2827 support. EUR/GBP should also be rebounding further to 55 day EMA (now at 0.8594). 142.47 support in GBP/JPY will now be a focus and break will alight the outlook with other Sterling pairs.

In other market, DOW is up more than 0.1% in initial trading. FTSE is up 0.22%. DAX is down -0.36%. CAC is down -0.06%. German 10-year yield is up 0.0320 at -0.218. Earlier in Asia, Nikkei dropped -0.29%. Hong Kong HSI dropped -0.30%. China Shanghai SSE rose 0.00%. Singapore Strait Times dropped -0.07%. Japan 10-year JGB yield rose 0.0094 to -0.005.

US initial jobless claims dropped to 234k, Philadelphia Fed manufacturing outlook dropped to 0.3

US initial jobless claims dropped -18k to 234k in the week ending December 14, but was higher than expectation of 225k. Four-week moving average of initial claims rose 1.5k to 225.5k. Continuing claims rose 51k to 1.722m in the week ending December 7. Four-week moving average of continuing claims rose 6.25k to 1.684m.

Philadelphia Fed Manufacturing Outlook dropped sharply to 0.3 in December, down from 10.4, and missed expectation of 8.5. It’s also the worst reading in six months. The result indicated “essentially flat growth” in the region’s manufacturing sector. Looking at some details, employment index dropped -4pts to 17.8. Prices paid index rose 11 pts to 19.0.

BoE kept rate unchanged at 0.75%, Haskel and Saunders dissented again

BoE left monetary policy unchanged as widely expected. Bank Rate was held at 0.75% with 7-2 vote. Jonathan Haskel and Michael Saunders dissented and voted for -25bps rate cut again. Asset purchase target was kept at GBP 435B on unanimous vote.

In the accompanying statement, BoE said since the previous meeting “economic data have been broadly in line” with November forecasts. GDP is expected rise “only marginally” in Q4. Household consumption has continued to grow steadily, but business investment and export orders have remained weak. There were some signs of “loosening” in labor market, but it remains tight. Headline CPI is expected to fall to around 1.75% by spring, “owing to the temporary effects of falls in regulated energy and water prices.”

BoE also noted that “monetary policy could respond in either direction to changes in the economic outlook”. “monetary policy may need to reinforce the expected recovery in UK GDP growth and inflation” should Brexit uncertainties remain entrenched, or global growth fails to stabilize. However, if the risks do not materialize and economy recovers in line with latest projections, “some modest tightening of policy, at a gradual pace and to a limited extent, may be needed”.

UK retail sales dropped -0.6%, all sectors contracted

In November, UK retail sales came in at -0.6% mom, 1.0% yoy, well below expectation of 0.5% mom, 2.4% yoy. Retail sales ex-fuel came in at -0.6% mom, 0.8% yoy, also well below expectation of 0.3% mom, 1.6% yoy. Total retail sales for the three months to November dropped -0.4% over the previous three months.

All sectors contributed negatively to the month-on-month figures. With fuel contributed -0.1%, non-store retailing -0.2%, non-food stores -0.1%, food stores -0.2%.

BoJ stands pat, expect economy to continue moderate expanding trend

BoJ left monetary policy unchanged as widely expected. Short-term policy rate was held at -0.1%. Purchase of JGB will continue to keep 10-year yield at around 0%, with monetary base expanding at JPY 80T per annum. Y. Harada and G. Kataoka dissented as usual in 7-2 vote.

The central bank said the economy is “likely to continue on a moderate expanding trend”. Impact of global slowdown is expected “to be limited”. Domestic demand is expected to “follow an uptrend” despite the impact of consumption tax hike. Exports are projected to “continue showing some weakness”, but are expected to be on “moderate increasing trend”. CPI is “likely to increase gradually toward 2 percent”.

Australia added 39.9k jobs, driven by part-time jobs

Australia employment grew 39.9k in November, well above expectation of 14k. Full-time jobs rose 4.2k while part-time jobs grew 35.7k. Unemployment rate dropped -0.1% to 5.2%, below expectation of 5.3%. Participation rate was unchanged at 66.0%.

Looking at some details, the largest increases in employment were recorded in Queensland (up 17.3k) and Victoria (up 13.7k). The only decrease was in New South Wales (down -2.8k). Unemployment rate increased by 0.1% in South Australia (6.3%), and by less than 0.1% in Western Australia (5.8%). Unemployment rate decreased by -0.2 pts in New South Wales (4.7%) and Victoria (4.6%), and by -0.1% in Queensland (6.3%)

Overall, unemployment rate remains well above RBA’s estimated full employment of 4.5%. More policy easing is still needed.

New Zealand GDP grew 0.7%, led by strong retail growth

New Zealand GDP grew 0.7% qoq in Q3, above expectation of 0.5% qoq. Q2’s growth rate was revised sharply lower from 0.5% qoq to 0.1% qoq. Looking at some details, primary industries grew 1.1%. Good-producing industries grew 0.5%. Services industries grew 0.4%.

Services growth, which account for 2/3 of the GDP, was led by retail. The 2.4% growth in retail and accommodation was also the fastest in eight years, dominated by electronics.

Also released, exports rose NZD 371m, or 7.6% yoy, to NZD 5.2B. Imports rose NZD 119m, or 2.0% yoy, to NZD 6.0B. Trade deficit came in at NZD 753m, slightly larger than expectation of NZD 700m.

GBP/USD Mid-Day Outlook

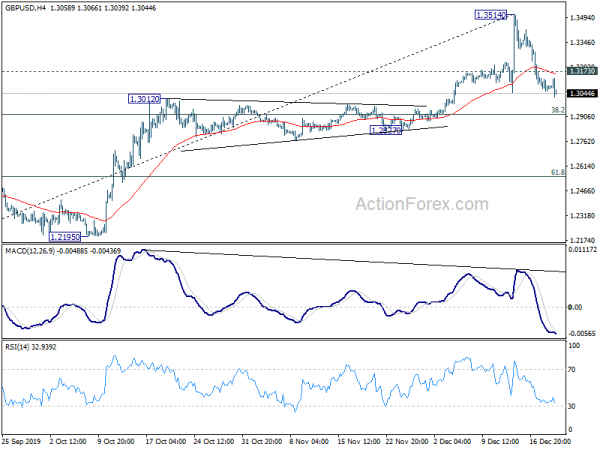

Daily Pivots: (S1) 1.3050; (P) 1.3092; (R1) 1.3124; More….

GBP/USD’s break of 1.3050 support how suggests that 1.31514 is indeed a short term top. Fall from there is corrective whole rise from 1.1958 low. Intraday bias is now on the downside for 38.2% retracement of 1.1958 to 1.3514 at 1.2920. On the upside, above 1.3173 minor resistance will turn bias back to the upside for retesting 1.3514.

In the bigger picture, rise from 1.1958 medium term bottom is on track to retest 1.4376 key resistance. Reactions from there would decide whether it’s in consolidation from 1.1946 (2016 low). Or, firm break of 1.4376 will indicate long term bullish reversal. In any case, for now, outlook will stay bullish as long as 1.2827 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | -753M | -700M | -1013M | -1039M |

| 21:45 | NZD | GDP Q/Q Q3 | 0.70% | 0.50% | 0.50% | 0.10% |

| 00:30 | AUD | Employment Change Nov | 39.9K | 14K | -19K | -24.8K |

| 00:30 | AUD | Unemployment Rate s.a. Nov | 5.20% | 5.30% | 5.30% | |

| 03:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 07:00 | CHF | Trade Balance (CHF) Nov | 3.92B | 3.55B | 3.50B | 3.54B |

| 09:30 | GBP | Retail Sales M/M Nov | -0.60% | 0.50% | -0.10% | 0.00% |

| 09:30 | GBP | Retail Sales Y/Y Nov | 1.00% | 2.40% | 3.10% | |

| 09:30 | GBP | Retail Sales ex-Fuel Y/Y Nov | 0.80% | 1.60% | 2.70% | |

| 09:30 | GBP | Retail Sales ex-Fuel M/M Nov | -0.60% | 0.30% | -0.30% | -0.10% |

| 12:00 | GBP | BoE Interest Rate Decision | 0.75% | 0.75% | 0.75% | |

| 12:00 | GBP | BoE Asset Purchase Facility | 435B | 435B | 435B | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–2–7 | 0–2–7 | 0–2–7 | |

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 13:30 | CAD | ADP Employment Change Nov | 30.9K | 66.6K | -22.6K | 2.9K |

| 13:30 | CAD | Wholesale Sales M/M Oct | -1.10% | 1.10% | 1.00% | 0.80% |

| 13:30 | USD | Initial Jobless Claims (Dec 13) | 234K | 225K | 252K | |

| 13:30 | USD | Current Account (USD) Q3 | -124B | -122B | -128B | -125B |

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Dec | 0.3 | 8.5 | 10.4 | |

| 15:00 | USD | Existing Home Sales Nov | 5.45M | 5.46M | ||

| 15:30 | USD | Natural Gas Storage | -87B | -73B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals