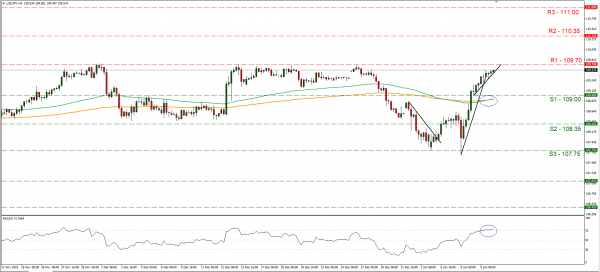

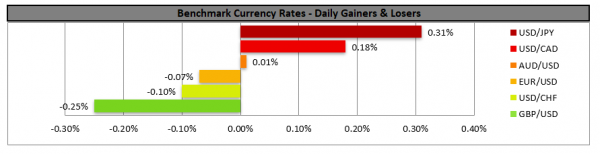

Today during the American session (13:30, GMT) we get the US employment report for December and traders tend to zoom into the release. The forecasts are for the unemployment rate to remain unchanged at 3.5%, the average earnings growth rate also to remain unchanged, at +3.1% yoy and the NFP figure to drop and reach 164k if compared to November’s reading of 266k. It should be noted that the low unemployment rate and the quite high average earnings growth rate support the notion of a rather tight US labour market. On the other hand the forecasted substantial drop of the NFP figure casts a shadow of a doubt over the actual tightness of the US labour market. Please note that the high November NFP reading was at the time attributed partially to the return of formerly striking GM employees to the working population. Also the recent weak ISM manufacturing PMI reading for the month, may not be the best news for the manufacturing sector part of the NFP figure. Should the actual rates and figures meet their respective forecasts, we see risks for the USD tilting to the downside, attributing a possible bearish reaction mainly on the drop of the NFP figure and a slight market disappointment. On the flip side, should the prints outperform expectations, we could see the USD getting some substantial support and vice versa. USD/JPY continued to rise yesterday aiming for the 109.70 (R1) resistance line. We maintain our bullish outlook for the pair as long as the upward trendline continues to guide the pair. On the other hand there seem to be some signs of reversal for the pair’s direction, as the steep upward slope of the trendline eases. Also the RSI indicator in the 4 hour chart is above the reading of 70, showing the bull’s dominance, yet at the same time may be also implying a rather overcrowded long position. Should the bulls continue to dictate the pair’s price action, we could see it breaking the 109.70 (R1) line and aim for the 110.35 (R2) resistance level. Please note that the 109.70 (R1) resistance line has proven quite strong in the past as it managed to contain the pair’s rise on a number of occasions during December, causing it to reverse its upward momentum. Should the bears take control, the pair could break the 109.00 (S1) support line aiming for lower grounds.

…while the USD seems to be in a winning streak…

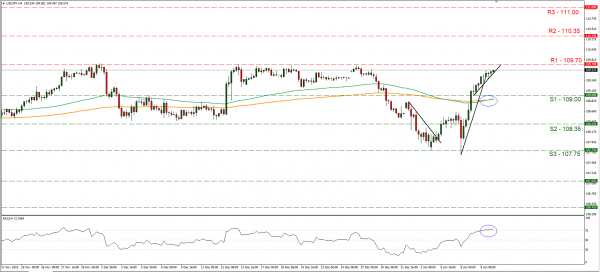

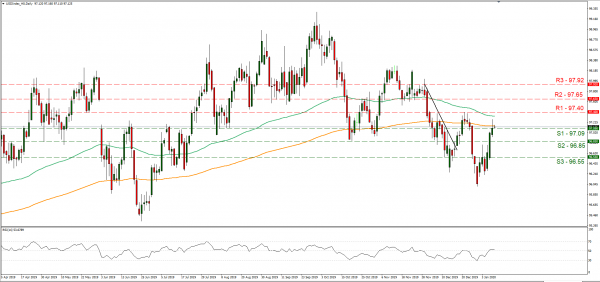

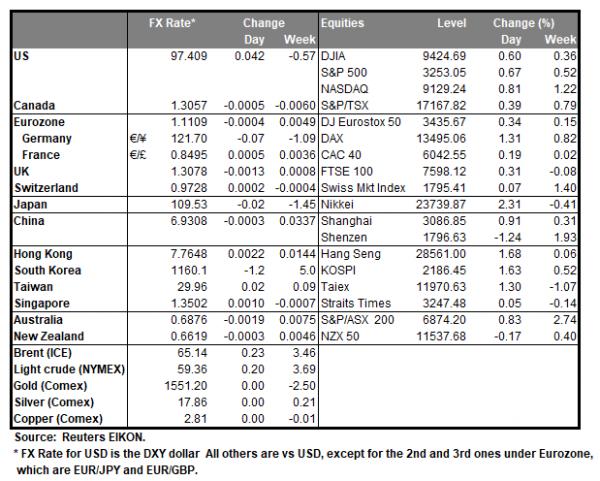

The USD continued to strengthen against a basket of its counterparts yesterday for a second consecutive day as per the USD Index. Analysts tend to comment that the USD seems to have benefited substantially from easing tensions of the US with Iran, however also may have been favoured by US financial releases. Despite a disappointing ISM manufacturing PMI, the US services sector economic activity seems to be picking up and falling joblessness claims along with some solid hiring numbers at the private sector. Analysts tend to note that there seems to be nothing fundamental to actually drive traders out of the dollar at the current stage. Should the positive momentum for the USD continue we could see it strengthen even further, however today’s NFP report seems to dominate the headlines. The USD Index continued its rise yesterday breaking the 97.09 (S1) resistance line now turned to support. Please note that we would like to see more bullish candlesticks confirming an upward direction in order to maintain a bullish bias for the index. Should the index continue its upward movement we could see it aiming if not breaking the 97.40 (R1) resistance line. Should the index move southwards, we could see it breaking the 97.09 (S1) and aim for the 96.85 (S) support level.

Other economic highlights today and early tomorrow

Today during the European session, we get Norway’s CPI rate for December. In the American session, apart from the US employment report, we get the Canadian employment data for December which are forecasted to be quite decent. As for speakers BoE’s Tenreyro is scheduled to speak.

Support: 109.00 (S1), 108.35 (S2), 107.75 (S3)

Resistance: 109.70 (R1), 110.35 (R2), 111.00 (R3)

Support: 97.09 (S1), 96.85 (S2), 96.55 (S3)

Resistance: 97.40 (R1), 97.65 (R2), 97.92 (R3)

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals